Last year, Sonia was diagnosed with stage three uterine cancer which had spread to her lymph nodes. She has gone through six months of aggressive chemotherapy and twenty-five rounds of radiation. Still, her cancer is progressing rapidly. But she is still fighting, and hoping to be eligible to try a new trial drug from Henry Ford Health System in Michigan. The cost of each treatment is $10,000 – Sonia would need about five or six to have a chance at beating her cancer. This $50,000 – $60,000 figure has her worried about paying her bills and keeping open her small business, Klueless Cupcakes. However, her main priority is to do everything she can to fight her cancer. Sonia’s mother started a GoFundMe campaign with a modest goal of $10,000 – the cost of just one trial drug treatment.

There are many stories like Sonia’s: individuals who have been fighting cancer for years and are no longer able to work, but are left paying hefty bills for each doctor’s appointment, surgery and mainly, treatment. Friends and families of these cancer patients have created GoFundMe campaigns to ask for the money their loved ones need, but are likely too ashamed to ask for themselves.

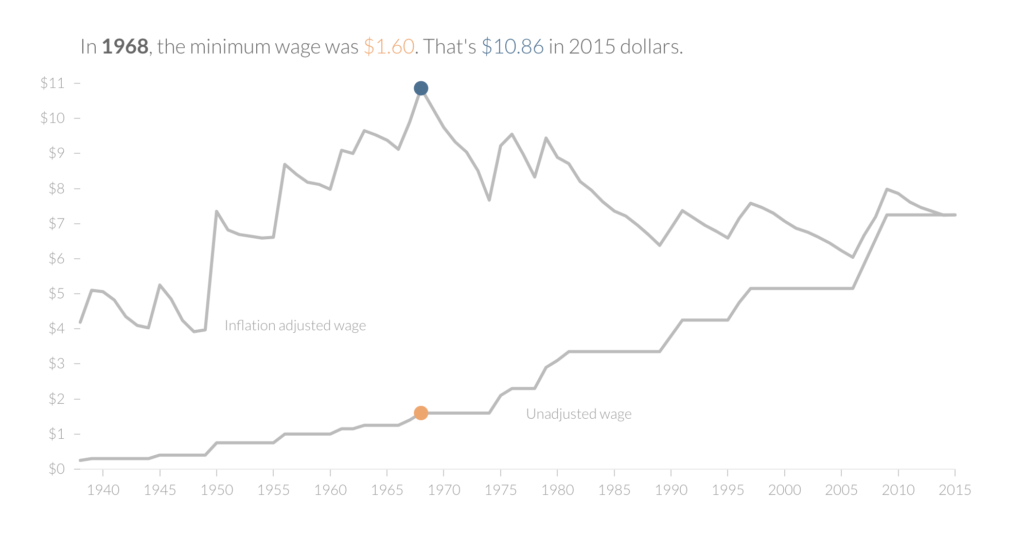

The healthcare crisis in the United States is multi-faceted. It involves the question of who has access to healthcare, health insurance costs, political interests, lobbying power, mergers and more. But the overwhelming issue is that healthcare costs are so much higher in the U.S. than other countries. According to The Wall Street Journal, the United States spends more per capita on health care than any other developed nation. Soon, the U.S. will spend almost 20 percent of its GDP on health.

While the U.S. is a rich nation, and it is logical to be spending more on healthcare than other counties, it should not be that much more.

There are obvious inefficiencies in the United States healthcare system, particularly related to insurance. The price of insurance is extremely high when it is not an employee benefit, leaving it unaffordable to many and the cause of millions of uninsured Americans. Ironically, the uninsured options for care are the most expensive – for example, emergency rooms. Often, uninsured individuals reach a point where they need extensive and expensive care because they never received preventive care.

Insurance policy prices and the high costs of care for the uninsured are two aspects of the increased medical spending in the United States, but there are many components that contribute to the overall high spending. Another contributor to increased spending is something called defense medicine – doctors are worried about malpractice lawsuits, so they run a lot of unnecessary, expensive, tests to cover themselves. Doctors and nurses in the U.S. are also paid more than in other countries. Administrative costs, like paperwork and marketing, are higher as well. But none of these reasons are as significant to spending increases as many think. What contributes most to high spending in the healthcare industry is a result of the way healthcare in America functions.

There is a mixture of private and public components of the healthcare system in the United States – from insurance carriers to healthcare providers to research and development companies. However, the majority of the U.S. healthcare system operates within the private sector. This differs significantly from single-player systems in Australia, Canada and the UK where healthcare services are mostly provided by the government.

The structure of the American healthcare system means there are many different players behind a single patient – but they are not on the same page. The insurer wants the patient to receive the least number of tests possible, in order to pay the least amount of money possible. The provider wants to run as many tests as possible to protect themselves from malpractice lawsuits and to rake in more money for their hospital or private practice and, of course, themselves. The patient hopes for the best care possible, ideally without spending too much out of pocket. However, if a patient feels they need care, they will do whatever necessary and pay whatever price is set.

One would think the increased competition in the marketplace due to lack of government involvement would keep prices low. However, little negotiation of prices for medical products and treatments takes place. Providers and manufacturers are not motivated to keep prices low because people will pay for the care they need regardless, and if they are told their insurance will not pay for something, they will go to another company. Insurers have no leverage to negotiate because there are so many players in the marketplace that will pay for the same care. Additionally, insurance companies are able to cover the costs with increased premiums. There is inelastic demand for healthcare – if a patient is told they need to pay $100 for a treatment and then that price changes to $1,000, they will still pay. They need the treatment no matter what the cost.

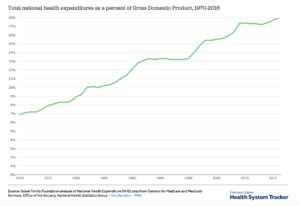

This system has led people to pay high prices for insurance policies and, subsequently, the care they need. Elisabeth Rosenthal said in a New York Times article, “Whether directly from their wallets or through insurance policies, Americans pay more for almost every interaction with the medical system.” A Commonwealth study reported by the San Diego Union Tribune found that among industrialized nations, there were significant pricing differences for many medical procedures. An MRI scan in the United States cost $1,145 on average in 2013, compared with $138 in Switzerland, $350 in Australia and $461 in the Netherlands. An appendectomy cost $6,645 in New Zealand and $13,910 in the U.S. And these prices are rising fast. According to Mayo Clinic, before 2000 a year of cancer drug therapy cost between $5,000 and $10,000 in the United States. In 2012, that average price increased to more than $100,000. Additionally, these costs in the U.S. are 50% to 100% higher than the same patented drug cost in other countries.

The pharmaceutical industry has significant power to set their prices and make high profit margins because of the inelastic demand of most of their products. Therefore, they have set life-saving treatments and drugs at high, unaffordable prices. Pharmaceutical companies justify these high prices with a few main arguments: there is a high cost of research and development, there are comparative benefits to patients, and that controlling prices limits innovation. It is true that most research spending is done in the U.S., and the innovations made are propelling science forward significantly with many individuals reaping the benefits. But these arguments do not justify the six figure numbers that Americans must pay for treatments when people using the same drugs in other countries are paying far less.

People like Sonia are being directly affected by the healthcare system in the United States. Healthy individuals pay their annual insurance fees and go to their yearly physicals without much extra cost. The sickest people in America are suffering, but because of a desire to fight for their health, they will continue to pay astronomical prices for their care if there are not systematic changes.

Stacey Li

Stacey Li

Source:

Source: