Germany. Deutschland. The leading country of the Eurozone.

Germany continues to maintain a strong economy. In fact, German workers have paved the way for economic success while utilizing fewer working hours with more productivity.

Seizing Opportunities

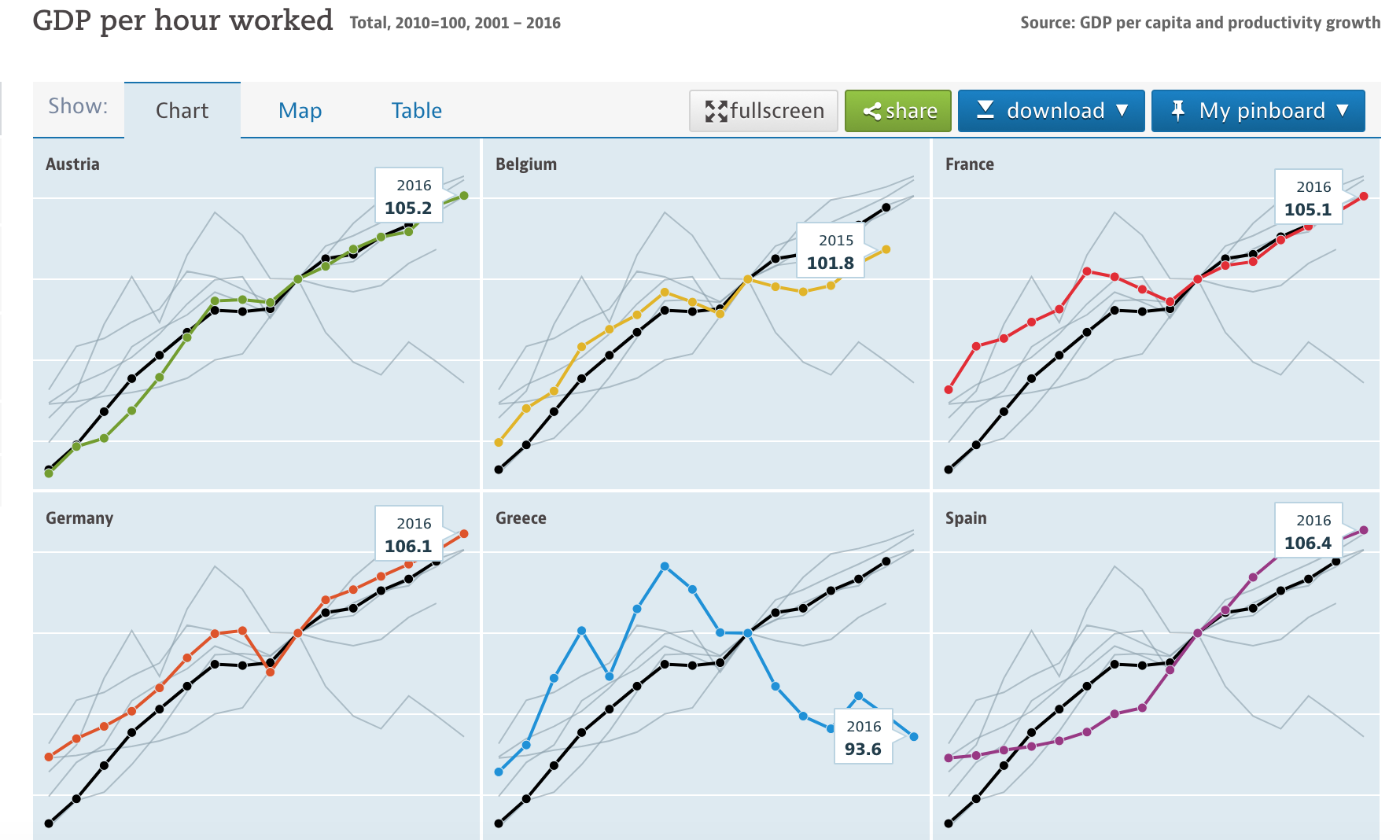

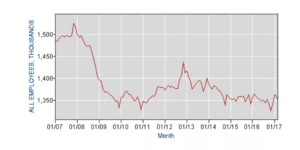

Ironically, the hours worked by Germans are significantly lower than other countries in the EU. Some of the strongest economies have an average of 32-hour work-weeks, whereas Germany, the leading economy of the EU, only has a short 26-hour work-week. The trick to Germany’s success? Productivity. By definition labor productivity is “the amount of goods and services produced by one hour of labor; specifically, labor productivity measures the amount of real gross domestic product (GDP) produced by an hour of labor” (Investopedia). German workers see success in productivity because they are investing in advanced technologies and machineries in order to “seize the opportunities of digitization, remain internationally competitive and drive innovation” (Nienaber, 2017). The graph below highlights the GDP per hour worked for various countries in the EU, ranking Germany with nearly the highest GDP per hour worked.

As seen in the data above, Germany produces more goods per hour than its competing countries and works fewer hours. In order to see growth in that productivity, an economy needs physical capital, new technology, and human capital, which Germany has (Investopedia).

