About 10 years ago, it was obvious that one should never sit in a stranger’s car. In March 2009, Uber Technologies Inc. sought out to change that norm and disrupt the taxi industry. 8 years later, they have reached complete dominance over the industry through their transportation app, Uber. Founded by Travis Kalanick and Garret Camp, the app was originally an effort to create an affordable black car service, which soon transformed into a massive ridesharing platform. Today, they operate in over 80 countries and over 670 cities worldwide (Uber). However, they are still growing. They now offer a low-cost ride program, rides in black cars, food delivery service, and more. According to Kalanick, the Uber app has more than 40 million active riders worldwide (Vanity Fair). Yes, that is 40 million people actively using 1 platform.

Although those numbers do sound sexy, the company is actually not making any money. During their past four quarters of operations, Uber experienced losses exceeding $3.3 billion. With this outrageous number, Uber has become the most loss-making private company in tech history. Simultaneously, the company has also become the highest valued private technology company. According to Bloomberg, Uber is valued at $69 billion (Bloomberg).

At this point, you might be thinking, “How does a company that continues to make no profit get such a high valuation?” Before understanding how a company gets valued, it is important to grasp the intentions of an unprofitable company. It is comprehensible for a startup business to not make any money within their first year or two in business. However, Uber has been around for more than 7 years, has raised over $11 billion, and still is unprofitable (Crunchbase). It may sound counterintuitive to stay in business after making no profits for such a long period of time, right? In fact, companies can become very successful and attract many investors even without making profits for lengthy periods of time.

There are three core principles that companies follow in order to survive without any profits. The first method is to continuously reinvest in the company. According to Uber’s release to Bloomberg, the company’s net revenue was $6.5 billion, excluding revenues from China (Bloomberg). Therefore, earnings are significantly large, but Uber is choosing to reinvest that money back into their company. The purpose is to continue their growth and boost future revenues. This intentional reinvestment strategy has been proven to work with Amazon, which irregularly reported a profit throughout more than twenty years in business to focus on growth. Amazon obviously has the ability to allow profits, but argues that they must constantly reinvest into the company in order to compete in different fields.

Another way a business could continue to operate without any profits is the expectation of potential expansion. Twitter was a great example of this, as they acquired Vine, Periscope, and other platforms in an effort to expand its social media presence. However, they are dealing with significantly large expenses due to the compensation of stock options. Other companies that used this method include Yelp and Spotify. Although Yelp reached profitability in 2014 through expansion, Spotify is still in the process. Similar to Uber, Spotify has consistently experienced increasing revenues, but still has continuously shown upwards of a billion dollars in losses. Their strategy is to increase their number of users on their free service to potentially convert them into subscribers.

Lastly, an unprofitable company can remain in business because of its speedy growth in its early stages. Tech companies that can show a rapid increase in user growth will secure the backing of venture capitals. Through the investors’ perspectives, they see massive potential due to their user base and disregard the early revenue drought. Uber is definitely the leading tech company in this category. As mentioned earlier, Uber’s valuation is extremely high, surpassing many established car-rental companies and airline companies, and it is exactly because of this reason.

All three of these categories play a crucial role in generating a valuation of an unprofitable company. In the case of Uber, their valuation is driven by the tremendous confidence investors have in the company due to its user base. However, the large size of the backing will make it challenging for Uber to deliver long-term. It is very important for Uber to continue to convince investors that profits will begin to unfold. It is very easy for investors to lose confidence in the company’s abilities to generate future profits. So why do investors continue to invest in Uber? Obviously, they trust the company’s growth models that will keep their stock high. They also have faith in the company’s ability to reach their large goals.

