American adults are drinking record high amounts of coffee and the price of coffee is dropping along with it. According to Reuters, sixty-four percent of American adults had a cup of coffee in their previous day as of 2018. Some have labeled coffee as “black gold” because of its value in the global economy.

Yet, the world’s largest coffee chain, Starbucks Coffee, is closing its doors at over 150 store locations in 2019. To many, it may feel like there is a Starbucks on every corner and the closing of these locations may seem insignificant but in the past, the trends of Starbucks have indicated the state of the economy as well future consumer trends.

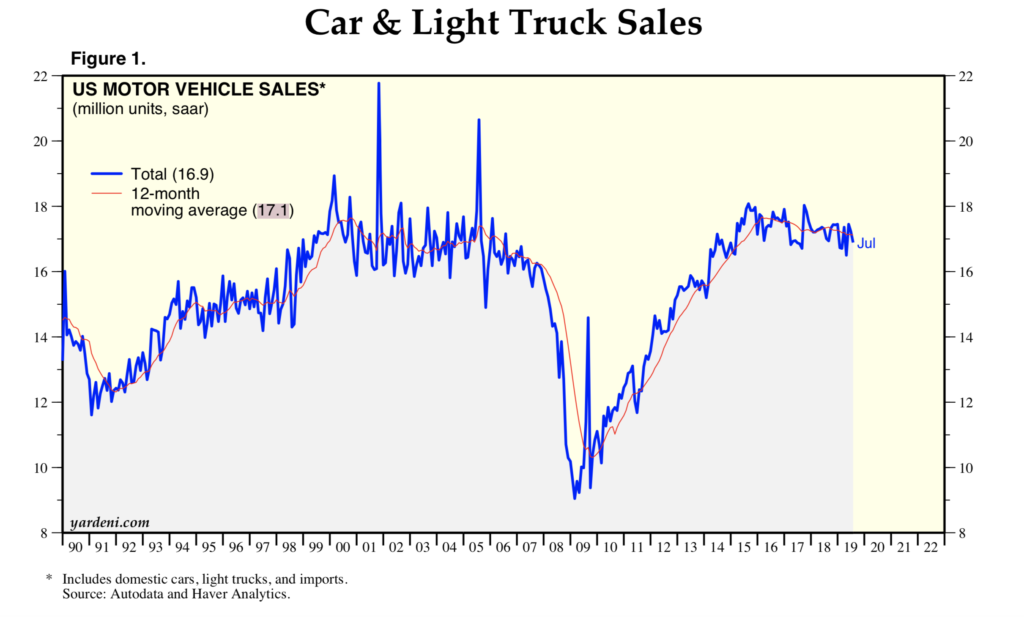

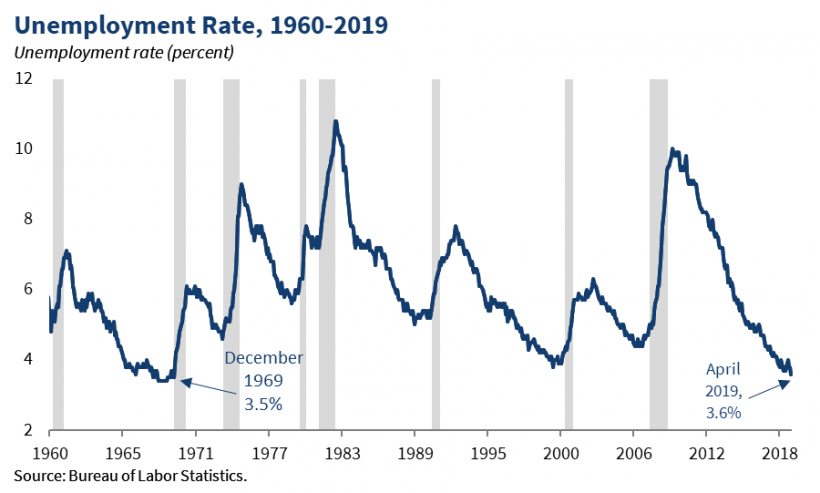

In 1983, Starbucks CEO, Howard Schultz, began shifting the stores focus as a coffee bean retailer into a chain of American cafes. According to CNBC, sales soared from $2B to $9.4B between the years 2000 and 2007. There was a significant hit in 2007 and the American economy began to face the great recession. According to the New York Times, Starbucks had to close 600 of its stores at the height of the American recession in 2008. The company laid off more than 12,000 employees and the stock price dropped more than 24 percent of that year. The annual percentage change (rate of inflation) was at 3.8% in 2008 during this time.

