Summer of 1894 marked the first official celebration of Labor Day in the United States; President Grover Cleveland signed a bill creating a national holiday across the country when reconciliation with the labor movement became a top political priority.

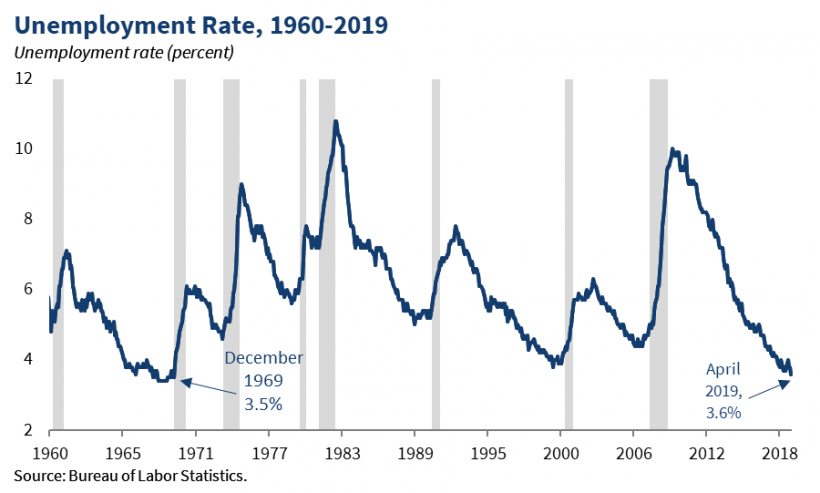

Since the original Labor Day, the U.S. labor market has been affected by economic upturns and downturns, governmental policies, changes in cultural values, and countless other factors. One significant statistic from the labor market, the unemployment rate, gives the percentage of unemployed workers in the total labor force. The rate reveals how many people are out of work or seeking a job, which affects the American economy as a whole. When one becomes unemployed, an individual or family loses its wages. In turn, the national economy loses the consumption of goods and services that the individual or family would be spending with earned wages. The purchasing power of the unemployed consumer declines and eventually puts other workers out of a job. The fact that unemployment affects purchasing power makes it an economic indicator: a means to gauge future trends in the economy. A low unemployment rate indicates a strong economy usually tied with high consumer spending; a high unemployment rate usually occurs during a time of economic downtown and causes low consumer spending.

During the year of the first Labor Day, the unemployment rate was 7.73%. The Panic of 1893 has just occurred due to international crop failures and other shocks that weakened the economy. Four million people were unemployed during what became a major depression in the business cycle. The unemployment rate confirmed the pattern of economic downtown in several sectors of the economy at the time.

Last month, July numbers showed a present-day unemployment rate of 3.7%, one-tenth of a point up from the record low rate of 3.6% reported in April. The rate has not hit that low of a percentage since December of 1969, indicating a robust labor market in the current U.S. economy. Consumer spending is high, building good business, and in turn, generating more jobs.

The unemployment rate, a trailing indicator, confirms the growth that the American economy is experiencing in the present day. Workers earning wages stimulate economic growth with spending.

The unemployment rate rose one-tenth of a percent between the first and second quarter of 2019. However, the small fraction of growth is not alarming on a month to month basis. If the unemployment rate were to rise 0.5% over a short period of time, there may be reason to worry about economic downturn.

125 years after the first official Labor Day and Panic of 1893, the U.S. sees a robust economy confirmed by a low unemployment rate. Although other indicators such as an inverted yield curve and slowing global growth may suggest an imminent recession, the unemployment rate confirms economic growth and stability in the present day.

Sources: