In many aspects, California has been seen as a unique case – at times an anomaly, even – of an American state. During the Rio Olympics there were many mentions of how many medals from the American roster belonged to California, and how that number would compare to other competing countries. When it comes to GDP, one can most definitely expect the similar kind of discussion taking place, especially in the current political atmosphere where the intensely progressive and liberal California stands among an overall right-leaning U.S.A..

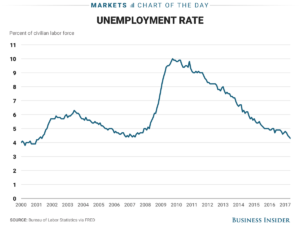

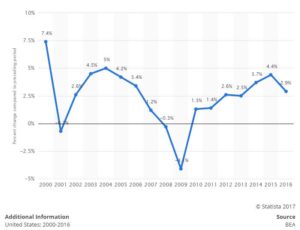

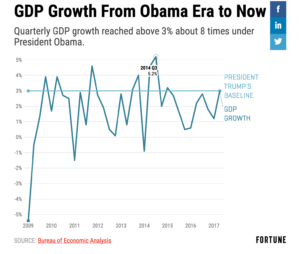

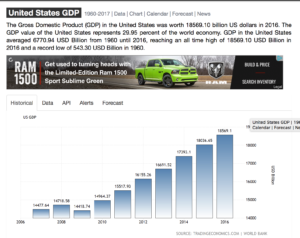

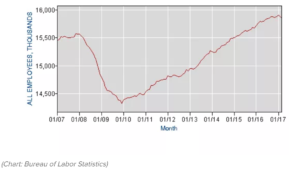

The above graph shows California’s annual GDP growth since 2000. As the data suggests, California’s economy has remained largely healthy throughout the way, only taking a reasonable hit upon entering the 2008 Financial Crisis. However, as Bloomberg noted, California has seen a surprisingly speedy recovery compared to the rest of the nation, which the news agency accredited to the state’s liberal cultural-political environment, even going as far as saying that California “is the chief reason America is the only developed economy to achieve record GDP growth since the financial crisis of 2008 and ensuing global recession”.

The article attributed California’s “magic” to its left-leaning policies, such as securing a strong labor force through laws favoring immigrants. At a time where the President has been very outspoken against the topic, California strives to do the exact opposite, by exercising its autonomy on a state level. From raising taxes instead of lowering to encouraging companies to globalize rather than discouraging, California is almost a “rebellious child” in the eyes of the federal government. However, this rebellion has proven successful, as California’s real GDP growth maintained an upward momentum since climbing out of the recession until 2015, where it attained 4.4% while the entire country had only seen 2.6% that year.

There is no reason to believe that California would change course from what it has been doing and what has been working under the Trump administration. In fact, the President’s orders would act as the inverse-compass for the Californian economy. Despite having seen a dip in 2016, California does not seem to concern itself with this little hiccup, and from the looks of its policies, the state is set on remaining being that “problem child” in Mr. Trump’s classroom.

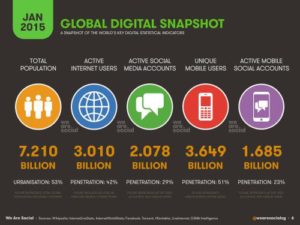

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.