Within the United States’ precarious political environment, many Americans live in fear that the economy will dip into a deep recession like that of the housing crisis, which occurred not even a decade ago. These nerves are rational, as our market economy is cyclical. Periods of growth have always inevitably been met with periods of recession.

Economic indicators can help us to analyze the economy. Studying trends in retail sales, unemployment, etc. can help us make educated guesses as to where the economy is and where it is going. An interesting economic indicator we can use to analyze these trends is restaurant sales.

In an economy with contracting growth, individuals and families may feel their first inklings of strain in terms of food. In an unhealthy economy, the dollar might be devalued and workers may be laid off, which would lead to a decrease in consumption, which accounts for almost two thirds of the U.S.’s GDP. Consumption measures what is spent on goods and services produced in the United States. Even though it is only a portion of a nation’s GDP, consumption can be used to help predict the future of an economy, especially in a country like America because its consumption is relatively high in comparison with other economic variables.

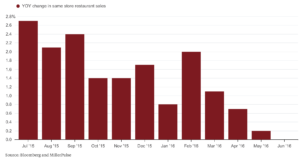

If an economy is shrinking, one of the first areas of decline is restaurant sales. Economically strained Americans first tighten their finances by refraining from eating out. Food as a commodity is a short-lived luxury, since after you eat it, it’s gone for good. Therefore, food, especially going out to eat, is one of the first areas in which people start to cut back when trying to save money. Declining restaurant sales are an indicator that economic growth is slowing.

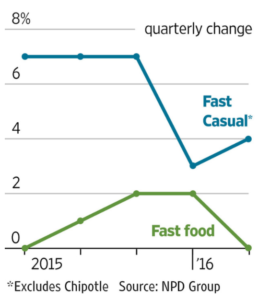

Within slowing or flat restaurant sales reports is a hierarchy. The first types of restaurants to feel decreases in sales are full-service, sit-down restaurants. They’re the first to go for individuals trying to save because they are the most draining of important resources, e.g. time and money. Next comes fast casual restaurants, whose sales’ declines mean that there is much more financial strain amongst a nation’s citizens, leading financial experts to turn decidedly bearish on them. Decisions like these lead to less valuable restaurant stocks.

However, not all trends in restaurant sales decline when Americans are nervous about the economy. An example of an outlier is pizza. As Bloomberg reports, in June of 2016, restaurant sales were flat, the lowest growth in sales since 2013. In contrast, Domino’s continued growing, with sales toping 5% for Q2 2014 – Q2 2016. Bloomberg Intelligence Analyst Michael Halen explains that Pizza does well in recessions due to its value proposition–moneymakers feel frugal spending $7.99 on a large pizza to feed their families.

Many other aspects of food can be economic indicators. Increases in grocery store sales indicate that more people are eating in and thus trying to save money. And similar to pizza shops, fast-food chains tend to do well during recession due to consumers’ value propositions. Hugo Lindgren of New York magazine went so far as to publish the “Hot Waitress Economic Index” explaining that during slow, flat, or declining economic growth, restaurant servers are more attractive, assuming that attractive people tend to find higher-paying work during good economic times.

Economic indicators are measurements collected to assist in hypothesizing the future of the economy. They are useful only with supportive data and examined in long-term contexts. Some indicators are estimated by governmental organizations or professional private companies. However, some are more suitable for normal citizens, like pizza.

Other sources: Eater Wall Street Journal Forbes