Headlines in the past two years have highlighted a growing concern for the economic hardship caused by the “retail apocalypse”. The term itself covers the story of thousands of big box retail stores shuttering its brick-and-mortar doors to downsize or filing for bankruptcy and liquidating its assets as a mark of extreme losses and business failure.

According to research firm CoStar, 10,600 retail outlets have closed in 2019 whereas 3,017 opened. In 2018, 5,400 stores closed and 3,200 opened. Among those closing shop included Charlotte Ruse, Payless Shoes, Forever 21, Sears, Toys R Us, and JC Penny—all which were previously known as common marketplace staples for most shopping centers in the U.S..

Many blame this phenomenon on the rise of e-commerce driving customers away from physical retail. As physical retailers suffer losses, they are forced to either pivot or close shop. While it is common for the retail market to swing its volatile head in either changing consumer habits or demands, the accelerated rate of change caused by the incumbent online shopping marketplace has left a graveyard of businesses in its wake.

To gauge a better understanding of ‘what went wrong’ in its failings and to look at ‘what has gone right’ for the surviving businesses, it is best to begin with a stakeholder dependent on the brick-and-mortars themselves: commercial real estate owners and investors.

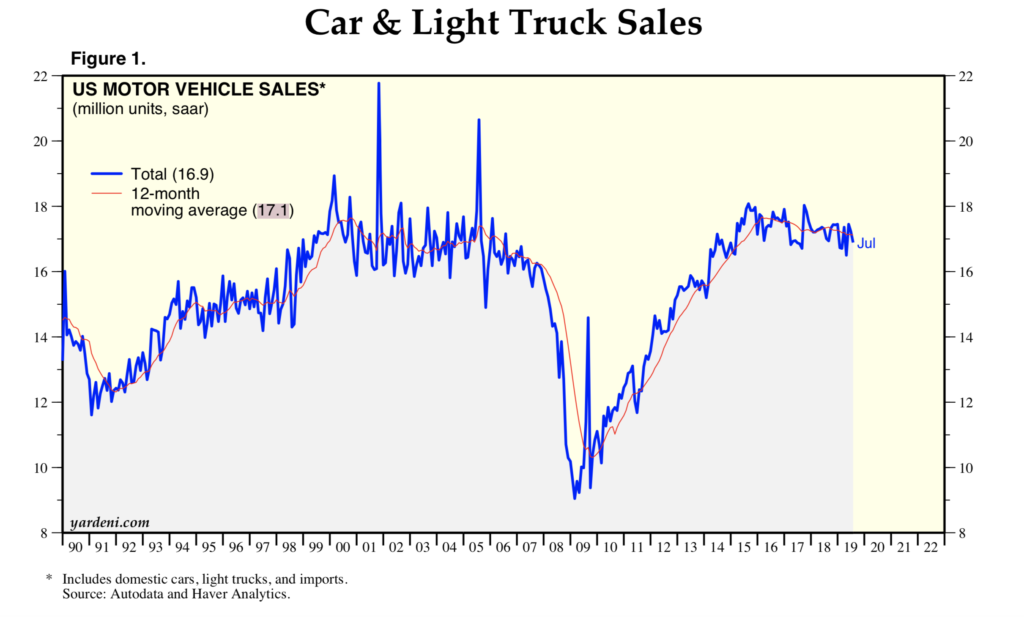

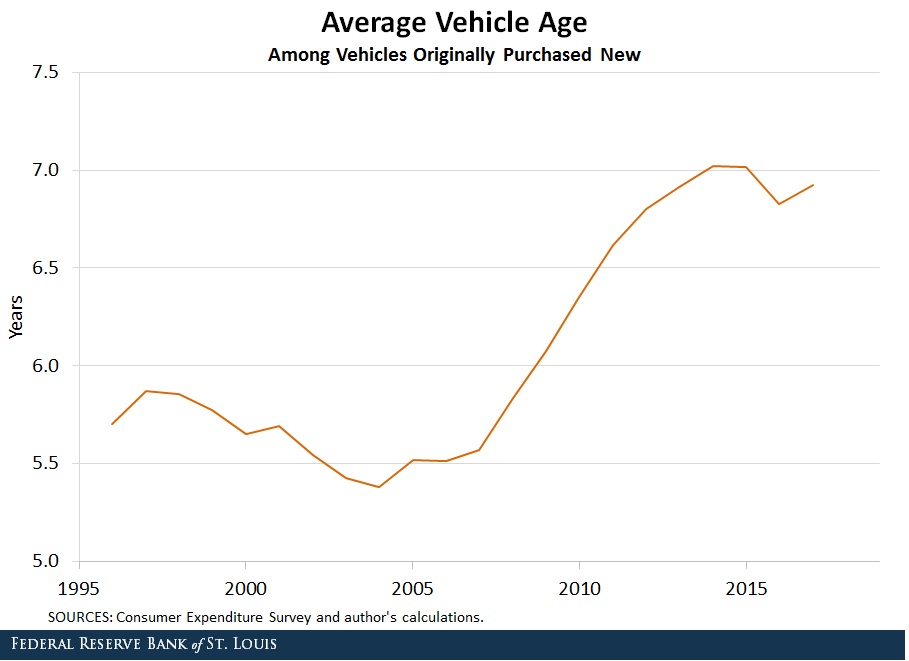

Because commercial real estate is tasked with managing the environment and land use of all retail properties, owners and investor’s sole responsibility is to identify and adapt to changes in the market to maximize foot traffic in order to charge the highest rent. Because of this, their troubles actually began a decade ago, when the financial crisis hit its peak and consumer spending was at an all-time low.

The Great Recession was the first wave to shake retailers as they saw the average storefront struggle while discount big box stores like Walmart and the Dollar General Store grew. Malls were hit the hardest as foot traffic began to dwindle, affecting all stores within its multiplex walls.

