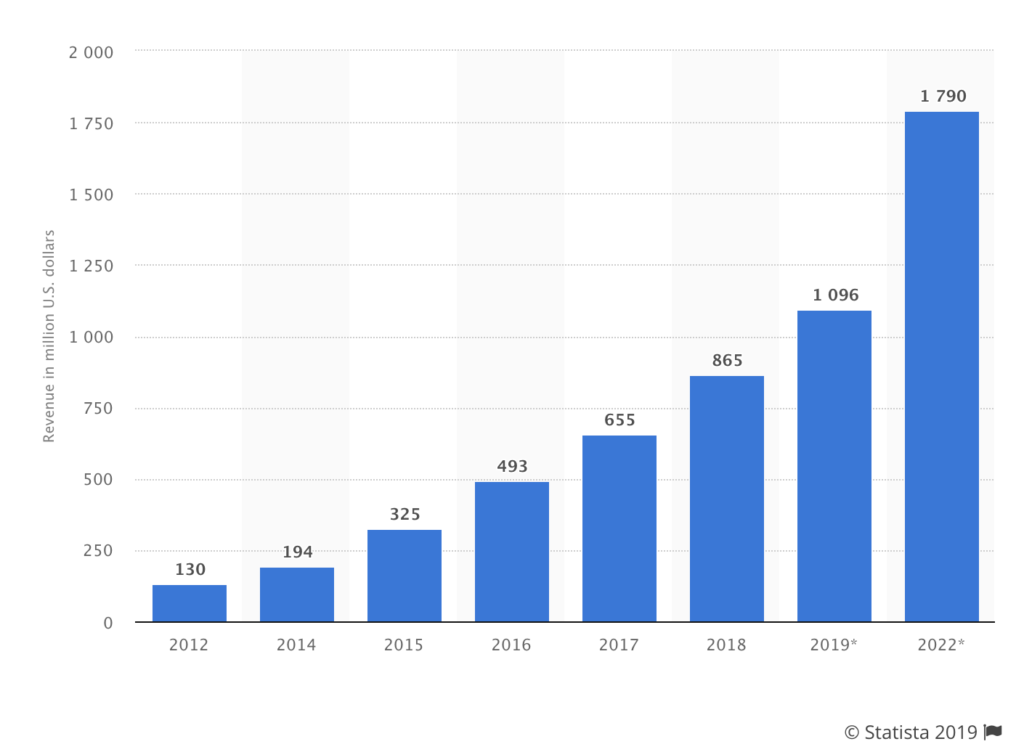

Virtual Reality industry has been on the rise since 2016. In 2016, only 28% of the general public was aware of virtual reality devices, demonstrating the industry’s potential for growth. Awareness of virtual reality devices rose to 51% in 2017. (Nielsen). Looking into the future, the global AR and VR market is expected to grow to $209.2 billion by 2022.

However, the rapid growth also shows a disruptive and transformative VR industry. VR companies, like VeeR, are examples of some of the industry-level changes.

In the beginning, while tech companies focus on developing new tools and improving user experience, some proactive entrepreneurs have been looking into the easy access and mass delivery of VR content. VeeR VR, founded by three Chinese in late 2016, is a global VR content community aiming at a developing cross-platform solution for viewing and streaming 360 or VR media.

VeeR was originally headquartered in Beijing, China but also established two branches in Silicon Valley, California and Shenzhen, China. It later moved its headquarter to San Francisco. Within one year of its official launch, it has grown into an international enterprise with millions of users from over 180 countries. The three co-founders have been featured by Forbes 30 under 30 Asia 2018 as honourees for the consumer technology sector, become the only founders of virtual reality technology company to make the list last year.

“Our original intention was to make the VR content accessible and bring the best viewing or editing experience to users,” said Denise Wu, the Head of Marketing of VeeR VR. Based on this intention, the company developed two unique features of VeeR – great content accessibility and a community to share the content easily.

Wu mentioned that when the VR industry was at its initial stage, there was an issue of accessibility and standardization of contents. “How do you upload the great work you did to platforms, how do you share them, and how do you watch them on different platforms – these are the issues we wanted to tackle. And this is the purpose of our company: to smooth the process of sharing content so that creators and spend more time on creating,” Wu said.