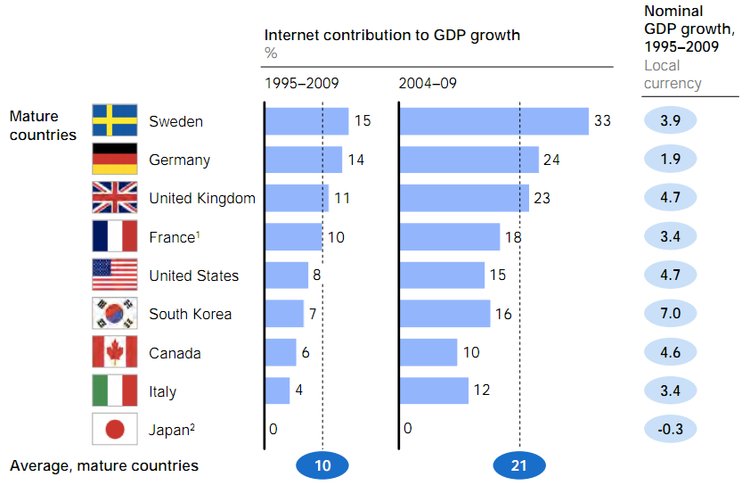

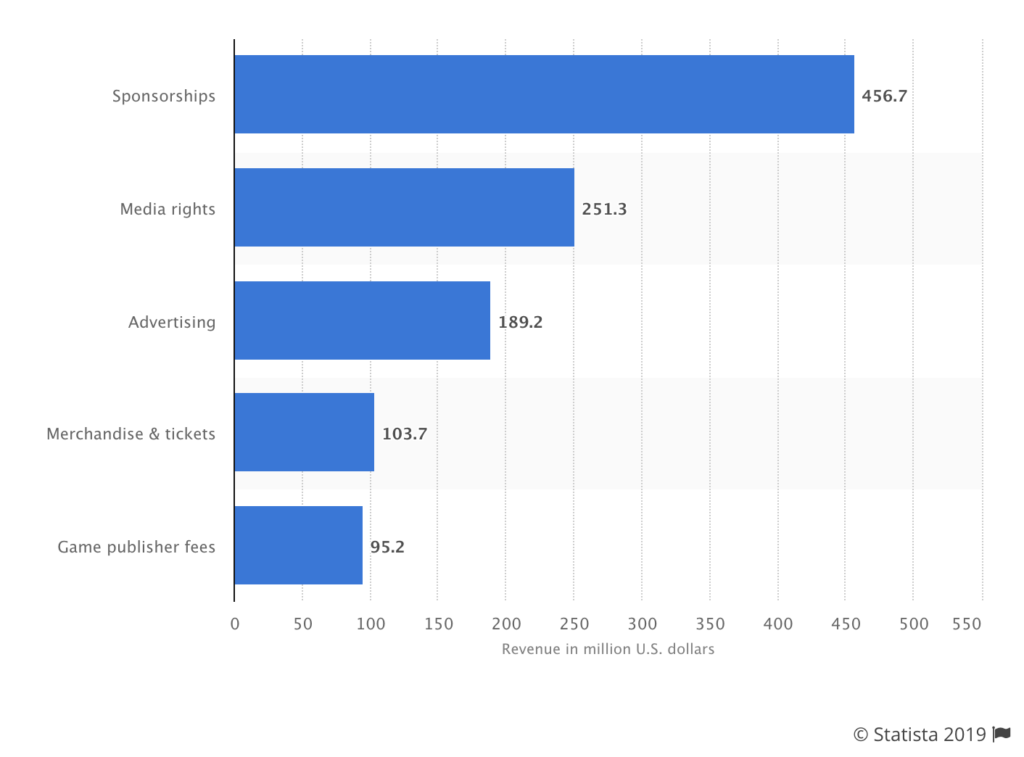

In a study done by the NCA USA Economic Report, consumers spent $74 billion on coffee in 2015. With the coffee industry accounting for 1.6% of the total U.S GDP. The industry is keen on depicting consumer spending given the majority of adult Americans are drinking coffee.

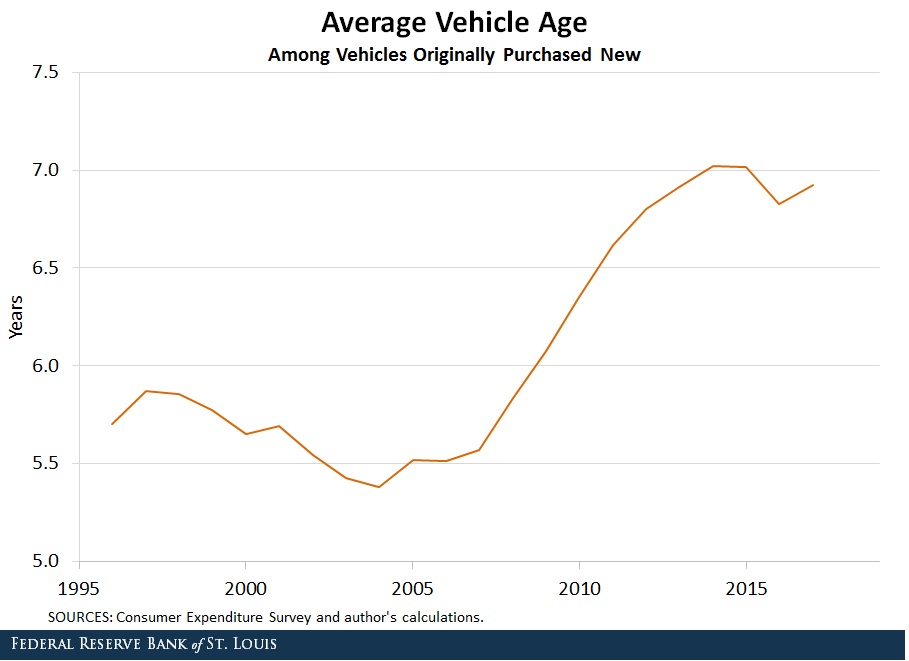

Starbucks will be closing 150 stores in 2019, which is triple the number of stores that it closes annually. The result of this can be mere over-saturation of Starbucks cafes that flood the corners of American cities which leads to a lack of store loyalty to individual locations. This may also be a result of consumers beginning to show less interest in sugary beverages. Whatever the cause may be, the important takeaway is that there is a possibility of an American recession in the near foreseeable future.

The Dow Jones dropped 800 points on August 14th as a result of a global economic slowdown. The U.S is currently facing a trade war in China which can hurt chains like Starbucks who have 3,300 stores sprawled across their country as well as imports for various mugs and equipment that are produced in China. The global influence that Starbucks has, stands as a representation of not only what is happening with American consumers but also for what is yet to come. Starbucks began experimenting with a new line of luxury store locations named “Starbucks Reserve” and has seen wide success, but if consumer spending does not reflect positively, This shift towards a fancy coffee cafe may hurt them in the future of their business.

Additional Sources:

https://fortune.com/2018/06/19/starbucks-store-closing/