This year’s presidential election has been classified as everything but gratifying. Hillary Clinton and Donald Trump have haphazardly disagreed on almost every national issue that has come up in debate. However, one issue they both agree on is to not implement the Trans-Pacific Partnership.

This trade agreement, referred to as the TPP, aims to promote economic growth, creation of jobs, enhance innovation and productivity, raise living standards, reduce poverty, and promote transparency, good governance, and enhanced labor across the 12 Pacific Rim countries, not including China (USTR). The creators of the TPP believe that they will achieve these goals by creating measures that lower non-tariff and tariff barriers to trade.

This trade agreement was proposed as an expansion of the Trans-Pacific Strategic Economic Partnership Agreement in 2005 (USTR). The U.S. signed in agreement with the trade proposal in 2008 and was one of the 12 countries included in the finalized agreement that was completed in February of this year. Implementing the TPP has been one of the trade agenda goals of the Obama administration (USTR). However, now that a new president is coming into power, the smooth implementation of this trade agreement will be affected, which could have detrimental effects on the U.S. economy.

The U.S. International Trade Commission estimates that the TTP will create 128,000 new jobs, increase annual U.S. income by 0.23% and raise our real GDP by 0.15% (USTR). Obama believes it will do this by opening up foreign markets for exporting goods and bettering standards for working conditions in 11 other nations. However, Clinton and Trump are not convinced.

The 2016 presidential candidates believe that the deal will actually hurt American workers (BallotPedia 2016). Trump declared, “I am going to withdraw the United States from the Trans-Pacific Partnership, which has not yet been ratified” (BallotPedia, 2016).

He also claimed, “we will move manufacturing jobs back to the U.S. and we will Make America Great Again”  (BallotPedia, 2016). Hillary, on the other hand, was suspected of being in support of the TPP agreement when working under the Obama Administration. However, in May of 2016, she said, “I oppose the TPP agreement – and that means before and after the election.” She made another comment about the issue in March, when she claimed that one of the reasons she opposed the TPP is because the final proposal has too many loopholes, which will allow countries and citizens to be taken advantage of (BallotPedia, 2016).

(BallotPedia, 2016). Hillary, on the other hand, was suspected of being in support of the TPP agreement when working under the Obama Administration. However, in May of 2016, she said, “I oppose the TPP agreement – and that means before and after the election.” She made another comment about the issue in March, when she claimed that one of the reasons she opposed the TPP is because the final proposal has too many loopholes, which will allow countries and citizens to be taken advantage of (BallotPedia, 2016).

Providing jobs to American citizens is one of the most essential aspects of a country’s economic success. The TTP encourages free trade, which supports the idea of importing goods from other countries on a large scale. As a result, this trade agreement will actually decrease the amount of jobs in America by encouraging cheap production and manufacturing overseas. If the country’s new president decides to remove the U.S. from the TPP agreement, it would wipe out years of Obama’s hard work in promoting economic growth through trade. However, it might be necessary, if America wants to promote production and innovation within our country’s borders.

Works Cited:

https://ballotpedia.org/2016_presidential_candidates_on_the_Trans-Pacific_Partnership_trade_deal

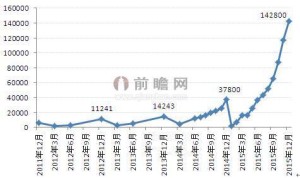

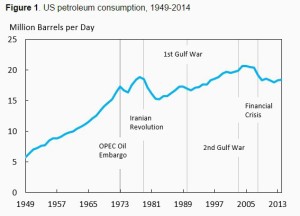

stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the

stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the