Although VeeR needs to fight with other giants like Youtube and Facebook, which already provided similar functions, VeeR has its own advantage: first, no platform has ever created such a huge community for VR sharing and editing. More importantly, all other platforms require the downloading of a third-party application to play the 360 video – you can’t just open a VR video in the browser, but it can be achieved with VeeR.

This could mean a lot. Platform-native is important to the audience because no one would love to download another app for the experience. In 2016 and 2017, if you see a VR film online, you have to go to (or download) Facebook or other third-party apps to view it. Platforms like Facebook did not support browser-viewing not because of the technical difficulties but because they want to monopolize the VR experience. Same for other VR apps, which put the app downloads over the quality and accessibility of the content itself. But VeeR broke the pattern. It directly connects viewers with the content, eliminating the frictions in between.

VeeR also brings a cross-platform experience: it currently works on mobile, mobile VR headsets, web and support for other platforms like Oculus. And they tried to create a seamless experience between the various devices, with the UX being similar on all platform, with only some differences to optimize the UX on every one of them.

The other feature of VeeR was the easy share of its content. Study shows that 77% of virtual reality users want more social engagement (Forbes). With VeeR, people can find a community to create, edit and share 360 videos and photos. Just like Youtube, you can create and share 360 videos and see their analytics. But Veer is different from Youtube on that it builds an ecosystem dedicated to 360 videos, with various features specifically dedicated to them.

The VR ecosystem includes VeeR Editor, a mobile app for editing 360 videos. So, VeeR VR lets you enjoy, comment share the content; VeeR Editor lets you edit and polish the content; VeeR Heat Map lets you, the content creator, analyze the appealing of your video to the public, highlighting which portions of the videos have been watched the most. There is a complete ecosystem that spans from content creation to customization, sharing, and analysis. None of the other platforms could achieve this specialty.

Nowadays, we’ve seen more and more VR-related products dominating the market, and the general trend for VR is “user-friendly.” Many companies launched high-quality professional 360 cameras, but oftentimes the cheaper 360 cameras with more costumer functions sell better. Instead of taking two hours to figure out how to import and export the video, buyers would be more likely to choose a camera easy to start. This is the same concept for the VeeR platform. It eliminates the gap between professionalism and customer functionality, making VR not exclusive to the public due to its technological barriers, but more accessible to the public.

With the mission of empowering everyone to create and share the next generation of media, VeeR has become one of the largest VR content hubs by both content and creator volume, and a trusted platform for VR professionals, production studios and prestigious brands on a global scale.