As the economy began to recover in the following years, online shopping simultaneously became more efficient and widely adopted by the general public. This change in the market’s habits contributed to the continued losses of these established brick-and-mortars, particularly in apparel and general goods. In an era where 70 percent of shopping centers comprised of apparel retailers, traditional malls and plazas were to face serious losses if they did not act promptly. Many were already feeling the effects of this disruption.

On average, shopping mall property values declined 13 percent, according to Green Street Advisors, a California-based research firm, and is the only sector in the real estate industry to have lost value over the past twelve months.

For long-time owners, such as the private equity firm Walton Street Capital, such a high devaluation leads to large losses. The firm purchased its Poplar-Prairie Stone Crossing shopping center in 2014 for $46.6 million and has recently sold the same property for $32.3 million this year—a 31 percent devaluation.

Part of this diminishing value lies in the fact that the primary foot traffic for these malls have always relied on anchor stores: big box retailers with a high known demand in the market. Many of these anchor stores were some of the staple brands mentioned before: Sears, JC Penny, and Forever 21, to name a few.

As these stores shutter and the overall number of opportune customers reduce, the remaining tenants in a shopping complex either suffer to the point of leaving themselves or negotiate for lower rental rates, depressing the profitability of the mall and driving down its valuation in the process.

Losses of big box retailers also mean an absence of otherwise highly profitable lots festering in the dark as other retailers of the same size appear to be in similar troubled waters and therefore pose the same risk of failure.

In the American Dream Mall in New Jersey, Lord and Taylor was slated to open as a major retailer for the complex. Due to poor finances, the company pulled out from their lease. The replacement for the chain, Barney’s New York, ultimately filed for bankruptcy several months after and had to abandon the same lease as well. With this pattern, vacancy rates remain high and compound over time.

