Last week the world saw yet another one of Tesla’s creations, the Cybertruck. This electric pickup truck that looks like a prop from a futuristic science-fiction film can accelerate from 0 to 60 mph in 2.9 seconds and boasts a driving range of up to 500 miles. Besides its peculiar design, it’s hardly a surprise for an electric vehicle to surpass some gasoline cars in performance and price nowadays. That wasn’t the case a couple of decades ago.

In the early 1900s, the first electrically powered cars gained quite a bit of popularity in the United States, especially in urban settings. However, the popularity was short-lived and as gasoline cars became cheaper the electric vehicle market became extinct and remained that way until the 21stcentury. Although there were several attempts to revive the electric cars market, it wasn’t until 2008 that electric vehicles started gaining a new momentum. Tesla Motors, headed by Elon Musk, has made the necessary leap into the EV market and introduced its first model, the Roadster, that was praised for an unprecedented performance and charge range at the time it was released. With a price tag of over $100,000, it has established itself as a luxury car brand and spurred the automaking competition. Over the years the cars have become cheaper, more convenient, and the infrastructure has begun adapting to satisfy consumer demand however, the infrastructure currently poses barriers for entry in some regions.

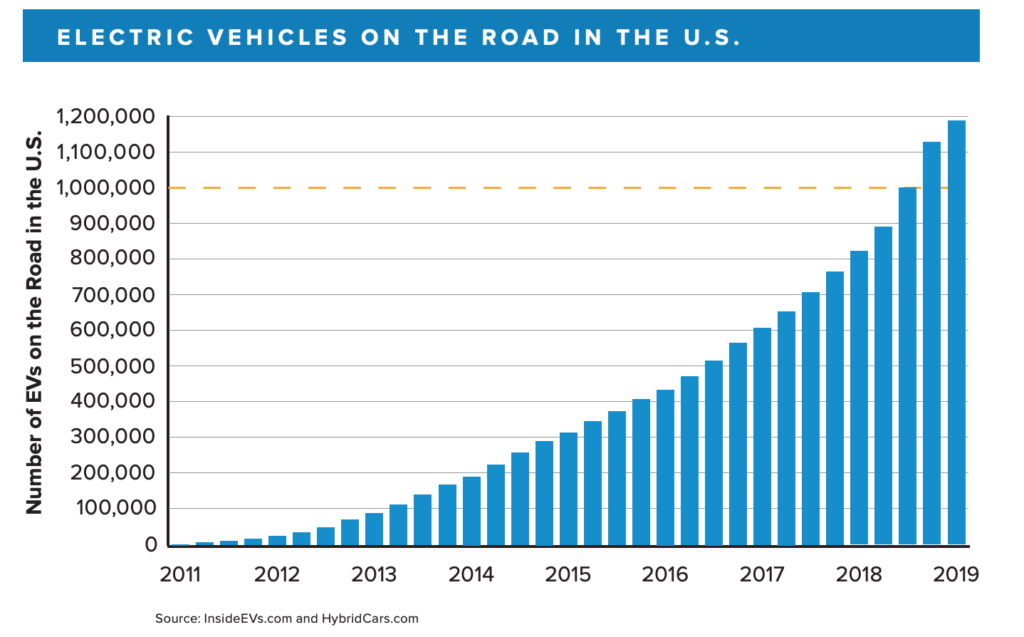

Since Tesla unveiled Roadster the EV industry has grown tremendously. Just in the U.S., the number of electric cars on roads has grown from barely a dozen thousand in 2011 to over 1.1 million cars in 2019. The following chart demonstrates a steady increase in electric cars in the U.S.

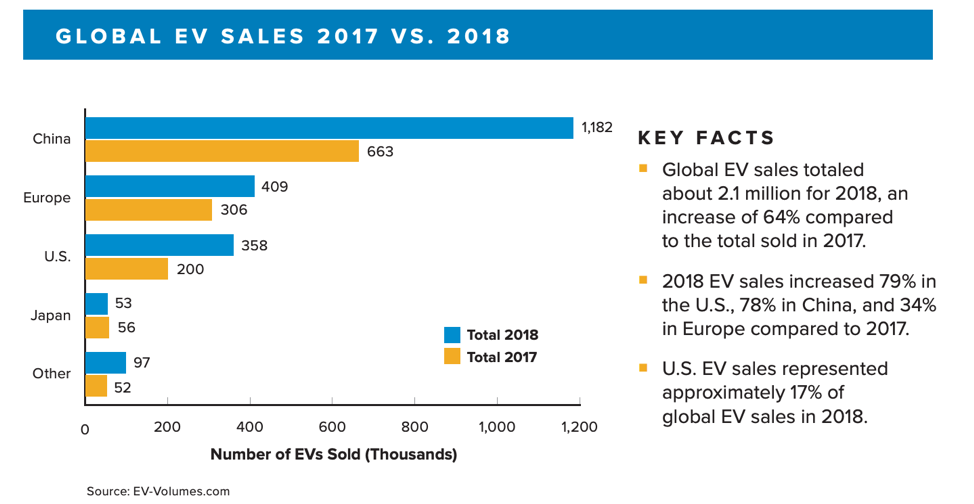

The promising growth of the EV industry and attractive car options have extended the market from the U.S. to an entire world. In fact, the sales of electric cars in the U.S. accounted for only 17% of global EV sales in 2018 with the most lucrative market in China.