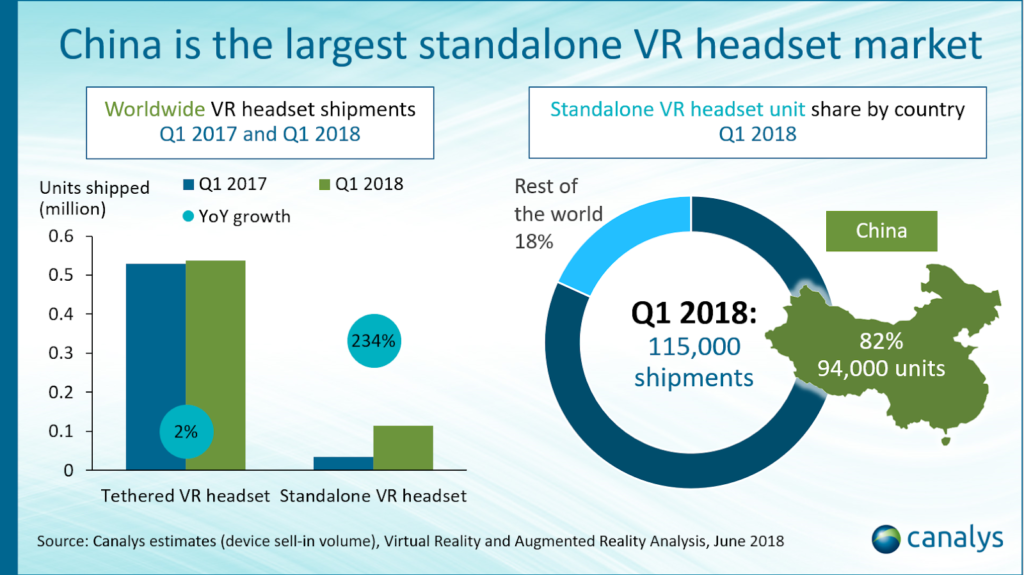

VeeR was founded in China, which is a double-edged sword for the company. Content-wise, VR is accessible behind the Great Firewall in China. A large variety of affordable VR tools in China encouraged countless content creators to experiment with VR technology. Meanwhile, China is leading the way of the growth of VR, and China has become the largest standalone VR headset market in the world. This positioning in the Chinese market has helped VeeR in establishing various partnerships with big companies that want to perform marketing operations in China. However, the VR contents produced in China are still subject to government censorship; therefore, they are somewhat monotonous to the global market, said Wu.

In an interview I had with Wu earlier this year, she said that “because our model is quite special, I don’t think we have a lot of strong competitors.” She thinks that in China, none of the VR companies has the skill and audience base to compete with VeeR. She also referred to Facebook and YouTube as the only two powerful platforms that are experimenting with VR content.

However, the industry has changed a lot over the year. With the mature of the VR technology, mass production of VR content and the lack of industry-standard regulation guidelines, the disparity in quality begins to show up on different VR platforms.

That is when VeeR decided to switch its focus from easy access and mass production to high quality (or premium, according to its website) content. Months ago, the company’s CEO Jingshu Chen wrote a letter to VeeR users, explaining some big changes to the platform, including the elimination of low-quality content and the gradual transition from mobile to headsets.

According to the letter, the company is “switching our focus to premium immersive films, including both linear and interactive videos. By doing this, we hope to bring the best immersive experience to the audience (online and offline), while providing a sustainable business model for content creators.”

For creators, VeeR introduced more opportunities for monetization and project funding and added benefits for verified creators. The company also stopped approving videos with a low resolution, content with low perceived entertainment value and mobile-uploaded content. It also removed the 360 photo function, which was introduced to VeeR Editor only last December.

For audiences, VeeR is encouraging (or forcing) them to switch from mobile app to headset. “The focus will be shifted to headsets. The mobile app will now be used to bookmark content for later viewing and purchase content more conveniently,” Chen wrote in the letter.

This is not only a result of the overflowing of unfiltered content but also a countermove to the expanding power of other video platforms. YouTube, for example, is becoming more skillful on VR content display and meanwhile benefiting from its large audience base from traditional videos. If YouTube wins by multiplying its user quantity, VeeR is trying to gain momentum by polishing its quality.

