Whether it be for ethical, environmental, or health reasons, vegetarians around the world have long been making a compelling case for why they do not eat meat. However, knowing Americans, perhaps the most persuasive reason of all lies in targeting carnivorous Americans where they would be most empathetic: their pocketbooks, as opposed to their hearts. With the difference of up to $200 billion dollars at stake for reducing meat consumption in the United States, the financial argument is one that could lead many to reconsider what they’re really putting into their mouths. However, red meat seems to be the main victim in an increasingly vegetable-dominated world.

Whether it be for ethical, environmental, or health reasons, vegetarians around the world have long been making a compelling case for why they do not eat meat. However, knowing Americans, perhaps the most persuasive reason of all lies in targeting carnivorous Americans where they would be most empathetic: their pocketbooks, as opposed to their hearts. With the difference of up to $200 billion dollars at stake for reducing meat consumption in the United States, the financial argument is one that could lead many to reconsider what they’re really putting into their mouths. However, red meat seems to be the main victim in an increasingly vegetable-dominated world.

This is profound news for a country where meat has always been a large cultural and historical component of the American diet. A majority of American holidays include meat as a staple item, including Christmas, Thanksgiving, Fourth of July, and perhaps the most revered American Holiday of all: the Super Bowl party.

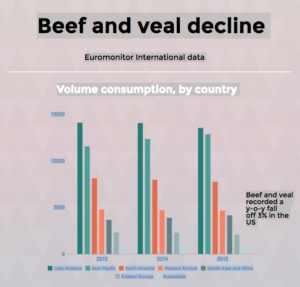

For the past few decades, demand for meat has steadily risen or declined, based on the type of meat. Americans have been adjusting their meat consumption patterns in accordance to the variations of meat pricing over the years. Global Meat News reported this past September that beef and veal recorded a three percent decline in consumption, compared to a global increase of meat consumption steady with the world’s growing population. In 1972 alone, the average American consumed 144 pounds of red meat a year, according to the USDA (National Chicken Council). Comparatively, in 2015, the average American consumed only 104 pounds of red meat. However, consumption of poultry has increased from 50 pounds per American in 1972 to 106 pounds in 2015 (National Chicken Council). This increase in consumption of poultry over red meat can be attributed to two factors: recent red meat health fears and rising red meat prices.

For the past few decades, demand for meat has steadily risen or declined, based on the type of meat. Americans have been adjusting their meat consumption patterns in accordance to the variations of meat pricing over the years. Global Meat News reported this past September that beef and veal recorded a three percent decline in consumption, compared to a global increase of meat consumption steady with the world’s growing population. In 1972 alone, the average American consumed 144 pounds of red meat a year, according to the USDA (National Chicken Council). Comparatively, in 2015, the average American consumed only 104 pounds of red meat. However, consumption of poultry has increased from 50 pounds per American in 1972 to 106 pounds in 2015 (National Chicken Council). This increase in consumption of poultry over red meat can be attributed to two factors: recent red meat health fears and rising red meat prices.

Behind the rising price of red meat in the United States is lower supply of cattle due to the drought. Raising cattle requires more room and feed than other animals like chicken or turkey, making it especially costly to raise throughout drought conditions, directly impacting the supply of cattle.

Cattle pricing strategy in an extremely volatile market is incongruent amongst internal sellers and producers. To combat unsteady prices are multiple safety nets are in place to protect sellers and buyers. These vary per seller/buyer relationship, ranging from simple forward contracts and more complex options and plans. Ultimately fueling the volatility in the cattle market is the strong basis levels, or the difference between the cash sales price and the futures price. According to Rabobank’s global strategist animal protein Justin Sherrard:

“In the event a producer has had the opportunity to place a hedge or further position at a price level that offers a positive price for the cattle, a strong basis can be viewed as a bonus. This is because it enables the producer to capture the difference between his cash sales price and the offset to the lower-priced futures position” (Global Meat News, “Extreme Volatility”). With ever-changing prices, both beef processors and buyers become weary as they find difficulty setting prices that will help the overall market.

Further impacting the demand for meat in the United States are alarming headlines and announcements from health organizations, including, “Red Meat causes Cancer” and, “CSPI calls for a cancer warning on processed meat,” Americans have understandably turned to alternative meat products to satisfy their desire for protein (Global Meat News). However, demand for meat in outside countries have remained high, and with the lifting of a Chinese import ban on U.S. beef in September 2016, the price of beef has not yet dropped despite the low demand (Global Meat News, “Food trends”).

Many Americans have not yet considered how their individual meat consumption patterns could have a larger significant economic impact. In March 2016, the Proceedings of the National Academy of Sciences published a global-specific health model study describing the varied effects of adopting a diet with pro rata reduction in animal products, including ruminant meat, total meat, and dairy. According to Marco Springman, one of the study’s researchers, “It’s always hard to really get your head around what it means if you avoid climate change to [a certain] degree, or have one less person dying from diet-related diseases. We wanted to illustrate the scale of those benefits.” In comparing the world’s current meat consumption patterns to diets that abstaining from meat or are less-meat heavy, they were able to examine the subsequent economic impact of current meat-heavy diets.

The five researchers from the University of Oxford compared hypothetical situations set to arise in 2050 if the world were to continue their current meat-heavy eating habits. They compared these hypotheticals to the recommended diets proposed by healthy global diets (HGD), vegan, and vegetarian diets, and examined the subsequent impacts that current diet trends could have on healthcare, environmental, and value-of-life benefits.In order to access the economic valuation of the health benefits associated with dietary change, the study relied on both “cost-of-illness” techniques which included direct and indirect costs of informal care and lost work days associated with deaths from specific diseases– and “value of statistical life” which would estimate the cost of the lives saved under each dietary scenario. They found that changes in diet, particularly in Western high- and middle-income countries would reduce the number of overweight and obese people, by 29-40 percent. Furthermore, in combined healthcare, illness, and “value of life” costs, the study found that current meat-heavy diets are costing Americans between $197 and $289 billion annually (PNAS). In particular, America, for its high per-capita healthcare costs, is in a favorable position to save more money than China, or all of the EU countries combined (Atlantic).

Though the current meat industry as a whole slowly declining as Americans begin to adopt more plant-based diets, meat will most likely remain a staple for a majority of Americans. In recent history, red meat has received its fair share of media backlash, and in conjunction with its steadily rising prices, Americans are filling their carts with more reasonably priced meat alternatives. As beef prices are set to increase, whether Americans continue their health-conscious meat-eating behavior, or revert back to their red-meat eating ways will reveal the true motivations behind their changing diet. However, the study published in Proceedings of the National Academy of Sciences suggests that continuing reducing meat-heavy diets could not only change the hearts of Americans, but also their pocketbooks.

Sources:

http://www.globalmeatnews.com/Analysis/Food-trends-meat-consumption-up-beef-declines

http://www.theatlantic.com/business/archive/2016/03/the-economic-case-for-worldwide-vegetarianism/475524/

http://www.pnas.org/content/113/15/4146.full.pdf

Per Capita Consumption of Poultry and Livestock, 1965 to Estimated 2016, in Pounds

http://www.msnbc.com/msnbc/the-decline-red-meat-america

http://www.globalmeatnews.com/Retail/US-beef-industry-targets-millennials

http://www.globalmeatnews.com/Financial/Food-trends-Beef-pork-prices-to-fall

http://us.blastingnews.com/news/2016/09/beef-prices-to-come-down-usda-001146533.html