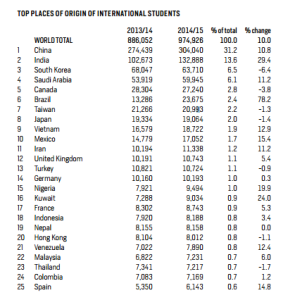

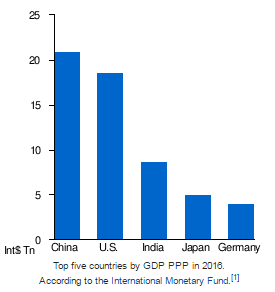

When most people hear the terms, “China” and “trade,” they think of the billions of dollars in merchandise moving back and forth between multi national conglomerates, or more recently some may think of Donald Trump. While China and trade are intimately connected to both of these notions, there is another fascinating arena in which China and trade are opening up incredible opportunities for savvy entrepreneurs at a micro-level. Due to tariffs, pricing laws, and other multi national rules, certain items in China cost significantly more than they do in America and other countries. While many think of luxury goods like Louis Vuitton and Apple, the wide schism in pricing creates arbitrage opportunities in healthcare, mid level clothing apparel, and custom goods.

In the early 2000’s, this trend was diametrically opposed. Smart Americans with the use of the internet could navigate early iterations of websites like Dhgate and Alibaba, two major Chinese online retailers, and buy items in bulk. They would then resell these items, like headphones, batteries, knockoff jerseys and toys, on American websites and capture profit in the difference in pricing. While these opportunities are still there, the more profitable move is now for individuals, usually Chinese nationals, to buy items in America and sell them back to China.

One of the reasons that there is a market for smaller entrepreneurs is that many of these items that are sent are considered gray market or even black market, meaning there is a legal risk to partaking in a venture. Since larger, more established companies don’t want to assume this risk and potentially clash with the Chinese government, brave and risk-seeking businessmen seek to exploit this opportunity. The market dynamics are such that no one can truly scale, as size would be a deterrent to profit. Eventually, if a person or company gets too large they will attract the scrutiny of retailers or the Chinese government.

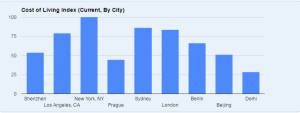

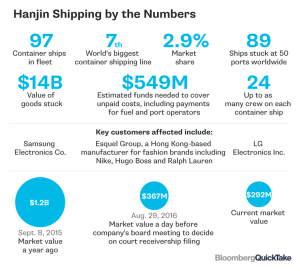

One of the most notorious areas where this exists is the luxury car market. Cars like the “Jaguar F-type S convertible parked in front of a Pasadena, California, dealership sells for $89,000—but it can go for quadruple the price in China thanks to high demand for everything luxury, especially cars,” according to the Daily Beast. In order to derive a profit, individuals in America and abroad will recruit straw men and women to go into dealerships and buy cars, or lease them and immediately sell the lease to a third party. After this, they will collect a commission for purchasing the car ranging from low four figures to low five figures, and put it onto a shipping container. There, the true business mastermind figures out a way to navigate the murky shipping laws and somehow get the car into China. This will either be sold to a dealer or an individual at an incredible markup, but still well below the market price that the same Jaguar or Range Rover would sell for in China.

Luxury Cars in China

This practice was especially popular in the early 2010’s, but as of late car dealers have caught on to this and put safeguards in place to prevent such actions. Now, depending on the dealer, especially those in states with no sales tax, some individuals who purchase cars will have to sign agreements not to ship their cars overseas. This is just one area where business people have figured out a way to derive profit from mismatches in pricing.

Since cars represent such a large dollar amount in one transaction they were a favored product to bring over as the payout on the effort per individual item sold was so high. Other cottage industries like vitamins, powdered milk, and athletic gear have all given rise to individuals setting up as middlemen between America and China. The problem with this strategy’s viability as a long term business is that the inefficiencies are either solved by better government relations or China cracks down on such sales by regulating transactions more intensely.

Currently, another booming trade area between individuals in America and end users in China is personal shopping for luxury goods. This is also taking place in England, due to the fall of the pound, but China is predominantly trying to crack down in the United States first. These shoppers are called, “haiwai daigou,” which can be translated to personal shopper. Since there is a major price discrepancy between America and China in terms of luxury brands, the members of the wealthy Chinese class will pay Chinese Americans to purchase items and ship them back.

This is another area that the Chinese government is trying to slow down as it hurts native sales within the country. According to CNN, China’s “General Administration of Customs has stipulated that all individuals engaged in ‘cross-border e-commerce’ must provide a list of imported and exported items to customs.”

Enjoying Luxury Goods

As the government and brands figure out new ways to stop the import, savvy entrepreneurs will continue to find new areas to exploit on a micro level of trade. The question is how long will this game of cat and mouse last, and whether or not any one individual will figure out a way to consolidate market share.