How we feel about the value of our money plays a huge role in the growth of the economy and the wellbeing of our monetary future. Entire sections of the government, like the Federal Reserve, are dedicated to managing that public perception through a two-pronged approach of managing interest rates and informing the press of their opinions to placate public anxiety. People turn to experts like the federal reserve along with metrics such as GDP growth rates and stock values to determine the value of their money both now and in the future. These projections then inform how people will decide to spend their money now or attempt to save, which will lead to a contraction or expansion of the economy.

While these metrics may seem like a holistic picture, their current numbers fail to rationalize the growing anxiety of an impending recession in the United States. While the economy has steadily been growing since the Great Recession, a Deloitte Global Millennial Survey states that 45% of millennials in the workforce believe that they will never achieve the financial status of their parents.

Where could this anxiety come from?

Well, let’s look at wages.

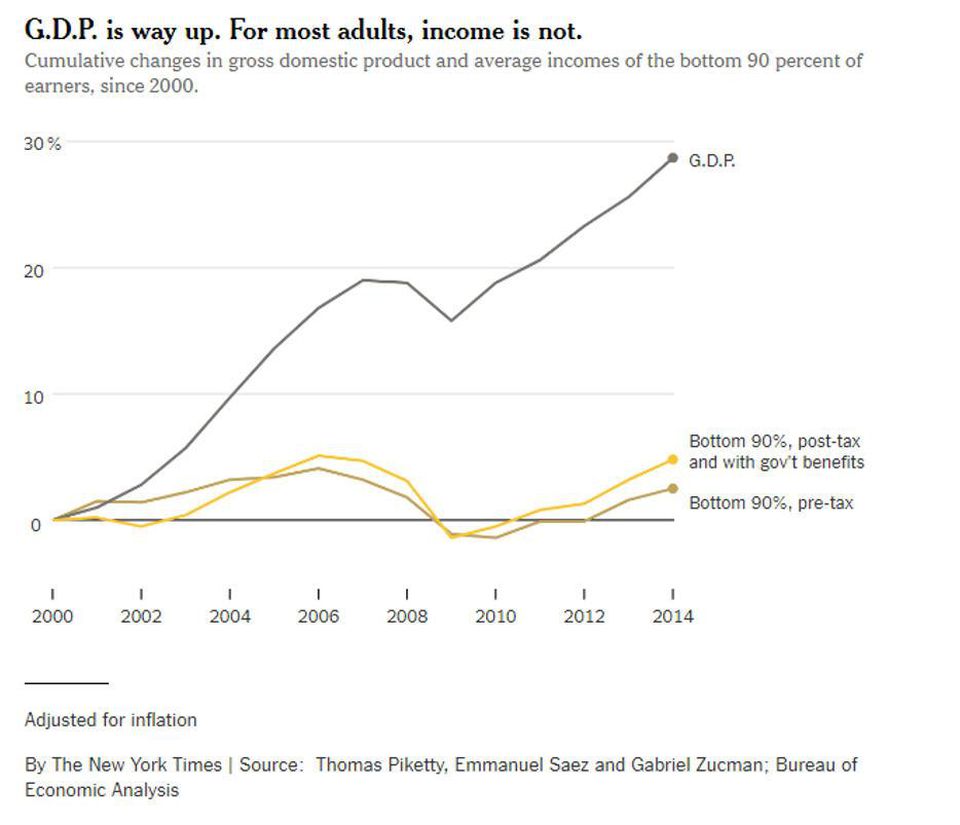

Up to 80% of Americans live from paycheck to paycheck. Because of that, wages are one of the more direct indicators of economic growth and wealth for a majority of the U.S. population. Wages themselves tend to grow with inflation and GDP. This stems from the concept that if more money is put into the economy, that money has the capacity to circulate through exchange. That has not been the case recently, however.