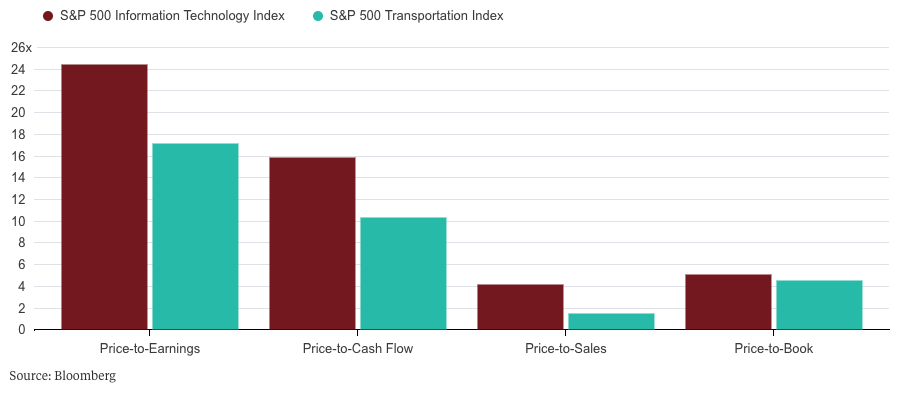

Usually, when evaluating a firm, one would pay close attention to the price-to-earnings ratio. This ratio suggests how much an investor would have to put into the company in order to get $1 in return. However, this ratio is irrelevant for many tech companies, such as Uber, as they do not have any profits to show in its early stages. Also, tech companies do not have many assets other than the software, which is extremely hard to value as is, so the price-to-book ratio is also out of the equation. Instead, investors of Uber, and other unprofitable tech companies, would look at their price-to-sales ratio to determine the company’s valuation. This ratio compares the stock price of the company to its revenues. This is an indicator of the value placed on each dollar of a company’s sales or revenues. Uber’s valuation of $69 billion and its net revenue of $6.5 billion in 2016 gives the company a price-to-sales ratio of 10.6. This ratio is much higher than the S&P 500 Information Technology Index price-to-sales ratio, which is the highest compared to all other S&P 500 sectors.

The technology industry is known for its overgenerous valuations. Even based on the technology industry standards, Uber’s valuation is still very high. However, if Uber was treated as a transportation company instead, they would be nowhere near their current valuation. The price-to-sales ratio of the S&P 500 Transportation Index is 1.5. Therefore, Uber’s value would have to fall by 86% to associate with the average transportation company. However, it is obvious that Uber enjoys being in the technology category.

Regardless of the industry, a company’s valuation also reflects their business plan. For Uber, investors are paying very close attention to the company’s path to make money and if they seem attainable and realistic. Although it is not possible to accurately predict when and how the company will become profitable, Uber must be very convincing to deserve such a high valuation. They have somewhat modeled themselves after Amazon, which had successfully completed the process after years of net losses. According to Mike Walsh, and early Uber investor, “There are many companies, Amazon as an example, that invest heavily in the early years and hit profitability only after a company IPO.” (CNN). However, the most Amazon lost in 1 year was less than $2 billion, even at the peak of the dot-com boom.

Uber generates revenue primarily by charging clients for the rides, taking around 20% of the total fare. The company has reached such enormous growth because of how convenient and affordable it is for consumers. This resulted in Uber stealing market share from taxis and other traditional transportation methods. Even drivers began to switch, realizing that driving for Uber would allow them to make more money than driving a taxi. This is largely because of the fact that Uber allows drivers to better optimize their time and services. However, these drivers are responsible for the depreciation of their own cars, which is not factored into the ride.

The affordable prices for users and high incomes for drivers are all part of a long-term strategy. Uber is essentially subsidizing each trip. The plan is to dominate market share and drive taxis and other competing rideshare companies away. The prices are expected to increase as the initial process of acquiring customers begins to slow down. Currently, drivers for Uber are essentially donating the use of their own cars in exchange for the company’s growth. This does not get factored into Uber’s actual cost of operation.

