In 2014, Ukraine underwent a revolution ousting a Russian puppet-president which sent the country into complete chaos both economically and politically. Following the revolution Russia annexed Crimea and full-on warfare broke out on the eastern border of Ukraine killing thousands of people. The economy shrank dramatically, prices went up, and given the unstable state of the economy, investments stopped flowing into the country. The interest rates set by the National Bank of Ukraine skyrocketed immediately. This interest rate is what’s called the federal funds rate in the United States. It is the interest rate set by the central bank that tells commercial banks how much interest they should charge when making loans to each other. What can the interest rate tell us about the economy and why should you as a citizen of Ukraine or foreign investor care about it? The answer is simple: what banks charge each other sets the interest rate at which they pay or charge you! The central bank’s interest rate is one of the most important factors that sheds light on the economic indicators reflecting the current and expected economic health of a country.

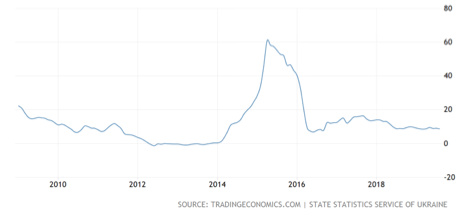

Take a look at this chart:

This chart shows the interest rate set by the National Bank of Ukraine in a 10-year period. There are a couple of conclusions we can make from observing the chart. The most noticeable one is that Ukraine’s economy is incredibly unstable. That is true and, in fact, the prime reason for a spike in interest rate starting in 2014 is high inflation.

Now, take a look at the following inflation chart:

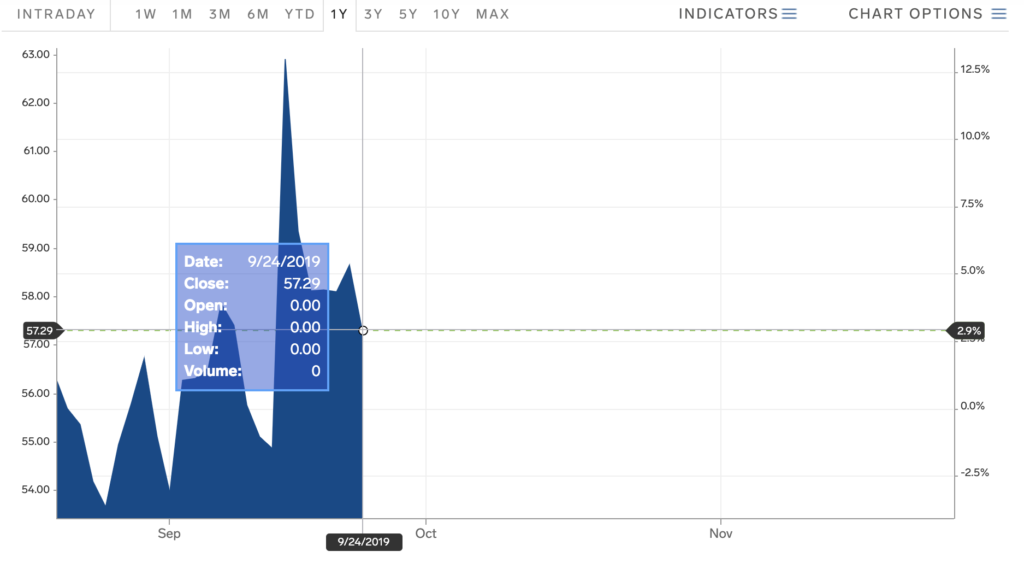

At its highest peak, inflation reached more than 60%. In order to offset the increasing inflation, the National Bank of Ukraine set its interest rate at 30% during the same time period. Since then the rate has gradually subsided to 16.5% and inflation went down to 8.8% as of this writing. As soon as the economic indicators started showing signs of recovery: inflation decreased, and GDP increased from $91 billion in 2015 to $130 billion in 2019 it made sense to lower the interest rate. However, the interest rates are still high, especially compared to those of the U.S. which recently lowered its federal funds rate to a target rate of 1.75% – 2%. The underlining explanation might not be obvious but part of the reason for keeping interest rates high is to lure foreign investments to finance the government’s debt and to rebuild Ukraine’s economy amidst the war and political pressure. Here’s what Ukraine’s short-term government bond yield looks like:

Data as of September 23rd, 2019

These percentages are unbelievably high. According to CNBC, the investors’: “holdings of domestic bonds have jumped nearly 10-fold since the start of the year, to 61.6 billion hryvnias ($2.4 billion).” If you are an investor searching for a high yield investment this is the time and place to invest.

Unfortunately, the Ukrainian side of the interest rate story isn’t nearly covered as extensively as the story of the Fed’s rate cut. Nonetheless, it is still worth examining the economic indicators and search for possible connections to the interest rates.

Sources:

https://tradingeconomics.com/ukraine/interest-rate

https://tradingeconomics.com/ukraine/gdp