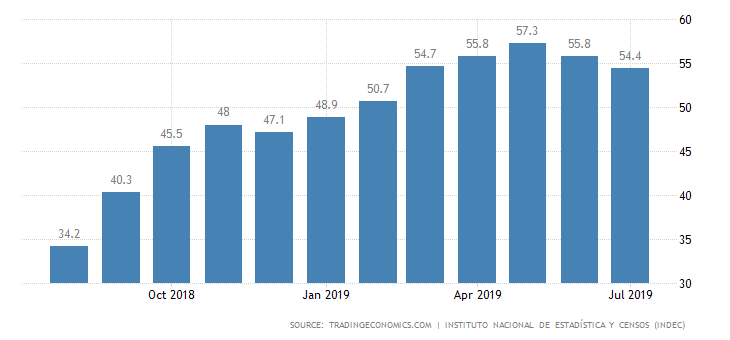

To an economic layman such as myself, the words “inverted yield curve” do not immediately mean too much. However, hearing that this past August was the first time the U.S. had an inverted yield curve since before the 2008 recession seems like cause for alarm, so I have attempted to break down this indicator.

The yield curve measures how the interest rate (or yield percentage) changes over a certain maturation period. With U.S. Treasury bonds, the curve takes into account whether the Fed raises or lowers interest rates and if investors believe their money will have future value or not. When looking at the curve, it’s clear to see that in a healthy economy the yield curve should slope upward as that indicates investors believe that both investing now is wise and that future bonds will appreciate in value. When the yield curve inverts in slope, this indicates that investor confidence in the market’s future is low and that they would rather keep their money in long term bonds than current investments. Yield percentage on long term bonds (Ten years +) has an inverse relationship with demand, so as investor and Federal Reserve confidence in the market goes up, long-term yield prices will drop.

Basically, when the yield percentage on bonds is greater for ten year bonds, that means less investors are buying ten year bonds and are instead investing in short term high-risk and high-reward investments. This bodes well for the economy as it means investors will spend believing they can get return soon. If the curve inverts, this means investors do not want to spend now and in turn that U.S. economic prospects look dim. Summer of 2019 has been the first time since the Great Recession that the curve has inverted, leaving economists fearing what comes next.

Economists are concerned and wary because historically, the inverted yield curve occurred six to nine months before recessions (only one time in the past 70 years has this indicator been proven wrong). However, the inverted yield curve doesn’t necessarily directly cause recessions. The tricky reality is that economists have not been able to come to a consensus on what the isolated link between the inverted yield curve and recessions are, so for now though there is cause for concern, there isn’t cause for despair.

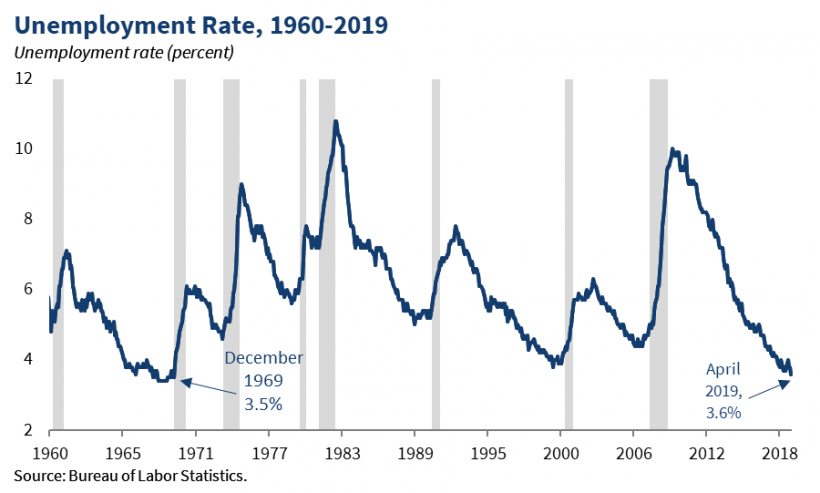

For the present U.S. economy, these indicators could point towards the uncertainty surrounding trade agreements and tariffs (particularly with China). Some say this will make goods cost more, and that there will be fewer jobs both supporting the production of those goods as employees and paying for the goods as consumers. Most economists agree that recessions are an inevitable season in a country’s economic life, and a recent study by the National Association for Business Economics found that 74% of business economists believe a recession will hit the U.S. by 2021. The consistency with which inverted yield curves have predicted recessions is stark and undeniable, but in order to more wholly assess the health of the U.S. economy, the many other economic indicators have to be weighed equally.

Sources:

- https://www.marketwatch.com/story/5-things-investors-need-to-know-about-an-inverted-yield-curve-2019-08-14

- https://www.youtube.com/watch?v=ukfA65KYyBY

- https://www.youtube.com/watch?v=bItazfbSptI

- https://www.youtube.com/watch?v=oW4hfaiXKG8