Tesla still leads the industry in terms of sales even outselling established luxury gasoline-powered car brands such as BMW in the United States. However, other brands such as General Motors, Nissan, Ford, Volkswagen, and BMW are not lagging behind in expanding their EV fleet. Volkswagen is spending billions of dollars to reshape its factories for electric car production. The company has already revealed its first electric car model, ID. 3 1ST, which will start deliveries in 2020. It will offer free battery charging for a year and the cost of the vehicle will be less than $45,000. Additionally, according to CNN Business, Volkswagen Group, which owns luxury car brands such as Porsche and Lamborghini, will spend $34 billion over the next half a decade to develop an electric or hybrid model of every car currently in production. Given that Volkswagen and other established brands have an advantage over Tesla in terms of revenue, these companies will put up a significant competition to it.

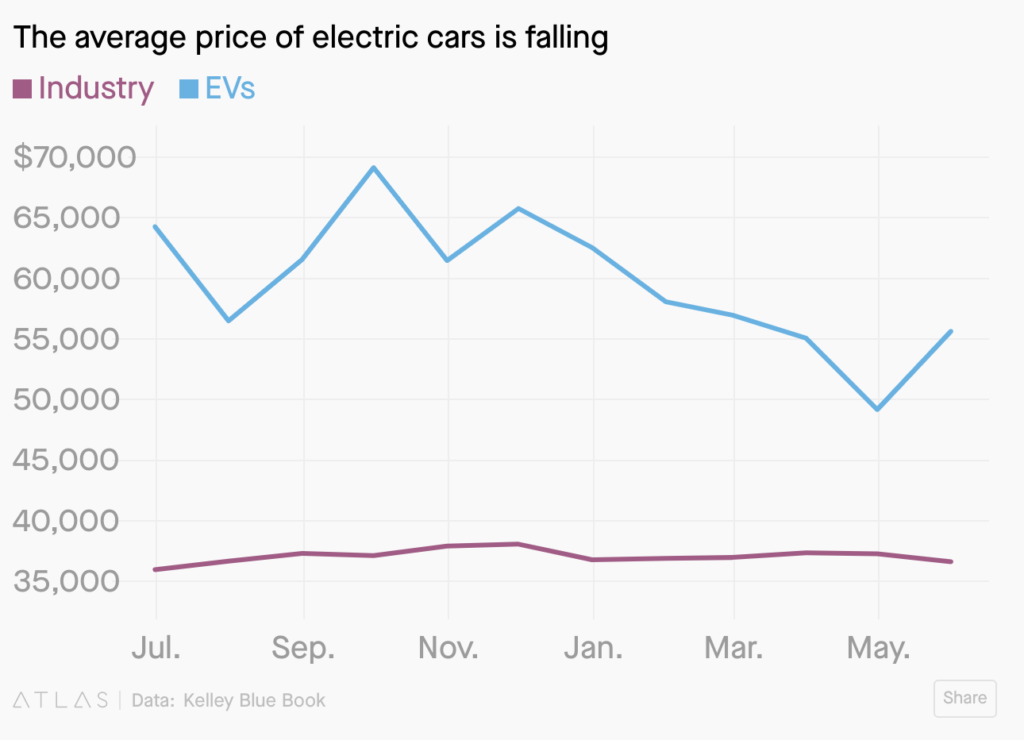

Although the electric vehicle industry is widely discussed, especially given the climatic circumstances and policies all over the world, gasoline cars are far in advance. It is estimated that non-electric passenger vehicles sales in 2018 exceeded 85 million units worldwide while electric vehicles only sold 2 million units. Furthermore, it is projected that electric passenger cars will outnumber gasoline-powered cars only in 2038. As for now, we can expect significant retrofitting of the automotive industry for the next two decades and predominantly more expensive EV models in the near future.

Sources:

https://www.cnn.com/interactive/2019/08/business/electric-cars-audi-volkswagen-tesla/

https://edition.cnn.com/2019/05/09/business/volkswagen-id-electric-car-reservation/index.html

https://www.britannica.com/topic/Tesla-Motors

https://www.energy.gov/articles/history-electric-car

https://qz.com/1618775/by-2038-sales-of-electric-cars-to-overtake-fossil-fuel-ones/