A Strong Work Environment

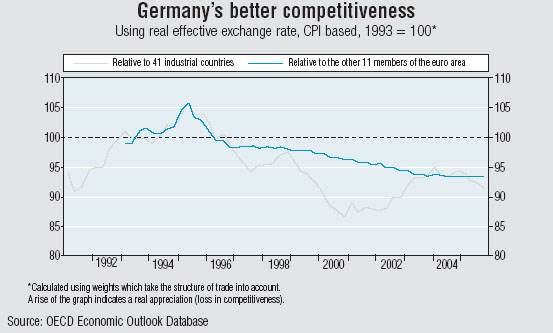

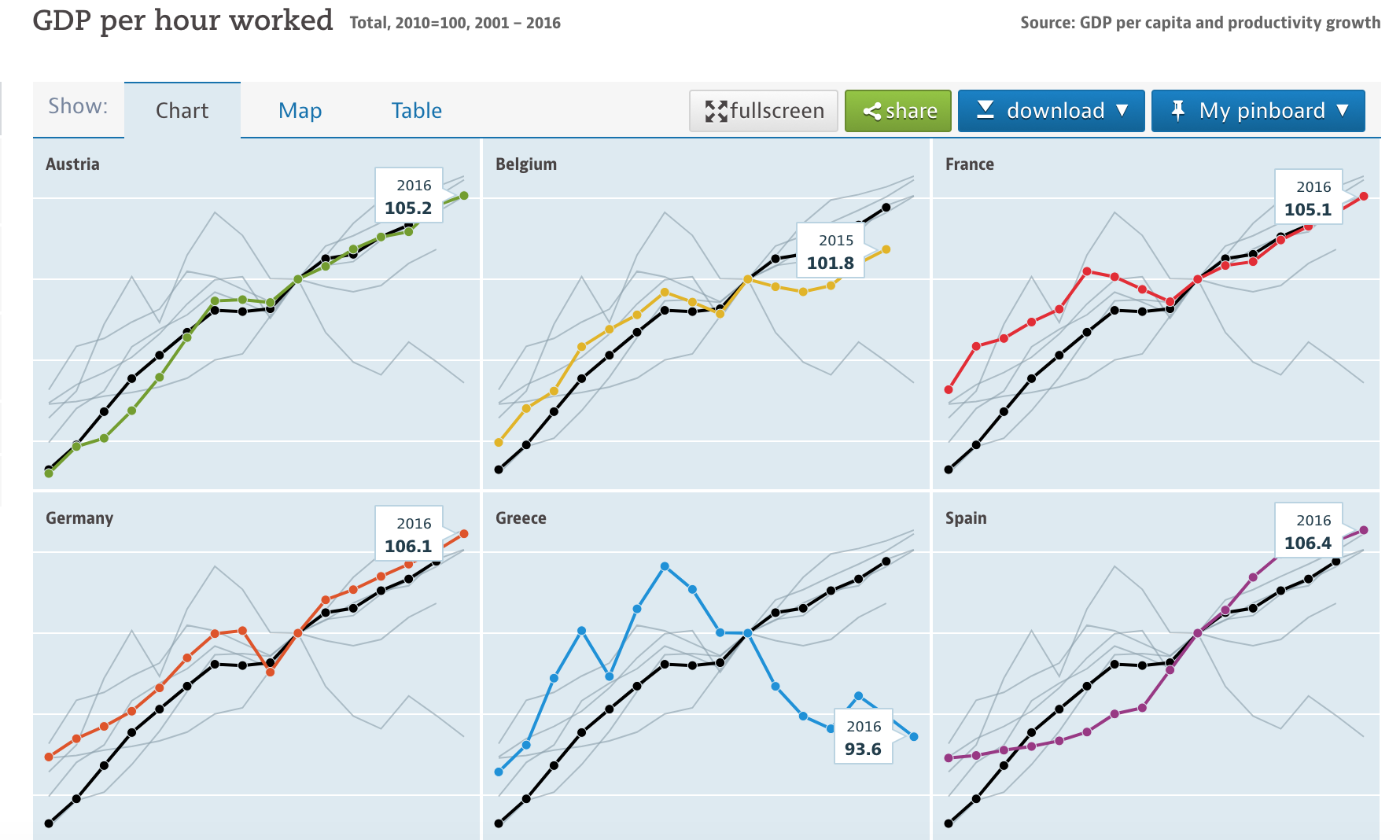

Many different aspects factor into Germany’s economic and productive success. Whether it is that German work culture is very by-the-book –– when you are at work all you do is work — or they have been trained as a population to maintain efficiency, they have found success in business. Essentially, they move quickly but also remain focused. Starting at age 15, German students leave their education to go into apprenticeships. Rather than staying in school and learning, they experience the working world and learn from there. At a young age they are automatically conditioned to be more efficient and productive in the work place. Adding light to Germany’s productivity makers, The World Economic Forum’s 2012-2013 Global Competitiveness Report ranks Germany 5th in higher education and training and 3rd in infrastructure and business sophistication. In fact, as the world’s 2nd largest exporter and one of the most highly advanced manufacturers, Germans would be expected to work off the clock, non-stop. But, that is not the case. Again, this goes to the point of their ability to seize opportunities because of their investment in advanced technologies and choice to constantly innovate. The ‘—‘ mark below indicates Germany’s competitive success relative to 41 other countries and 11 other members of the European Union. This demonstrates that they have remained a strong and leading export country since the fall of the Berlin Wall. So, what made the fall of the Berlin Wall such a strengthening factor in Germany’s economy? Let’s look at a brief history.

