Hurricane, earthquake, and wildfire… America and the world have been entangled by natural disasters recently. The natural disasters indeed never could be a positive thing because of its destruction and death tolls; however, the disasters also tend to make reconstruction the primary task for the government, which would face little obstacle to pour money into the affected regions. Thus, setting humanity aside, natural disasters in some situations could be a boost to the regional economics.

Sichuan in China, where a magnitude 8 earthquake stoke in 2008, is an example that the local economy benefits during the post-disaster reconstruction. The poor infrastructure led the Sichuan earthquake in China to end with 87,150 people death toll and 4,800,000 people homeless, according to the BBC News. With $191 billion economic loss, the Sichuan Earthquake was the second highest in terms of economic losses. The fortunate part was that the center counties in 2008 Sichuan earthquake, Wenchuan and Ya’an, were neither a raw material production base nor manufacturing zone; actually, these counties were poor. Thus, the earthquake did not hurt much the Chinese exports and GDP.

(from BBC)

The rebuilding efforts costs the Chinese government almost $150 billion,equivalent to a fifth of its entire tax revenues for a single year, according to the Guardian.The rebuilding plan will “envisages building 169 hospitals and 4,432 primary and middle schools to replace collapsed structures.” “Another 2,600 schools that remained standing will be strengthened.Under the plan, more than 3 million homeless rural families will get new houses and 860,000 apartments in the city will be built.”

It is brutal but true to say this immense earthquake served as a stimulus to Sichuan’s local economy. “When something is destroyed you don’t necessarily rebuild the same thing that you had,” said Mark Skidmore, an economics professor at Michigan State University. “You might use updated technology, you might do things more efficiently.”

As poor and small counties in China, WenChuan and Ya’an have minimal chance to receive this much of national investments and resources.