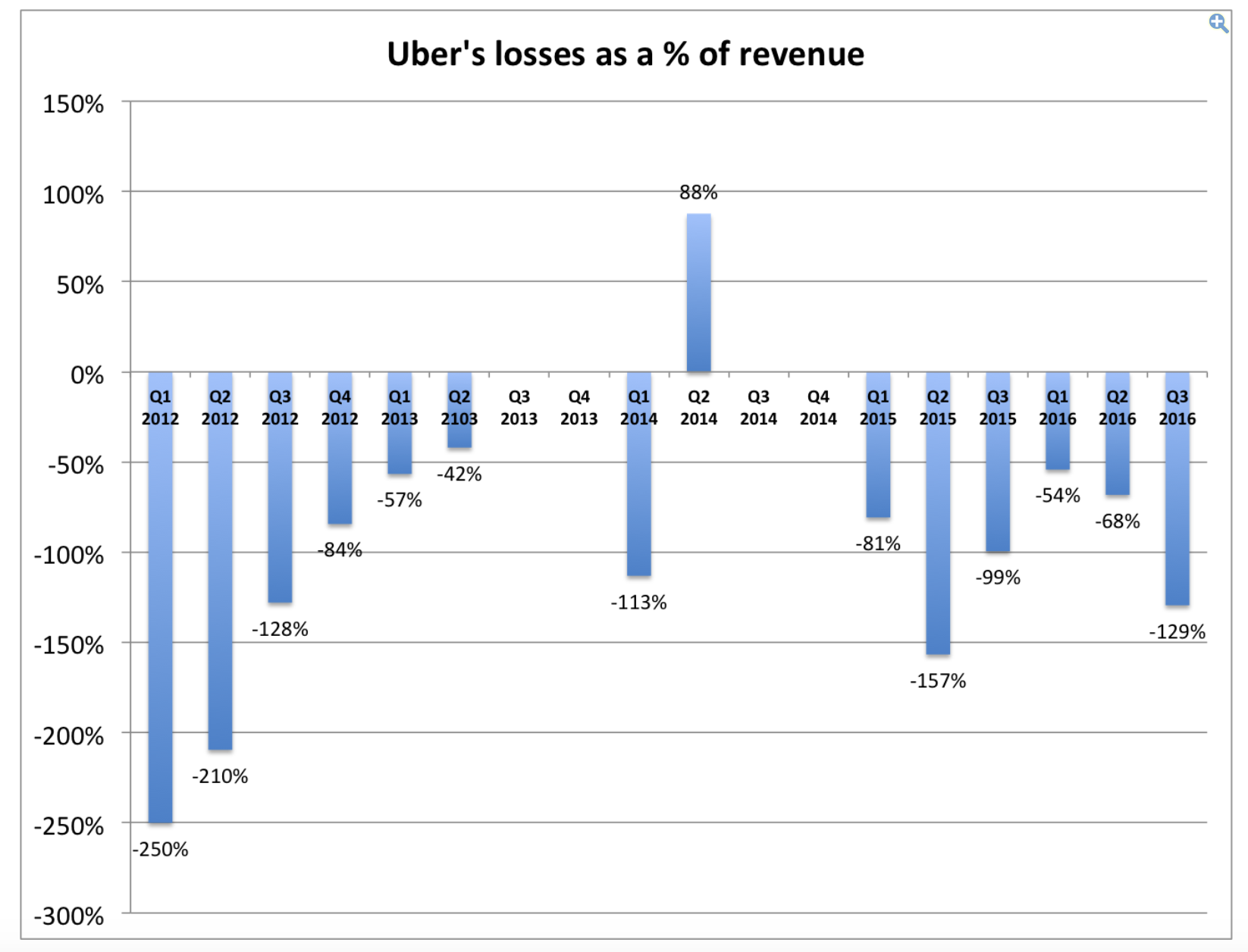

Is Uber’s business model sustainable? Will they eventually become a profitable company? How long will that take? These are obviously very important questions to consider. Clearly, Uber is significantly unprofitable as of right now. However, you can make the argument that the company’s losses are diminishing over time. As seen through the chart, Uber has the ability and control to accelerate or slow their spending to become more or less profitable. This is important evidence to deliberate when making the case that in the long run, Uber does have potential to become profitable. Many optimists argue that the company is so large that people are just not used to the losses on such a large scale. Their revenues are also massive, and are quickly growing. However, they might be taking a longer time getting their global business under control, whereas a smaller business, such as Snapchat, would not take as long. This could be due to their attempt to break the norm, as well as the need for actual drivers and app awareness.

Is Uber’s business model sustainable? Will they eventually become a profitable company? How long will that take? These are obviously very important questions to consider. Clearly, Uber is significantly unprofitable as of right now. However, you can make the argument that the company’s losses are diminishing over time. As seen through the chart, Uber has the ability and control to accelerate or slow their spending to become more or less profitable. This is important evidence to deliberate when making the case that in the long run, Uber does have potential to become profitable. Many optimists argue that the company is so large that people are just not used to the losses on such a large scale. Their revenues are also massive, and are quickly growing. However, they might be taking a longer time getting their global business under control, whereas a smaller business, such as Snapchat, would not take as long. This could be due to their attempt to break the norm, as well as the need for actual drivers and app awareness.

However, recent headlines have given Uber a tough time throughout their road to success. Earlier this year, Uber got caught up in allegations of prevalent sexual harassment throughout the workplace. Not to mention, the company even experienced a #deleteuber campaign throughout social media, and accusations of technology theft. As controversies added up, investors began to question Travis Kalanick, the current CEO and Co-Founder, and his ability to run the company. Kalanick had become a massive liability to the company due to his unclear business practices, poor management skills, and concerning lawsuits. Therefore, Kalanick resigned as CEO of the company back in June of this year.