A Brief History

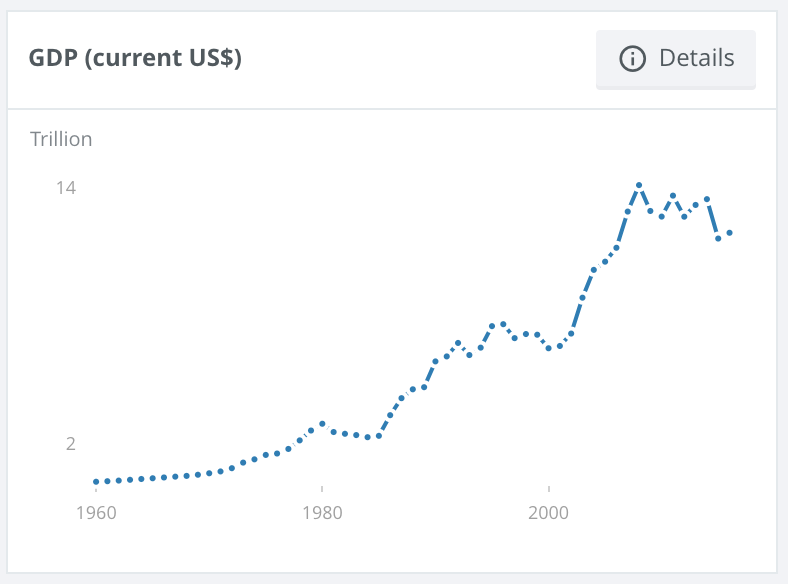

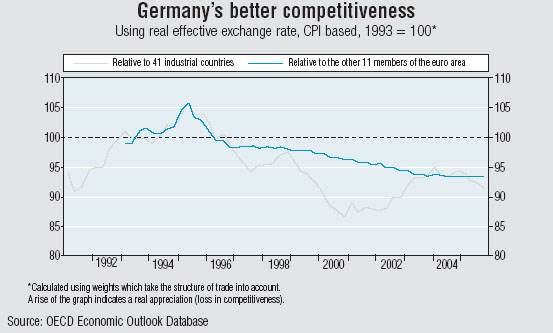

Looking back to the Industrial Revolution of the 1830s, Germans had an innovative and entrepreneurial mindset which led them to be early adopters of coal production and rail transportation (Brenner, 2014). That’s just a mere example of the beginning of their strong economic trajectory. In order to properly look at their success, let’s fast forward to 1989 with the fall of the Berlin Wall. This historical moment finally ended the divide between East Germany and West Germany and brought forth a whole new labor force and marketplace of ideas. Germany acted fast and placed an emphasis on the complex manufacturing of products by which other countries simply could not compete. For example, they have created a thriving auto industry producing the world’s most innovative, luxurious and strongest car brands. Through advanced manufacturing and trade exports, they quickly became a top net exporter to other countries. Not only did this pave the way towards a healthy economic future for Germany, it also made them a key country in the expansion of the EU –– mending the European financial crisis with one currency: the euro. For reference, the graph below represents the significant raise in GDP of the Eurozone after enacting the euro.

