In 2015, 8.2 million TEUs (twenty-foot equivalent units, a standardized maritime industry measurement for counting cargo containers) passed through the Port of Los Angeles (Port of Los Angeles). Few people consider the economic impact when a trade supply chain this large is disrupted. However, cargo theft is a growing problem that can have major effects on local, national and even global economies.

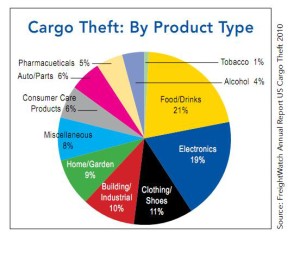

The FBI defines cargo theft as, “the criminal taking of any cargo including, but not limited to, goods, chattels, money, or baggage that constitutes, in whole or in part, a commercial shipment of freight moving in commerce.” (FBI) Cargo theft can happen at any point on a supply chain from origin to final destination. This can manifest itself in a variety of ways such as stealing containers from a warehouse, hijacking a truck or even attacking a container ship at sea as Somalian pirates have done.

Cargo theft has both direct and indirect economic effects. In 2014, 29 U.S. states reported 547 incidents of cargo theft to law enforcement with losses from the stolen goods totaling $32.5 million. (FBI) However, losses go far deeper than the goods stolen. Manufacturers who have goods stolen lose customers to competitors as they cannot keep up with demand, potentially long-term due to lack of trust. Owners of the affected part of the supply chain also risk losing business. Insurance premiums also rise after cargo theft incidents, forcing companies to either spend more on security or run the risk of paying high insurance.

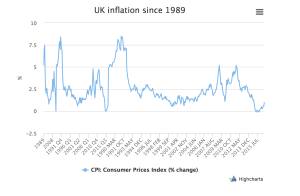

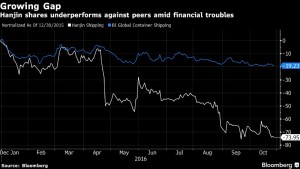

Brazil’s recession has led to an increase in cargo theft, as organized criminals capitalize on a weakened police force and residents who cannot afford mainstream goods in the face of 11% unemployment and 8% inflation (Bloomberg). Brazil’s mountainous regions, such as Rio de Janerio, are being hit particularly hard as trucks are more susceptible to theft in such unprotected areas. In June 2016, a truck 25 miles outside of Rio carrying $440,000 in goods was swarmed by a rifle-toting gang and forced to drive to a local favela (Bloomberg). The goods were unloaded onto another truck and sold to locals at much lower costs than conventional retailers. According to Brazilian police, the state of Rio alone is on track for more than 8000 cargo thefts this year that could total anywhere from $100 million to $1 billion, depending on estimates (Bloomberg). These are significant losses, especially in a struggling economy.

Cargo theft is a difficult issue to deal with because goods can pass through many different countries with different regulations and law enforcement capabilities. For example, a container originating in the United States can be stolen with less effort in Brazil. This could potentially deter manufacturers from selling their goods in Brazil. Companies and supply chain managers should take initiative and invest in security measures. This takes away responsibility from federal governments, who may not have the resources or willingness to fight cargo theft.

Sources:

https://www.portoflosangeles.org/maritime/stats.asp

https://ucr.fbi.gov/cargo-theft-user-manual

https://www.fbi.gov/news/stories/statistics-on-2014-cargo-thefts-released