After a couple months of searching for the perfect candidate, Dara Khosrowshahi was hired as the new CEO in August to get the company back up on its feet again. Khosrowshahi’s resume includes being the former CEO of Expedia, becoming one of the highest paid CEO’s in America, and being a board member of BET.com and the New York Times Company. He believes that although Uber is unprofitable as of right now, the “math is working” in certain countries, and that they are currently focused on subsidizing other investments. In an interview by Andre Ross Sorkin, a New York Times columnist and CNBC anchor, Khosrowshahi mentioned that Uber will not be profitable in the U.S. for the next six months, depending on the performance of their rival company, Lyft (CNBC). He has inherited a company that has been hit with a public scandal, the faction among its board members, an investigation into workplace harassment, and many other lawsuits. Therefore, he has not been given an easy task.

So, how do these public-relations woes impact the Uber’s road to profitability? Ultimately, they take away from the company’s primary focus – growth. Instead of concentrating on expansion, reinvestment, and strategies for profitability, they are forced to deal with fixing their public image.

However, it has been announced that Uber does have big plans for the future. They are currently in the middle of negotiations with SoftBank Group for a multi-billion-dollar investment deal. The Japanese-based company has global ties that could potentially help Uber in its constant international expansion. Also, Uber has recently agreed to a deal to purchase thousands of self-driving cars from Volvo. Last year, Uber and Volvo joined together to develop autonomous vehicles that will potentially become the future of Uber. Additionally, Uber’s project, Elevate, is set to bring “flying cars” into the market by as soon as 2020. They have partnered with NASA to sign a Space Act Agreement that will allow these low-flying, possibly self-flying, aircrafts to become a reality.

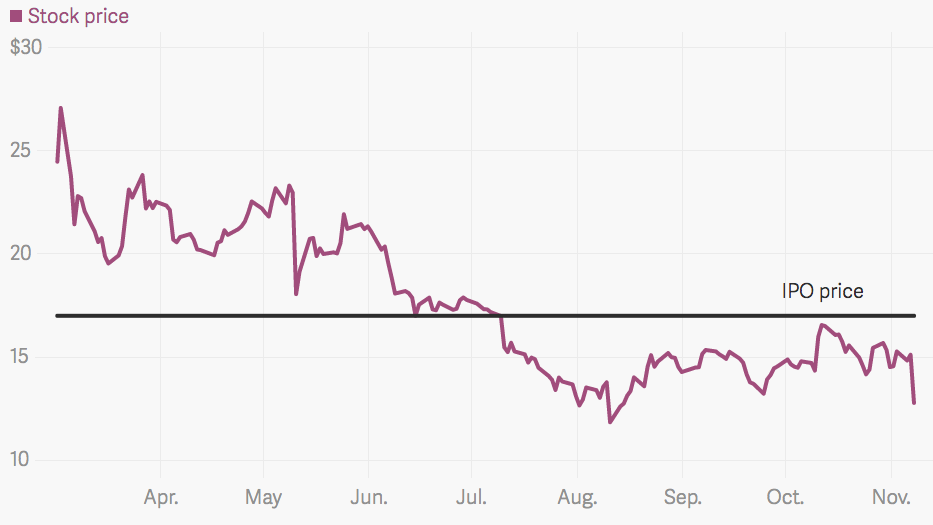

Uber has already begun taking steps to prepare for an IPO. Khosrowshahi announced in an interview that the company plans to go public in 2019. This will be a big day for investors, and a brand-new chapter for the company. Uber has the chance to live up to its extremely high valuation. It is clear that they have big plans for the future that can potentially allow the company to generate massive amounts of profits, but only time will tell.

https://uberestimator.com/cities

https://www.vanityfair.com/news/2016/10/travis-kalanick-uber-ipo

https://www.crunchbase.com/organization/uber

https://techcrunch.com/2017/11/09/uber-ceo-says-2019-is-the-target-for-ipo/

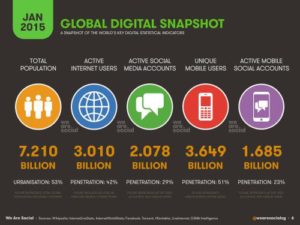

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.