Source: data world bank

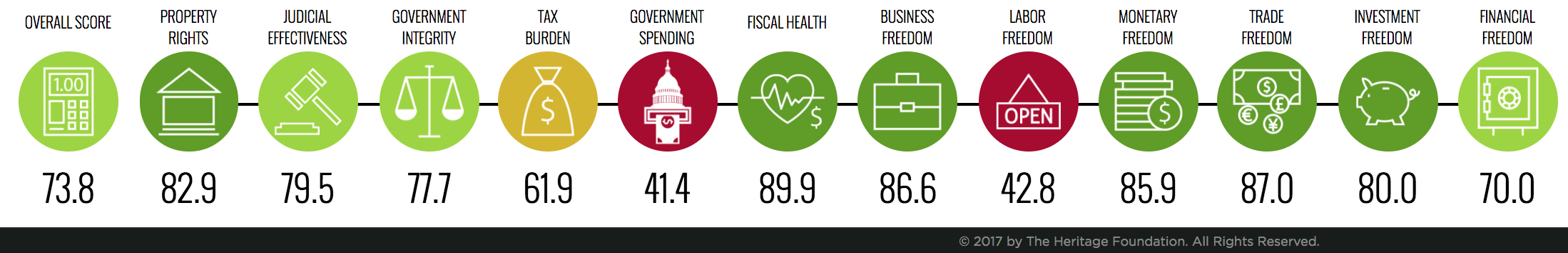

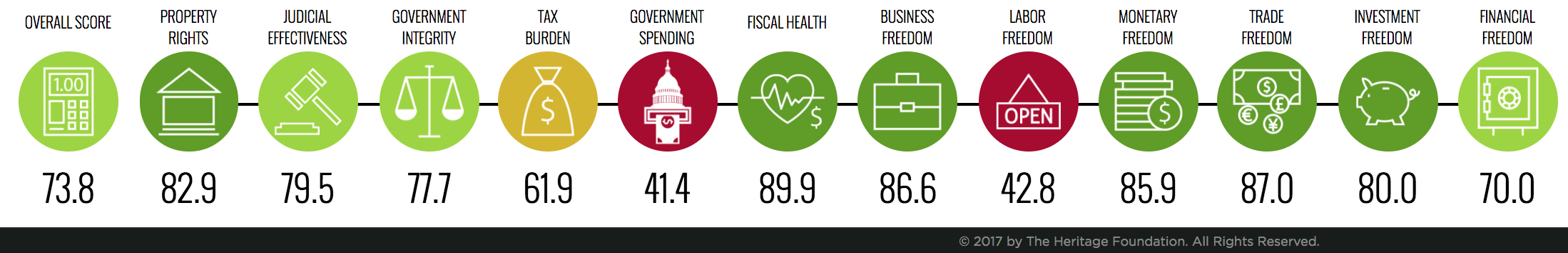

According to current (2017) data from The Heritage Foundation, Germany’s overall economic score is a 73.8 out of 100. A country’s economic score “focuses on four key aspects of the economic environment over which governments typically exercise political control – rule of law, government size, regulatory efficiency, market openness” (Heritage). Within these four measures, there are 12 sub-components that are measured on a scale of 0 to 100 which “are equally weighted and averaged to produce an overall economic freedom score for each economy” (Heritage). Where Germany’s numbers show strength is under fiscal health (government size), business freedom (regulatory efficiency), monetary freedom (regulatory efficiency), trade freedom (open markets), investment freedom (open markets), and property rights (rule of law), as identified in the graphic below. What is so great about Germany is that they continue to show success in business freedom — both on the business side and the investment side. To that end, Germans are willing to start their own businesses, invest in businesses, and overall innovate a business because they have the capital for it.

If you wish to view this further and get directed to the site, click here.

If you wish to view this further and get directed to the site, click here.