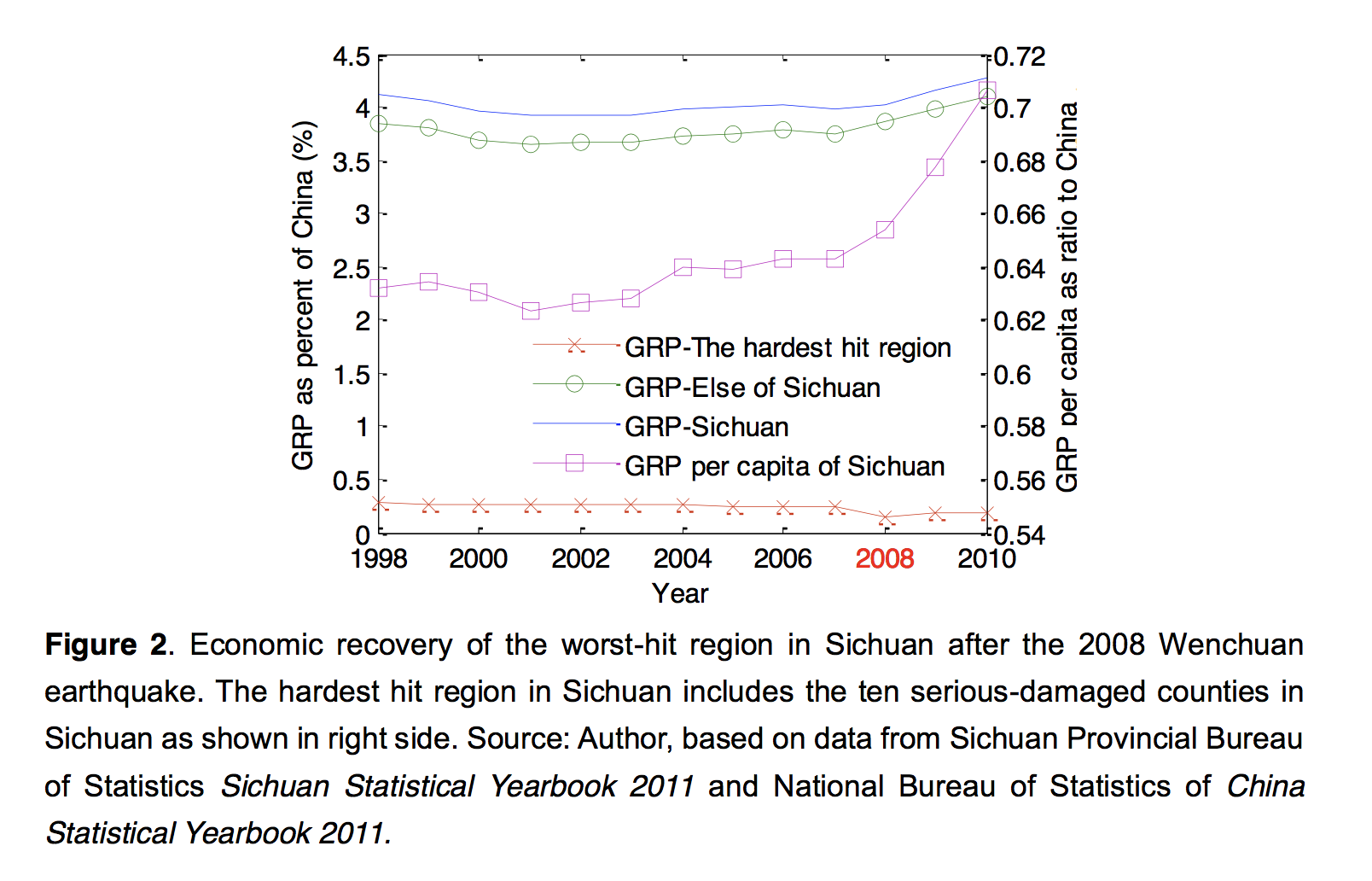

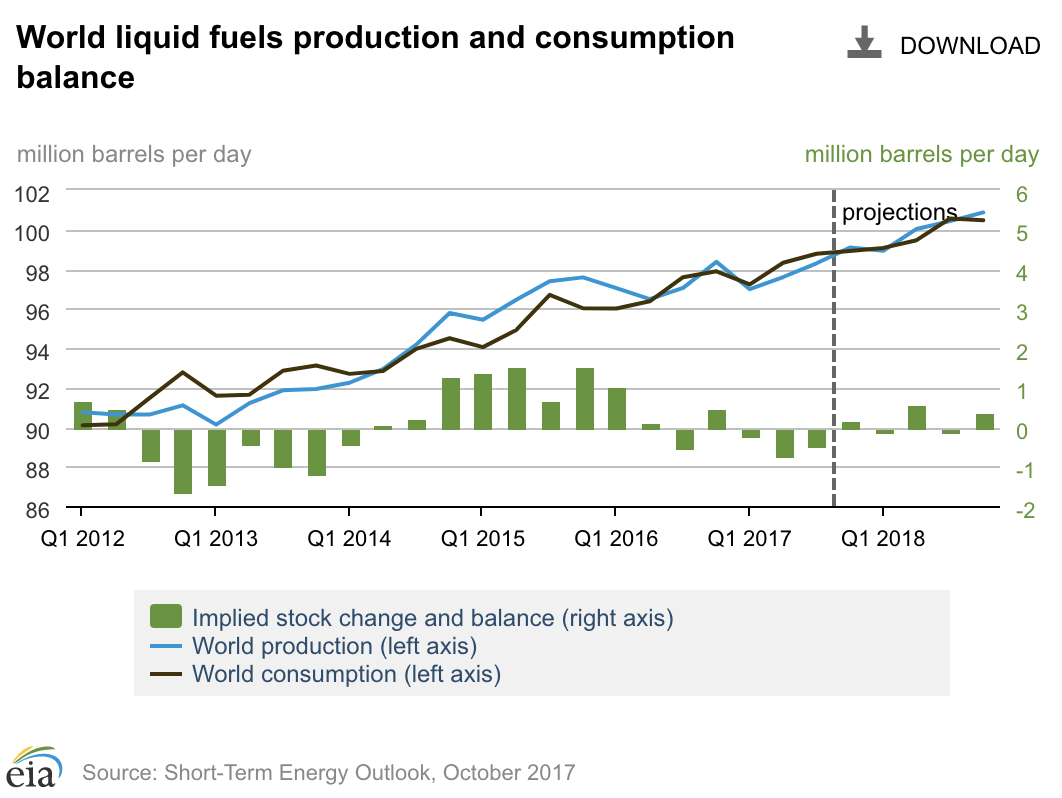

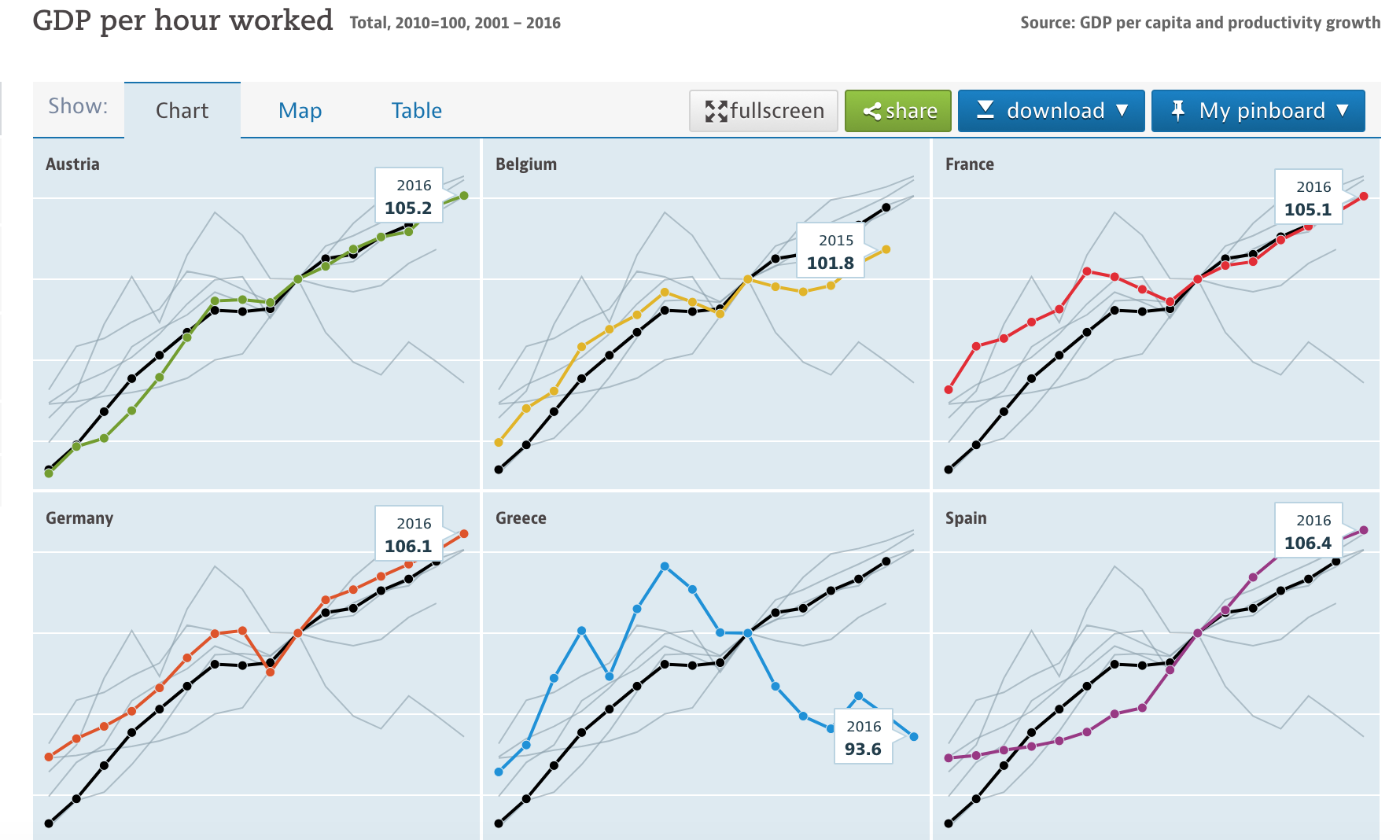

“The GRP level (as a percentage of Chinese GDP) of the worst-hit area of Sichuan decreased by 35.4% in 2008 compared to the 2007 level. After three years of reconstruction, the region had still not returned to its pre-earthquake GRP level, but the GRP level of the rest of Sichuan experienced a boom in those three years because of the reconstruction demand stimulus,” According to a studies conducted by MOE Key Laboratory of Environmental Change and Natural Disaster of the Beijing Normal University.

