In his book “Misbehaving,” behavioral economist Richard Thaler analyzed a 2011 study by Justine Hastings and Jesse Shapiro which explored the relationship on spending and gas prices. The study found that during the 2008 financial crisis, when gas prices fell 50 percent from $4 a gallon to $2 a gallon, the money that was saved on buying regular gasoline ended up being spent on premium gasoline instead. Instead of pocketing the money in case of an emergency or allocating the extra cash elsewhere, car drivers viewed their decision to upgrade gas as a splurge.

If households view premium gasoline as a splurge, then gas may be seen as an economic indicator. By definition, an economic indicator is used to predict investment possibilities and assess the economy’s overall health. In the same way that women view cosmetics like lipstick as an affordable splurge during hard times, an increase in buying premium gasoline can be an indicator of an economic fall.

Gas is a frequent and telling purchase. 85 percent of Americans either drive alone or carpool to work each day, according to American Community Service data, and there are over 115 million cars on the roads each day.

Although it may seem counterintuitive to be spending more on a higher grade of gasduring a recession, Thaler attributes this seemingly irrational behavior to a concept he termed “mental accounting,” meaning that consumers all have mental spending “buckets” that are largely separate and unchangeable. For example, the study found that a save in filling up a driver’s gas tank did not readily translate to a consumer using the extra money to upgrade their orange juice or milk choices.

Another study conducted by the American Automobile Association found that 16.5 million motorists in the United States purchase premium gas. However, 70 percent of cars driven in the U.S. require only regular gas. The study estimates that purchasing premium gas wasted $2.1 billion in 2016 because motorists perceive premium gas as better for their engines when in reality, it is an unnecessary purchase. Despite the state of the global financial crisis in 2008, spending on premium grade gasoline rose by 14 times the usual amount even more so than normal, according to the Hasting and Shapiro study.

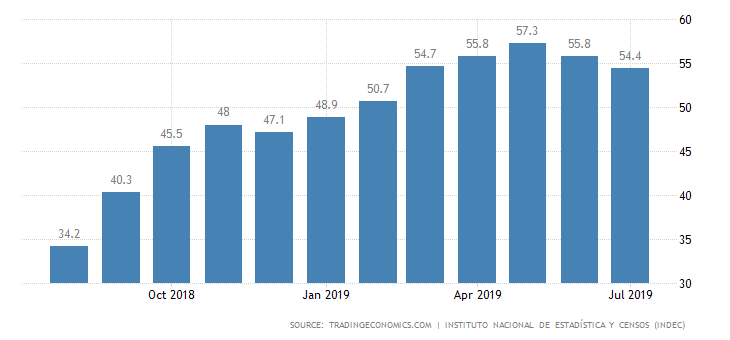

In April of this year, the L.A. Times reported that gas prices rose to over $4 a gallon for the first time in four years. While the price of gas itself may be seen as an economic indicator, the amount of spending on premium grade gasoline can also chart economic changes. When gas prices go down during periods of economic recession, the purchase of premium grade fuel may go up due to its now-affordability as a splurge item, signaling an economic downturn. As gas prices rise, more consumers have forgone splurging on premium and have settled for regular due its lower cost because in their minds, they don’t have any discretionary funds from their gas money “bucket” to pay for better quality fuel.