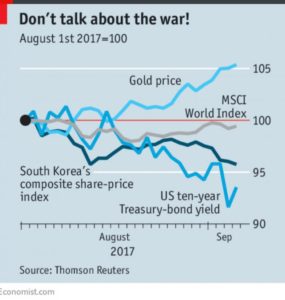

A rogue state testing hydrogen bomb sent a missile over the territory of a neighboring country. The American president promised “fire and fury” if threats continue. Sounds a lot like the plot of a Hollywood thriller, right? Tthe Market, however, doesn’t seem to think the world is heading for to conflict and chaos. International investors are relaxed about the potential crisis on the Korean peninsula, and the market stays undisturbed. According to the recent data collected by the Economist, economic indicators including the yield on Treasury bonds and the MSCI World equity index fell, while the Gold price rose in the recent month. However, these movements are not big. In fact, the South Korean stock market, which should be most sensitive to the risk war, is doing better in comparison to the start of the year.

Let us consider the terrible possibility of a conflict on the Korean Peninsula. In addition to the tragic humanitarian loss, the global economy will also suffer. Capital Economics points out that South Korea produces 40% of the world’s liquid-crystal displays and 17% of its semiconductors. If Japan was the target of missile strikes from North Korea, as it might be, the disruption would be even greater for that Japan is the world’s third largest economy.

So how can we justify the market’s insensitivity to this delicate political situation? Some propose that the market is simply not very good at assessing political risk. A recent example would be when the European market failed to foresee the result of Brexit. The vast majority of polls and markets had “remain” with a solid lead. It was only when the polls shifted towards “leave” in early June 2016 did the market moved in the same direction. Still, never once did “leave” come close to taking the lead.

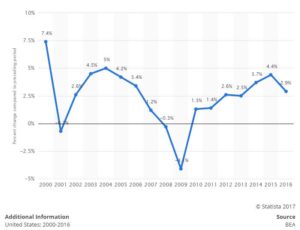

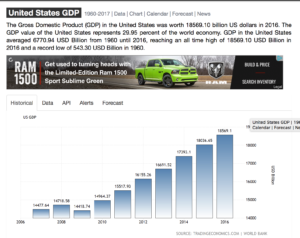

Another explanation is that investors have learned in recent decades that geopolitical events tend to have only very short-term impacts on the markets. In comparison to political risks (e.g. the result of a presidential election), economic growth and corporate profits are far more important factors to consider for the investors. The reality is, no one can run enough analysis to properly assess and predict the situation with North Korea based on polls or past data. Nevertheless, the market has made a decision that for now, they do not believe a serious incident will happen on the Korean peninsula. So let us all hope that the “wisdom of crowds” wins this time.