It’s no secret that American’s love avocados.

Restaurant’s have quickly figured out that their customers crave the juicy fruit. Nowadays you can find avocados on almost any menu across the country whether it is on your toast, burger, or even as ice cream!

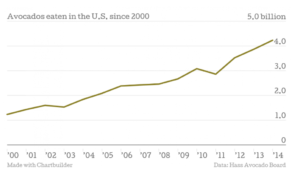

According to the Hass Avocado Board, American’s consumption of avocados has been increasing rapidly over the past 15 years. Furthermore, Hass avocado’s account for 95% of all consumed in the United States, reaching nearly 4.25 billion avocados in 2014.

The growth in popularity for avocados over the last two decades is due largely in part to trade restrictions between the US and Mexico that were lowered in the late 1990s. Before this, fruits (avocados) were prohibited from being shipped to the US, which meant that all of the avocados in America had to come from California. However, the state’s climate was not able to support year round production of the fruit and therefore only specific areas of the country were able to receive the product at certain times of the year. This meant that only supermarkets in close proximity to producers could sell avocados due to their short shelf life.

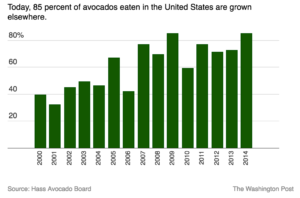

By lowering the restrictions in the 1990s, the avocado market in the US was revolutionized. As seen in the graph below, by 2000, 40% of all avocados sold in the US were produced out of the country and that number has now risen to over 80%.

So what’s happening now?

There are two forces that are contributing to the sharp increase in avocado prices that have been seen and made headlines over the past year: environmental change and US consumers’ increased appetite.

In the wake of California’s dramatic drought in 2015, avocado prices have almost doubled in the past year.

Another contributing factor is the decreased number of avocado’s being shipped to the US from Mexico. The reason for this is unclear, although according to Ingardia produce buyer Cruz Sandoval, he argues that, “Mexican growers are holding out for more money because the California season is running dry, and there’s no other sources.”

For retailers, they are feeling the pressure immensely, as the Hass Avocado Board reports that the average unit price of avocados has gone up nearly 20 cents since December 2015.

It is also important to consider how the increase in prices will affect the fruits two key consumer groups: shoppers and restaurants.

For consumers going into the grocery store, they are more likely to notice the change in price and can make an instinctive decision on whether or not to buy more expensive avocados. For restaurants, however, the decision is more challenging as their customers still expect to have the ingredient on their menus despite the higher costs. Restaurants must then decide whether or not they will take the loss or increase prices for valuable customers.

SOURCES:

http://www.theatlantic.com/business/archive/2016/10/avocado-shortage-price-hike/504383/

https://www.washingtonpost.com/news/wonk/wp/2015/01/22/the-sudden-rise-of-the-avocado-americas-new-favorite-fruit/

http://www.ocregister.com/articles/prices-731700-mexico-avocados.html

http://www.forbes.com/sites/geoffwilliams/2016/10/31/how-the-avocado-shortage-is-affecting-chipotle-grocers-and-you/#7257eeb969f1