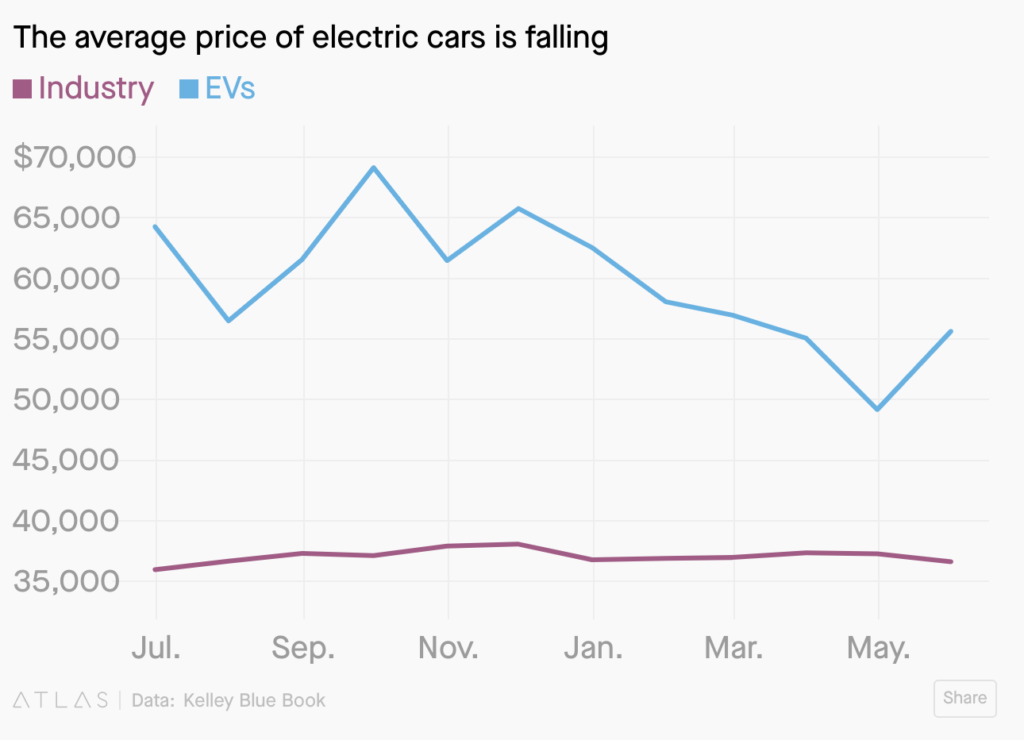

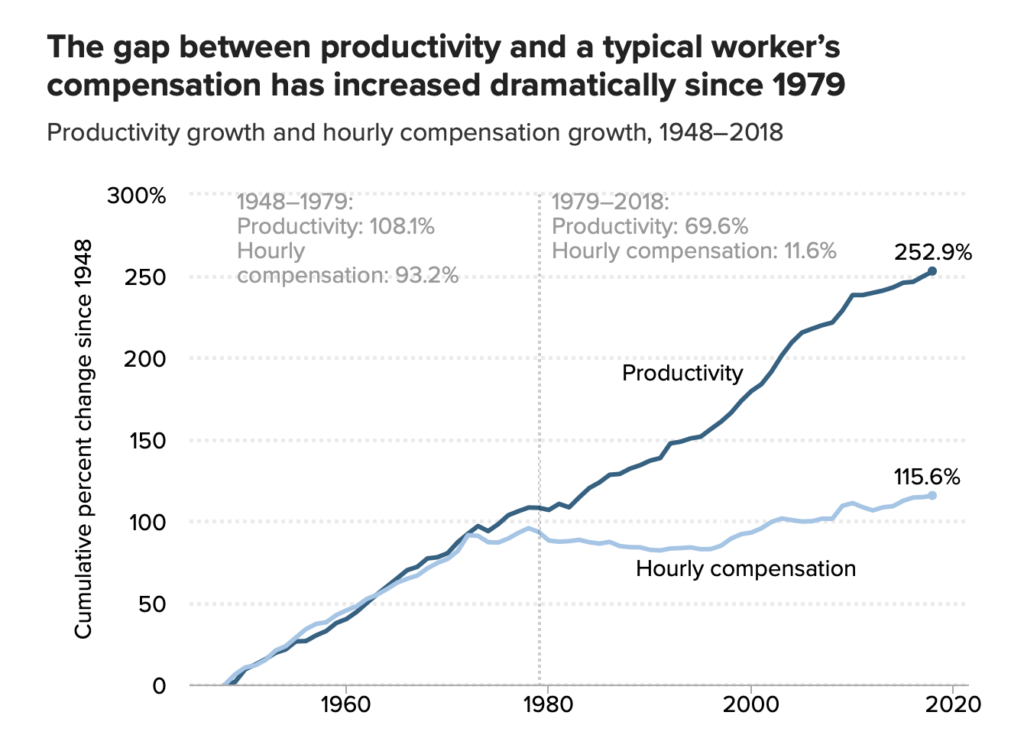

Since the Great Recession in 2008, average wages have dropped significantly due to unemployment and an increasingly competitive job market for most sectors. In 2008, the sentiment was simply that everyone just wanted a job, and so most people were willing to take jobs at lower pay. As the economy began to improve in the subsequent decade, average wages remained virtually the same. If we account for inflation, this means that the average worker was actually being paid less over the course of ten years. This is because the same amount of money must pay for the constantly growing costs of commodities such as housing, food, education, and medicine. This lack of growth is attributed to businesses holding off on increasing wages. Instead, they are apportioning more of its increasing revenues to shareholders.

While it may seem like a bad move on the companies, this actually is a common business practice due to the sticky wage theory: wages may be easy to rise, but are increasingly difficult to drop during a recession. However, this theory is becoming impractical for the era. As companies continue to keep wages low, when a recession ultimately does hit, they have no choice but to layoff workers rather than cut costs . These policies instead increase wealth inequality and leave working Americans vulnerable to financial struggle or even disaster.

The good news is that wages are beginning to rise. Some economists attribute this to a tightening job market as unemployment rates drop . Others say government policies such as increasing the minimum wage have forced companies to address this stagnation. Still, there is a lot work to be done as productivity continues to increase while wages fail to grow at the same rate . Policies such as the most recent tax cuts to companies have also failed to increase the spread of wealth (Forbes). Thus, many Americans are seeing increasing inflation due to a rising GDP yet consistent or underperforming wage growth, leading them to believe that their lives are getting more expensive but that they will ultimately be unable to afford it.