It is understandable for the chart above that depicts the economic recovery of the worst-hit region in Sichuan and else of Sichuan. The hardest hit region suffered the destruction and the labor shortage the most. Even with such tremendous amount of resources and capital, the quake center regions hardly could reach effective capacity and productivity. The else of Sichuan are in a much better situation that these recovery investment creates job opportunity and industrial production.

More practical reflection of the benefits from 2008 earthquake to Sichuan region comes from the 7.0 magnitude Sichuan earthquake in Ya’an. According to the BBC report, “none of the buildings built since the Sichuan earthquakes collapsed.” The quality of housing for sure has improved.

The claim that natural disaster would boost regional economy is not new, but it has remained a small field of study because critics charge “disaster economists with oversimplifying enormously complex economic systems and seeing illusory effects that stem only from the crudeness of the available economic measuring tools.”

In 1969, Douglas Dacy and Howard Kunreuther, two young analysts at the Institute for Defense Analyses, published a book called “The Economics of Natural Disasters.” It was probably one of the first attempts to measure the economic influence of catastrophe. The book argues that the dreadful Alaska earthquake of 1964 helped Alaska economy by garnering government loans and grants for rebuilding.

Gus Faucher’s study also supported the Dacy’s and Kunreuther’s claim. Fauncher is the director of macroeconomics at Moody’s Economy.com. He found sharp increases in construction employment after Hurricane Andrew attacked Florida in 1992 and after the Northridge earthquake of 1994.

The Bernard L. Schwartz Chair in Economic Policy Development Martin Neil Baily said whether the economy of affected regions can be benefited depends on “the way the country or region responds to the crisis”. The time factor is the most important here. He gave an example that Haiti, where is too poor to manage the immediate recover after hurricane, has to wait international aid to get basic rebuilding, leaving alone economic growth.

The Hurricane Katrina was a debatable case. Faucher accuses government aid was slow to arrive and with insurance payouts so low, there were so many residents left New Orlean. The economic recovery and boost both did not come.

However, there are also many critics to the theory of disaster economic growth. It is important to remember that the wealth to the affected regions is not generated by the hurricane or earthquake, “the money and labor that go into postdisaster rebuilding are simply being redirected from other productive uses.”The natural disaster could be an economic boost to a region, but it always is an economic downturn for the whole nation. Moreover, some jobs are benefited at the cost of other industries.

“If you’re a carpenter, a trash remover, a physician, you may be made better off,” said Donald Boudreaux, an economics professor at George Mason University. “But the things that those producers would have otherwise produced are not going to be produced.”