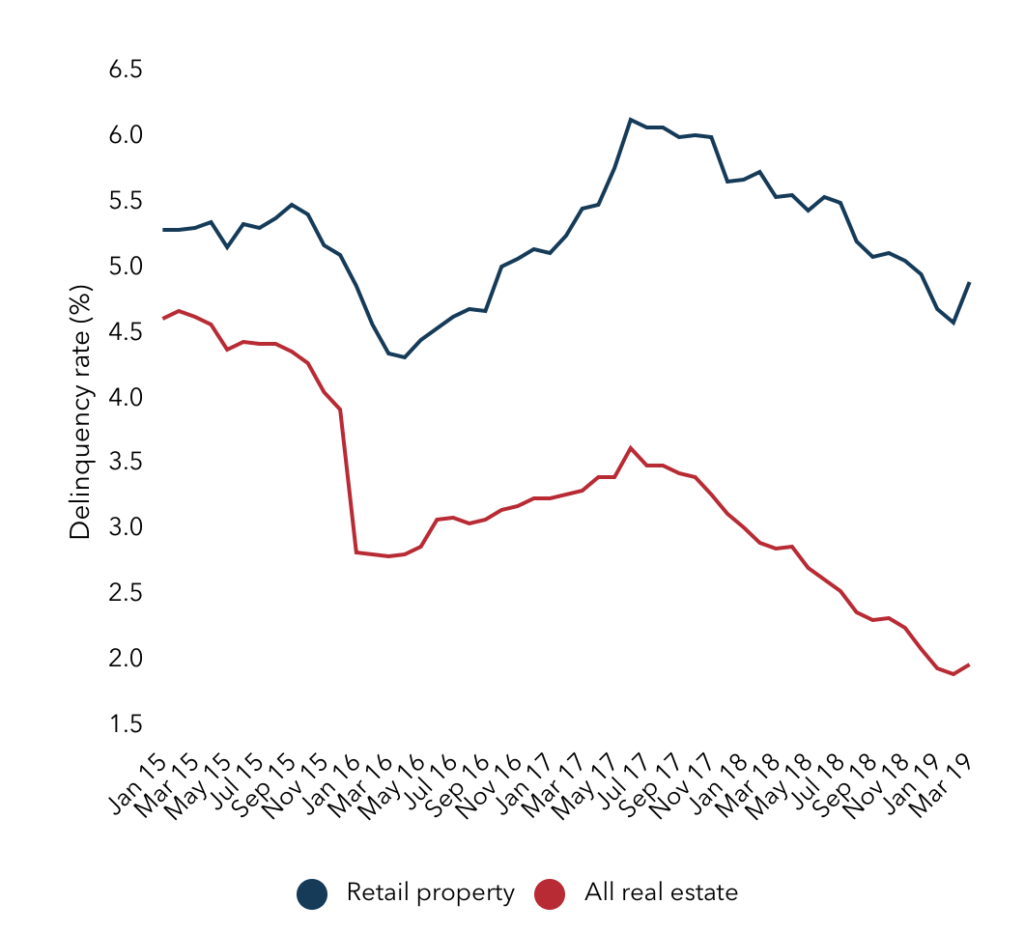

This increasing risk both affects the value of the properties as well as presents an increasing risk for investors, which has led many to hold out on commercial real estate investment in recent years, even for shopping centers that are relatively full. Due to lack of access to capital coupled with diminished returns, retail delinquency rates are up 6 percent in the past four years, which is twice the average for all other forms of real estate.

Property owners are pushing to get connected to investors as a means of recovery. Many are looking to mortgage-backed securities, called CMBSs. These securities spread the risk for lending to commercial properties, though many investors are not even willing to approach that much. Consequently, only “trophy malls,” high-end shopping centers with strong financials to ensure trust, are able to gain access to investment capital. Those comprising of the middle- or low-tier shopping districts are thus left to fester or are abandoned.

Those who are able to collect a sizable investment allocate their funds in a variety of ways, each with its degree of success dependent on its location and demographics. The general consensus, however, has been to replace those who are competing with online retail with unique or specialized tenants.

1. MORE EXPERIENTIAL BUSINESSES

A majority of shopping malls across the U.S. have approached this first by increasing the ratio of restaurants and entertainment on their property. According to Harvey Ahitow, general manager of the North Riverside Park Mall in Chicago, the current average proportion of apparel stores to the entertainment-restaurant mix in shopping malls is about fifty-fifty, in comparison to the seventy-thirty of a few years prior.

This emphasis on entertainment and restaurants is part of a growing focus on experiential shopping over shopping for general goods. If the shopping experience can provide an aspect that is unable to be generated through online simulation or information, then it is more viable in this new post-retail-apocalypse context.

Some of these businesses even outfit the place of anchor stores, including kid’s recreation facilities, gyms, and even grocery stores. Niche interests are also encouraged over general goods as well, including specialty stationary stores or other novelty stores that will bring in customer base on their own.

Some shopping centers are looking to expand the entertainment value of their mall to the extent of an amusement park to attract both locals and tourists to their property. The newly-opened American Dream Mallis the second-largest in the U.S., located in New Jersey. On top of containing an array of staple brands, the mall also boasts a bunny field, an aviary, a doggy day care, and a luxury lounge. The development also included the construction of several hotels beside the mall to add convenience for visitors and tourists.