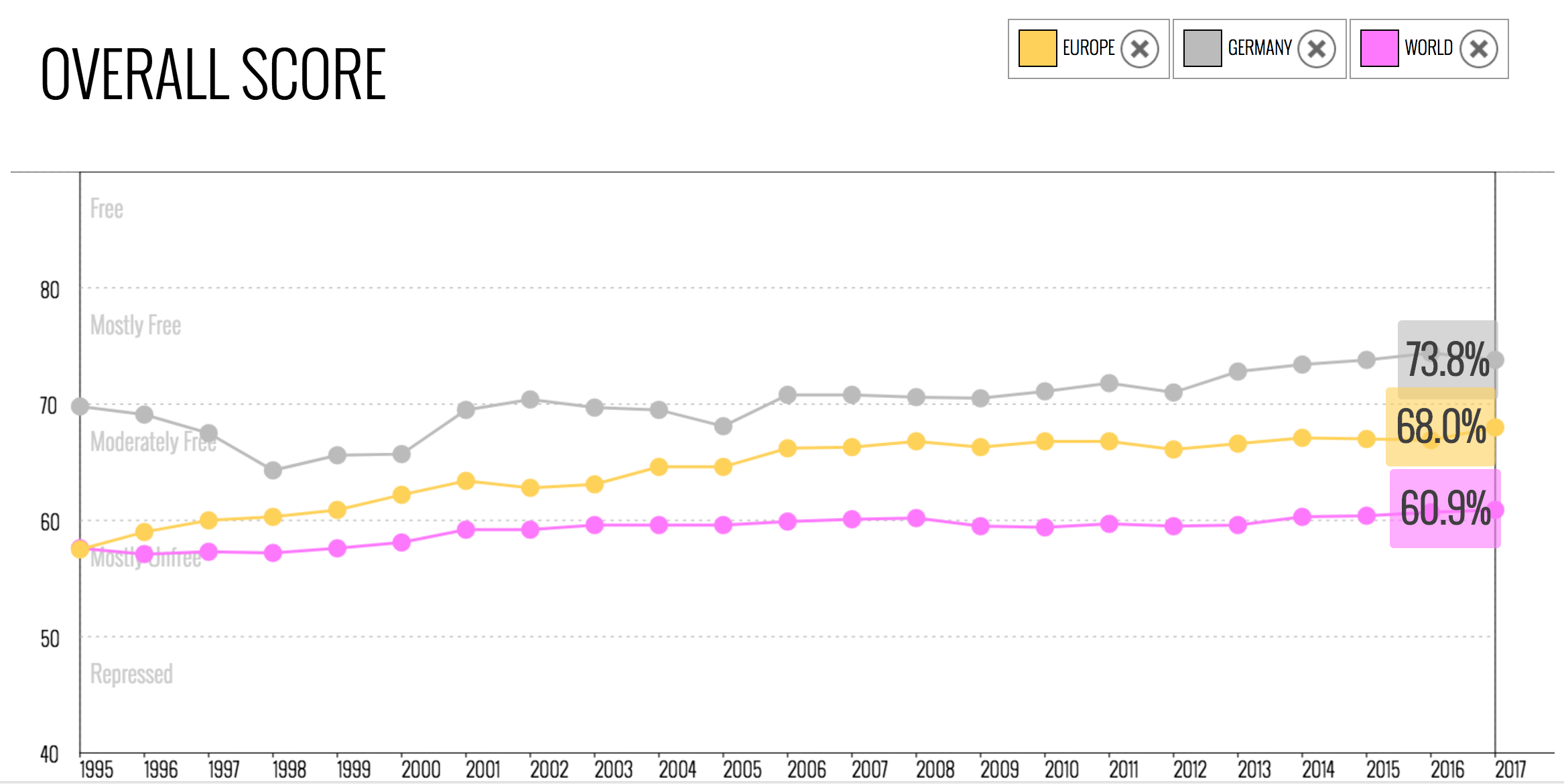

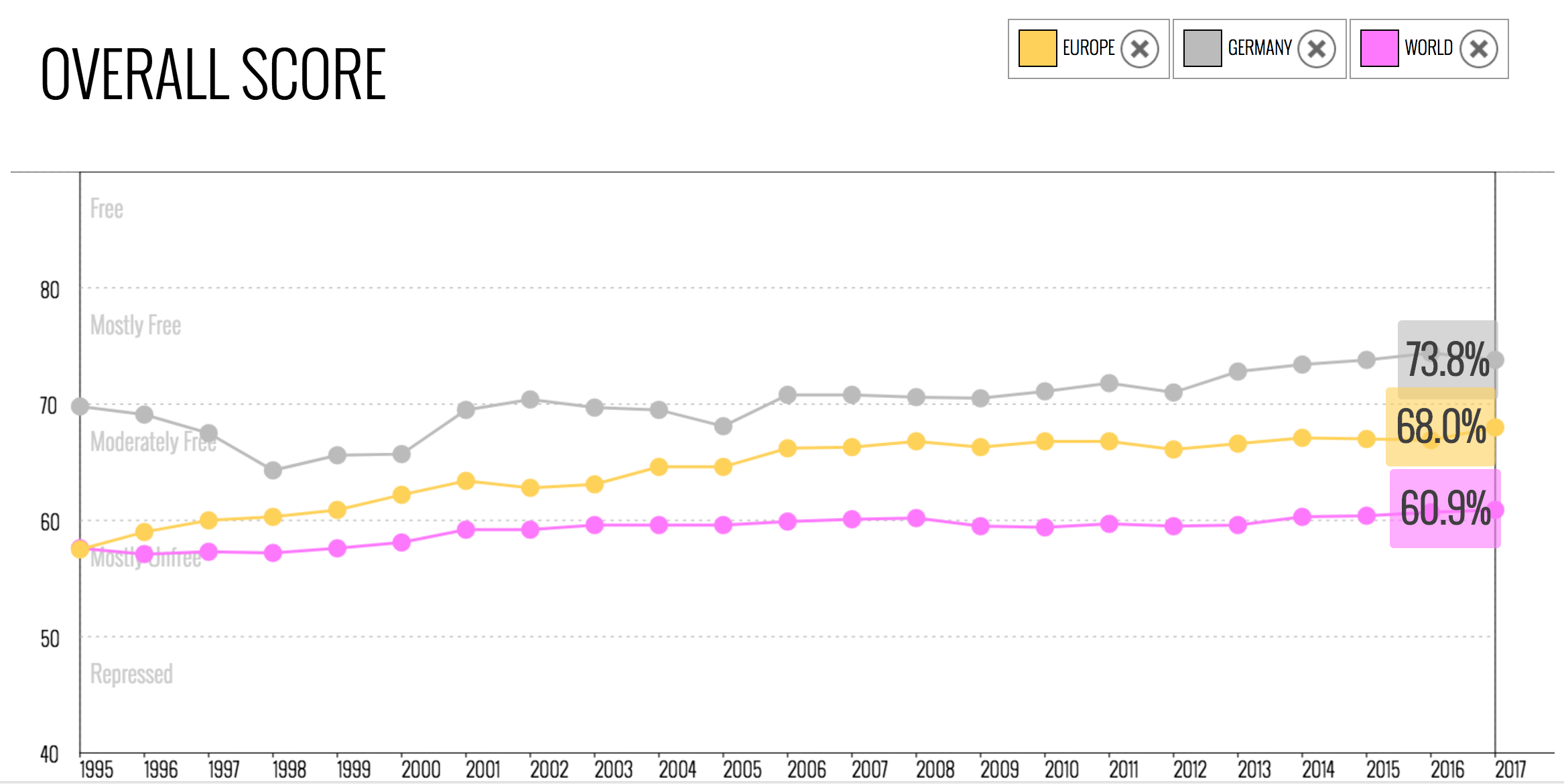

Now that the economic score of Germany is clear, below is a graph of Germany’s score in comparison to both Europe and the world, with Germany ranking higher against each.

If you want to compare other countries and view the graph in real time, click here.

If you want to compare other countries and view the graph in real time, click here.