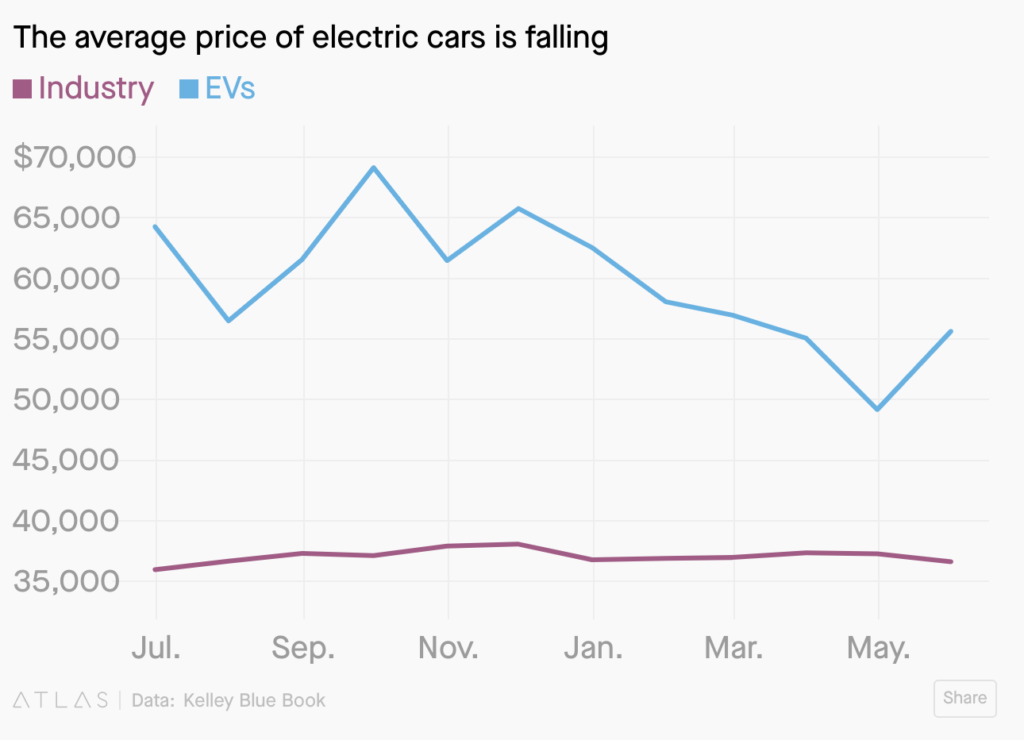

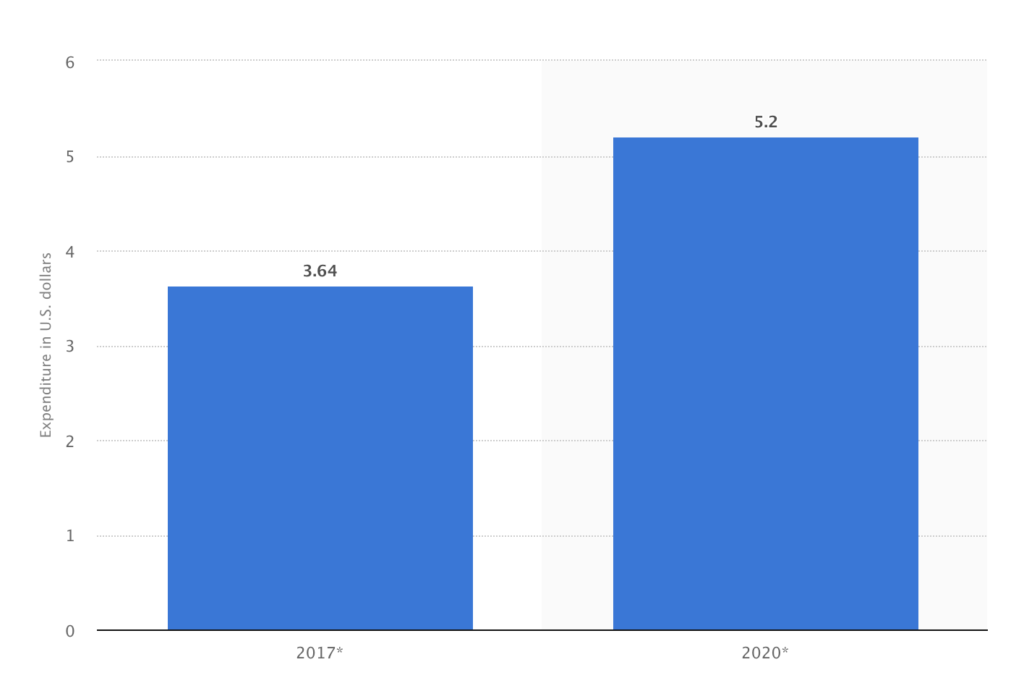

As Virtual Reality grows in the market in recent years, people can feel the overflowing supply and a higher demand for high-quality work. When first released, the majority of cutting-edge AR and VR technology cost thousands of dollars to buy. This was something that many people couldn’t afford, which often hindered the growth of the industry. Alongside this, the technology was often of relatively low quality, especially by today’s standards, which meant that many consumers weren’t getting enough value for their money. This is something that has been inverted in recent years.

With the advancements that have been made in the industry, costs have plummeted while quality has skyrocketed, giving end-users much more value. This is something that is expected to continue in the future.

VeeR is a young company, but it did a great job of pioneering the industry by putting the audiences first. Through VeeR’s struggle to survive in the new trend of VR, we can take a glance at the consequence (both good and bad) of an overheating industry.