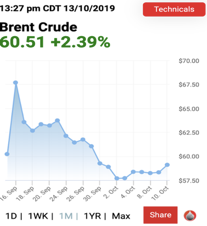

In 2001, it cost Brian, Paul Walker’s character in The Fast and the Furious, $24.674 to fill up his lime green 1995 Mitsubishi Eclipse. Gas cost $1.46 per gallon. The Mitsubishi has a fuel capacity of 16.9 gallons. As the Fast and Furious franchise grew, so did gas prices. According to AAA, California’s current gas prices are $4.075. In 2019, it would cost Brian $68.87 to fill up his Mitsubishi Eclipse.

Let’s pretend that even in a cinematic universe now defined by lucrative physics-defying crime, Walker’s character still owns that 1995 Mitsubishi Eclipse. If his character was still involved in the franchise (RIP Paul Walker), he would rather steal a Tesla than pay almost $70 for a full tank of gas.

In the real world, Californians may not be stealing Teslas, but interest in electric and hybrid cars has grown. This year, the California New Car Dealers Association found that electric car sales have increased since 2018 by 63.7%. Hybrid car sales are up 22.1%.

Gas prices are one of the reasons why. When filling up your tank makes a visible dent in your disposable income, being able to drive without worrying about gas becomes really appealing. The opposite is also true – when gas prices are low, alternatively powered car sales decrease. The Bureau of Transportation Statistics found that while electric and hybrid car sales increased rapidly from 2011 to 2014, sales decreased in 2015 “due to low gasoline prices.”

Despite California’s rising gas prices, the top two cars sold in the Golden State for the first six months of 2019 were the gas-using Honda Civic and Toyota Camry. Tesla Model 3 came in at third place.

Even though California’s gas prices are at $4.075, getting an electric is not an investment some Southern California drivers are willing to make for a variety of reasons.

NOT AS GREEN AS YOU THINK

Hanna Richter, a stable attendant at Disneyland, lives approximately 45 minutes from the Happiest Place on Earth in Riverside, Calif. Richter commutes on what she describes as a “heavily trafficked route.”

“It’s awful,” she said.

Richter drives a gas-using vehicle, a 2018 Toyota RAV4, and pays just under $200 per month for gas. She said she is on the fence regarding electric and hybrid cars. “I like the one hand of less gas and saving money by using said less gas,” Richter said.

What is stopping her is concerns about whether one of the main selling points of electric cars – that it is better for the environment – is actually true. “The batteries used to make electric cars cause a greater carbon footprint than just using a gas-powered car,” Richter said. “So I’d like to save money on gas, and use less gas. But I also want to lessen my carbon footprint.”

Many electric cars are powered by lithium-ion batteries. According to Amnesty International, making them is an energy intensive practice, and is primarily located in China, South Korea and Japan – countries where electricity generation is dependent on fossil fuels. Lithium-ion batteries are also linked to human rights abuses in the Democratic Republic of Congo.

Richter’s concerns were confirmed in a 2018 study by the International Council of Clean Transportation that found that making an electric vehicle produces more emissions than the manufacturing of a conventional car because of lithium-ion batteries.

“On the other hand, electric vehicles travel farther with a given amount of energy and account for fewer emissions through the fuel production and vehicle use phases,” the study said.

According to the ICCT, although the long-term environmental benefits of electric cars is not outweighed by emissions created by lithium-ion batteries, the emissions are still substantial. Without technological improvements, these emissions could become more substantial as electric cars increase in popularity.

For consumers like Richter who want to lessen their carbon footprint and spend less money on gas, striking the balance between an ethical decision and a logical financial decision is complex.

In addition, electric vehicles are generally more expensive to purchase than their gas-fueled counterparts. The manufacturer suggested retail price for a 2019 Toyota RAV4 is $25,650. The hybrid version of the car is retailed at $27,850 – an 8.2% increase from the gas version.

According to the Office of Energy Efficiency and Renewable Energy, the federal government and several states offer incentives to buy electric cars. California offers a rebate of $1,500 to $7,000 depending on the purchaser’s household income and the kind of electric car bought.

CONVENIENCE

Richter’s boyfriend, Dan Grecu, works for a tile contracting company in Riverside, Calif. He lives in the same city he works in. Unlike his girlfriend’s 45-minute commute, his drive to work is only 10 minutes. His car – a RAM truck – consumes gas.

Going green did not factor heavily into his car purchase. “I wanted that car because it has plenty of room for passengers and storage,” he said.

Southern California’s traffic and high gas prices are a recurrent source of frustration for him. That, and the lack of rain, has made him consider moving to Canada or the Pacific Northwest. “Gas prices in California are and always have been too high. I spend about $250 a month on gas,” he said. Spending that much a month on gas for one year would be like buying a new pair of Apple AirPods Pro, which cost $249, per month.

One of the reasons why California’s gas prices are so high is because of SB 1, colloquially known as the Gas Tax. Grecu is not a fan of the policy. “I think it’s ridiculous,” he said. “I would like to know where the money actually goes.”

Passed in 2017, SB 1 taxes gasoline to collect revenue for transportation infrastructure. California’s roads are one of the worst in the country, and were given a D grade by the American Society of Civil Engineers. With over 175,000 miles of public roads, ASCE estimated 44% are in poor condition. “A good transportation system enables efficient movement of goods and people and is critical to California’s economic well-being,” ASCE’s California infrastructure report card said.