Unparalleled Unemployment Rates

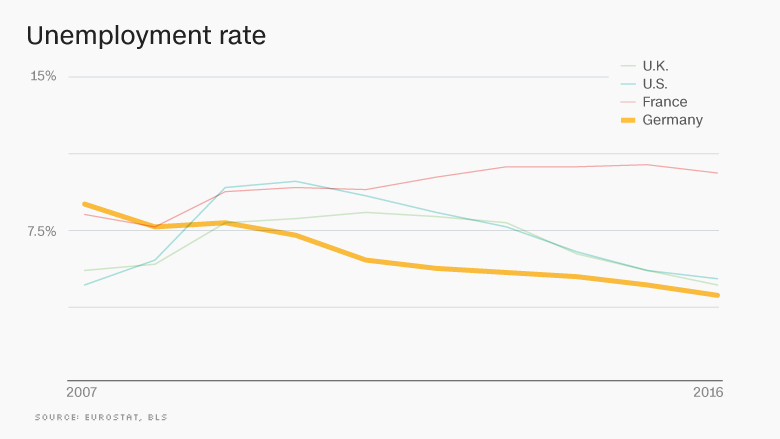

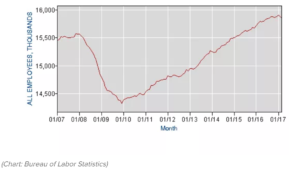

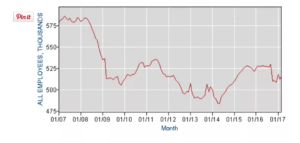

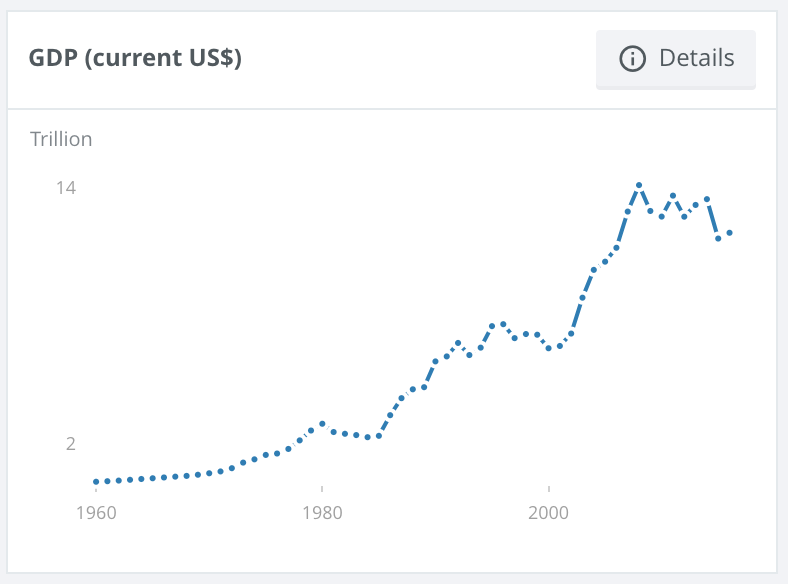

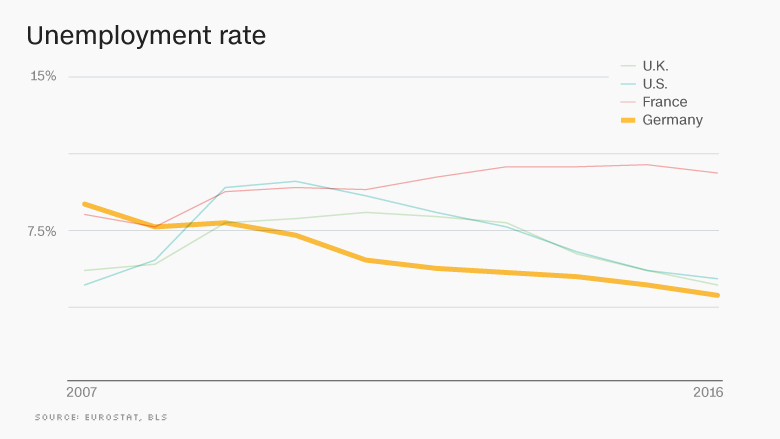

Without high employment rates, productivity would remain low because typically it means there is not as much work to be done. In the simplest terms, Germany has more money to invest in business, therefore they have more money to invest in workers, which leads them to more employees getting the job done. Germany went from a steep 5 million unemployed workers in 2005 to a low 2.7 million unemployed, as shown in graph A titled “Germany unemployed persons.” Graph B, titled “Unemployment rate,” demonstrates Germany’s unemployment rate in regards to the U.S., U.K., and France.

A)

B)c

According to The Guardian, “a strong economic backdrop has helped Germany post a record budget surplus of €23.7bn in 2017, fueled by higher tax revenues, rising employment and low debt costs. It was the highest budget surplus since reunification in 1990 and the third successive year the government has had a budget surplus” (Monaghan and Wearden, 2017). Clearly, the Germans productivity is paying off in more ways than just being a leading exporter. They are truly a financially sound country.

The German Way