Triple Five, the company behind the largest malls in North America, including the American Dream Mall, is looking to establish American Dream as a “community hub”, modeled heavily off of its two other malls, the West Edmonton Mall in Alberta, Canada and the Mall of America in Bloomington, Minnesota.

2. SMALLER STOREFRONTS

Shopping centers are also looking to diversify their portfolio by quantity. Since previously-established anchor stores no longer carry the same weight in terms of bringing in foot traffic, multiple smaller retailers ultimately can bring in the same amount of their own customer bases. At the same time, more retailers spreads the risk of loss if one fails. Smaller tenants are also easier to replace.

3. MIXED USE DEVELOPMENT

Some shopping centers decide to abandon the mall format altogether and adopt a form of mixed-use development. The architecture of this format includes commercial real estate on the ground floor and residential real estate on the upper floors. This mix is conducive to urban settings and is a prime way to diversify the property’s portfolio in a manner that isn’t reliant solely on the whims of the retail market

At the same time, the convenient accessibility of both components to the property also give each an added value proposition. Apartment complexes can be charged higher rent due to convenient access to shops, which often includes access to a grocery store in the complex. Retailers also are given easy access to a customer base and therefore can be charged higher rent because of the increasing exposure to and producing revenue from that customer base.

These development projects adapt malls and plazas into strip commercial districts, which have been more capable of recovering from both the recession and the retail apocalypse. According to Costar, strip retail center values are growing 2 percent in the 2018-2019 year, which is a stark contrast to the 13 percent decrease in mall property values.

4. EDUCATION APPROPRIATION

Shopping centers themselves are buildings with size specifications that can fit the needs of many different services outside of business operation as well. For Austin Community College, the Highland Mall was a perfect venue for a state-of the art lab space. The Hickory Hollow Mall received a similar treatment when Nashville State Community College decided to renovate its space into a professional hockey rink and a school-sponsored ethnic market filled with immigrant businesses.

5. ENVIRONMENTAL RECLAMATION

Development of commercial spaces did not go without its environmental costs either. As suffering low-end malls see their end-of-life, government initiatives buy up land of parking lots and structures to repurpose into recreational parks or nature conservation regions, such as the Northgate Mall salmon stream in Meridien, Connecticut.

This decision could imply an admittance of failure in the commercial structure itself. This does not mean that the value derived from a park is no less than the value of a commercial property.

THE OUTCOME

With these pivots in mind, it is more difficult to see the retail market failures as an “apocalypse” intent on destroying our physical retail economy, but rather a change in the guard of the major players in the industry based on which companies were able to adapt to the shift in customer wants and utilize new technologies to compete with new value propositions created by the emergence of the online shopping space.

What exemplifies this distinction is in the fact that many of the online entrants in the retail space are beginning to open their own brick-and-mortars themselves. Native internet companies such as Warby Parker, Glossier, and even Amazon itself have set up storefronts nationwide.

It should also be noted that new anchor stores have emerged from the rubble of the fallen. High-end apparel such as Nordstrom and Lululemon as well as specialty goods such as Apple and Peloton have since replaced major general goods retailers and drive in a majority foot traffic to shopping districts.

What distinguishes these new major players from companSears is therefore not in the replacement of physical stores with online shopping and direct-to-consumer shipping, but rather the adoption of technologies that enhance value proposition of basic goods or distribute increasingly valuable specialty goods. Those who are able to survive in the landscape are those who stand out either in price or in specialty.

However, some of these value propositions come at a cost. Amazon, the dominant hand in the e-commerce space, has a prolifically deplorable record for workplace abuses and underpaying its warehouse personnel, which have contributed to its cheap and highly efficient shipping systems. It also has a history of extorting its vendors. Since these value propositions come at an unfair cost, the possibility for other businesses to challenge the behemoth ultimately diminish into a fraction of the typical market environment exhibited just a decade prior. It is through this that we may see more graveyards appear as retailers existing in the same space of general goods, apparel, or even furniture struggle as underdogs. In this new landscape, it is either “be better” or “fail with the rest” with no room for averages or just getting by.