Two years into SB 1, and officials estimate that $130 billion more in revenue is necessary to improve the state’s roads. The policy has found itself caught in a sort of catch-22.

A 2017 report by Next 10, a California-centric nonprofit organization focusing on the economy and the environment, found one of the reasons California’s roads are in poor condition is because “funding for repairs and improvements – which traditionally comes largely from motor vehicle fuel taxes – is declining as cars become more fuel-efficient and the state’s electric vehicle fleet grows.”

According to the report, the displacement of gasoline as a revenue source could lead to $572 million in losses in state gasoline taxes by 2025 without new, sustainable transportation funding solutions. SB 1 may not be doing enough – and in fact, with increasing gas prices driving up electric vehicle sales, may be ineffectual at fixing California’s roads and very effective at irritating people who drive gas-powered cars.

SB 1 does not expire for 10 years and is designed to grow over time to fall in line with the cost of living. The most recent increase occurred in July 2019.

Despite rebates, rising gas prices, and lower operating costs of an electric car, Grecu said he is not considering one because the technology is not where it needs to be to make sense for him.

“I would consider electric if I lived in a house with solar panels as electricity is still expensive,” he said. “I don’t think there are enough charging stations, yet. Once the batteries are built for longer trips, it would be more convenient.”

NOT THE RIGHT TIME

Vicki Ghines, a resident of LA’s Koreatown neighborhood, drives approximately 120 miles five days out of the week to her job as an account manager in the Inland Empire. She drives a 2017 Honda Accord. She said that getting an environmental or hybrid car is not something she is considering right now. “My car is fairly new and I know it would be years before I get another one,” she said.

Ghines said she got her new Honda under protest. “I had to replace my 2001 Honda Accord. It had 345,000 plus miles on it, and since I had been going home late at night from work, my sister was so afraid that the car may break down, especially at night,” she said. “So she kept ‘nagging’ me, asking when I will get another car.”

Her average consumption of gasoline per month is around $300.

A car is a significant purchase – a purchase consumers want to last them years. For consumers like Ghines who bought new cars recently, buying an electric car is not feasible. It’s a decision they can afford to procrastinate on.

Ultimately, a car is a personal choice – an economic expression of identity. In California, having a car is an almost inescapable purchase. According to Hedges & Company, over 84 percent of California’s driving age population is a licensed driver. Perhaps because it is so ubiquitous, a car choice matters all the more.

SOURCES

- https://www.sandiegouniontribune.com/business/story/2019-08-15/california-new-vehicle-sales-down-5-6-this-year

- https://www.amnesty.org/en/latest/news/2019/03/amnesty-challenges-industry-leaders-to-clean-up-their-batteries/

- https://gasprices.aaa.com/?state=CA

- https://www.energy.gov/eere/vehicles/fact-915-march-7-2016-average-historical-annual-gasoline-pump-price-1929-2015

- https://www.cncda.org/news/california-electric-and-hybrid-vehicle-sales-increasing-other-powertrains-decreasing-in-sales/

- https://www.latimes.com/politics/la-pol-ca-california-gas-tax-increase-road-repairs-20190620-story.html

- http://www.laalmanac.com/energy/en12.php

- https://www.ecowatch.com/electric-vehicle-sales-2573683410.html

- https://www.energy.gov/eere/electricvehicles/saving-fuel-and-vehicle-costs

- https://hedgescompany.com/blog/2018/10/number-of-licensed-drivers-usa/

- https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201720180SB1

- https://www.bts.gov/archive/publications/national_transportation_statistics/table_01_19

- https://www.next10.org/sites/default/files/2019-06/transportation-funding-press-release-2.pdf

- https://www.apple.com/airpods/

- https://ww3.arb.ca.gov/msprog/lct/cvrp.htm

- https://theicct.org/sites/default/files/publications/EV-life-cycle-GHG_ICCT-Briefing_09022018_vF.pdf

- https://www.google.com/search?q=2019+toyota+rav4&oq=2019+Toyota+RAV4&aqs=chrome.0.0j69i59l3j0l2.190j0j7&sourceid=chrome&ie=UTF-8

- https://www.google.com/search?sxsrf=ACYBGNS-H3uMHk-gNjKninsu-xQhDN67-A%3A1572737345451&ei=QRG-XdGDG6C_0PEPxLif4AQ&q=2019+toyota+rav4++hybrid+price&oq=2019+toyota+rav4++hybrid+price&gs_l=psy-ab.3..0i20i263i70i251j0i7i30l9.58078.60006..60119…0.2..0.104.759.6j2……0….1..gws-wiz…….0i71j0i67i70i251j0i13i70i251j0i13.YqA6SbJOlEo&ved=0ahUKEwiRqLOW18zlAhWgHzQIHUTcB0wQ4dUDCAs&uact=5

- https://www.google.com/search?q=1995+mitsubishi+eclipse+gas+tank+capacity&oq=1995+mits&aqs=chrome.0.69i59j69i57j0l4.1783j0j7&sourceid=chrome&ie=UTF-8

- https://cleantechnica.com/2016/09/25/icct-analysis-ev-market-development-californian-cities/