Germany finds its way as a leading economy due to the productivity it has retained from its workers, the strength in their manufacturing technology, their education systems, and their overall ability to constantly innovate. German workers are unafraid to pave the way for business freedom. With an abundance of capital to invest toward business success, a strong workforce, and overall economic strength, Germany continues to be a force to be reckoned with. Fewer hours doesn’t always mean less work! Use Germany as that example.

http://money.cnn.com/2017/09/06/news/economy/germany-election-merkel-economy-inequality/index.html

https://www.reuters.com/article/us-germany-economy-gdp/german-economic-growth-picks-up-speed-good-news-for-merkel-idUSKBN1880S6

https://www.expertmarket.co.uk/focus/worlds-most-productive-countries-2017

https://www.theguardian.com/world/blog/2017/feb/23/germanys-gdp-shows-19-rise-over-last-year

https://qz.com/586547/germany-is-the-worlds-strongest-economy/

http://www.cnn.com/2014/10/16/world/europe/germany-25-years-of-success/index.html

http://www.investopedia.com/terms/l/labor-productivity.asp

http://www.investopedia.com/financial-edge/1212/why-germany-is-the-economic-powerhouse-of-the-eurozone.aspx

http://stats.oecd.org/Index.aspx?DatasetCode=ANHRS#

http://www.heritage.org/index/heatmap

http://www.heritage.org/index/country/germany

https://data.worldbank.org/region/euro-area?view=chart