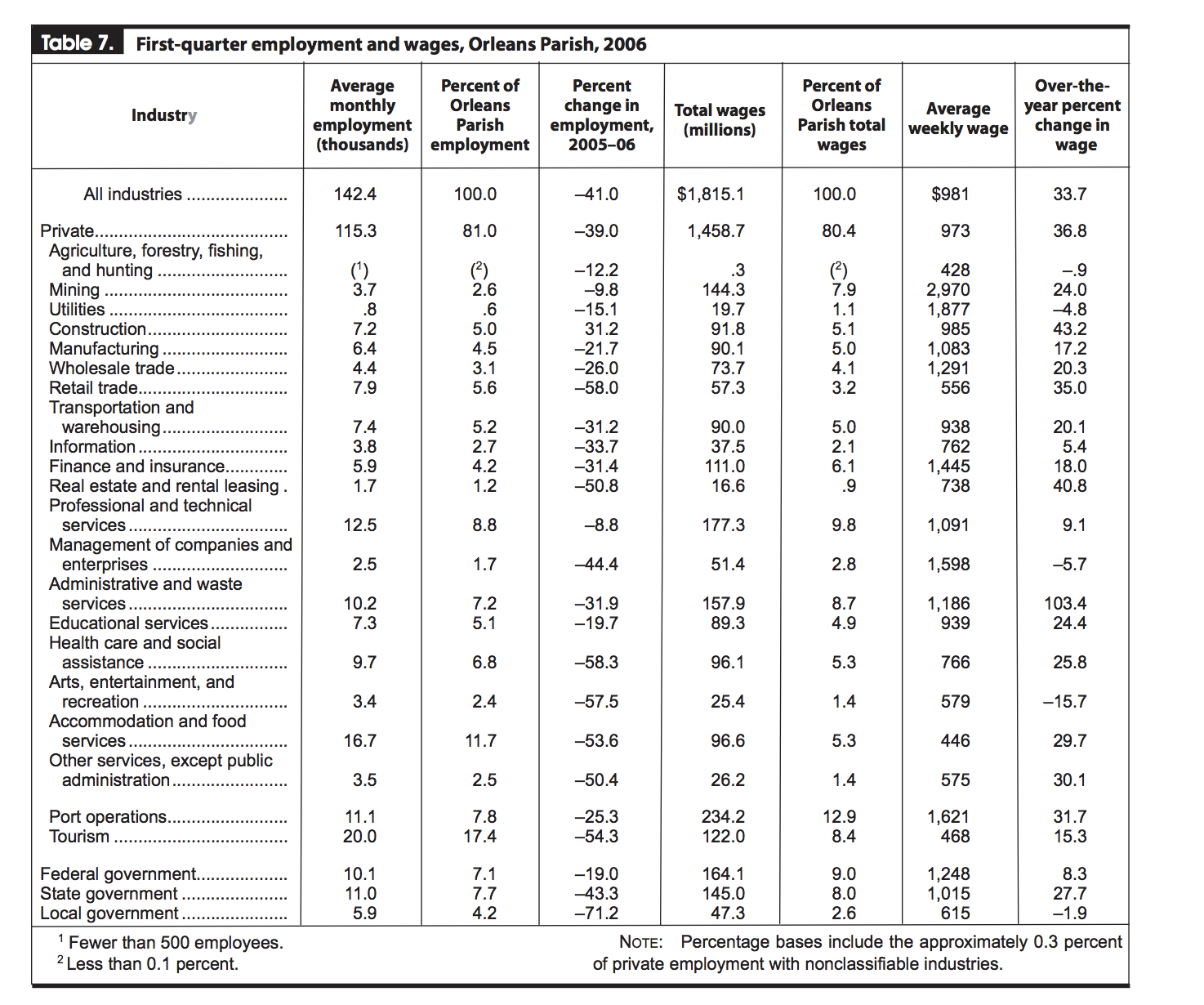

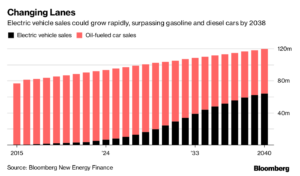

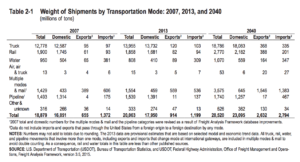

Here is the chart of the wage and employment growth for New Orleans during the immediate recovery time after the Hurricane Katrina.

It is clear that construction, waster service, and real estate enjoyed a huge economic boost, while entertainment and food service suffered.

“Over any reasonably relevant period of time, society is not made wealthier by destroying resources,” Boudreaux said. If it were, “Beirut should be one of the wealthiest places in the world.”

The theory model of disastrous benefits for economy should be viewed as that the areas that would not receive national resources or investment during the normal time becomes privileged after suffering catastrophe. It also gives these areas more opportunity and capital to develop during the reconstruction. The catastrophe wiped out the outdated facilities and infrastructure and replace them with more efficient and modern ones. “It might be seen as Mother Nature’s contribution to what the Austrian-born U.S. economist Joseph Schumpeter famously called capitalism’s ‘creative destruction.'”

As long as the government responds to the disaster quickly with reconstruction capitals, it is general to see a quick recovery for the affected area and a bullish future for the local economy.

Once again, it is inhuman and cruel to say the natural disaster is a good thing, and it is significant to remember it hurts national economy as a whole. However, it could be an opportunity for the specifically affected regions to develop and reform its economy.