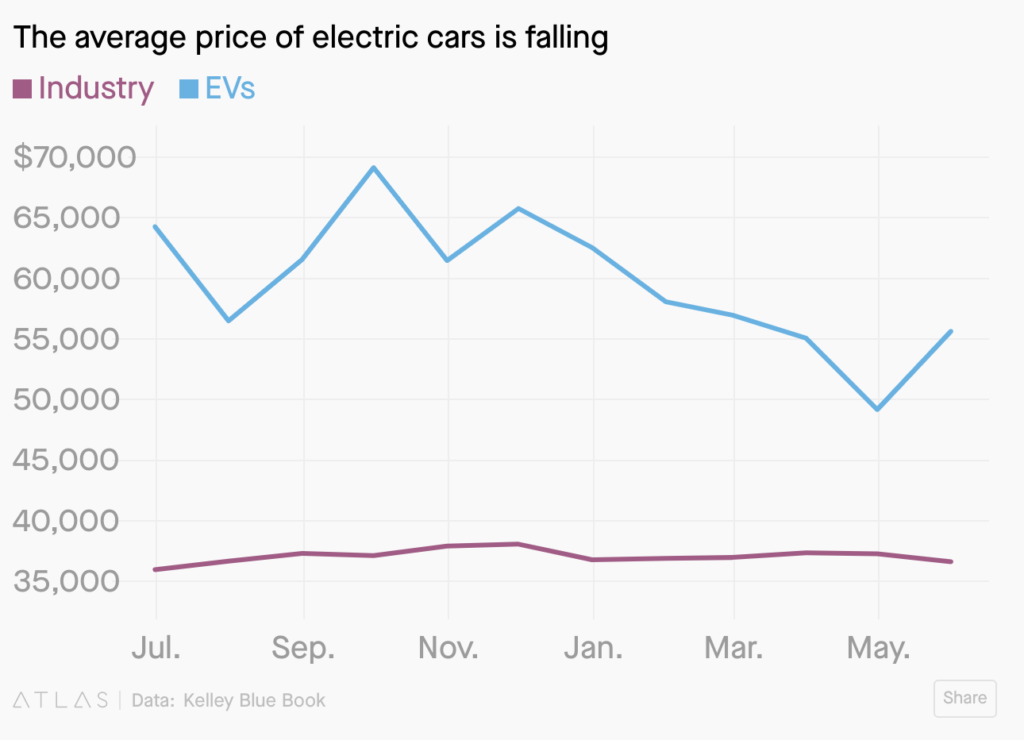

Considering buying an electric car? Now might be a good time. The sales of electric vehicles (EV) are increasing both globally and nationwide – and the prices are going down year by year.

Globally, the market for electric vehicles has grown rapidly over the years. In California, even while sales of cars have fallen in the state through the first half of 2019, sales of electric cars have soared from 3.3 percent of the market in 2018 to 5.6 percent in 2019.

There are a steady increase and a spike in the import price of electric motors, which are essential for plug-in hybrid electric vehicles. According to the observatory of economic complexity, the top exporters of Electric Motors are China ($12.9B), and the top importers are the United States ($9.6B). With the ongoing trade war between China and the United States, the import price of electric motors would likely go up for a while, adding to the producer price index (PPI) of electric cars made in the U.S.

However, the median electric car in the U.S. is getting cheaper. Monopolizing the U.S. electric car industry, Tesla could release cheaper median EV models due to the maturity of the technology and the shrinking of EV battery prices.

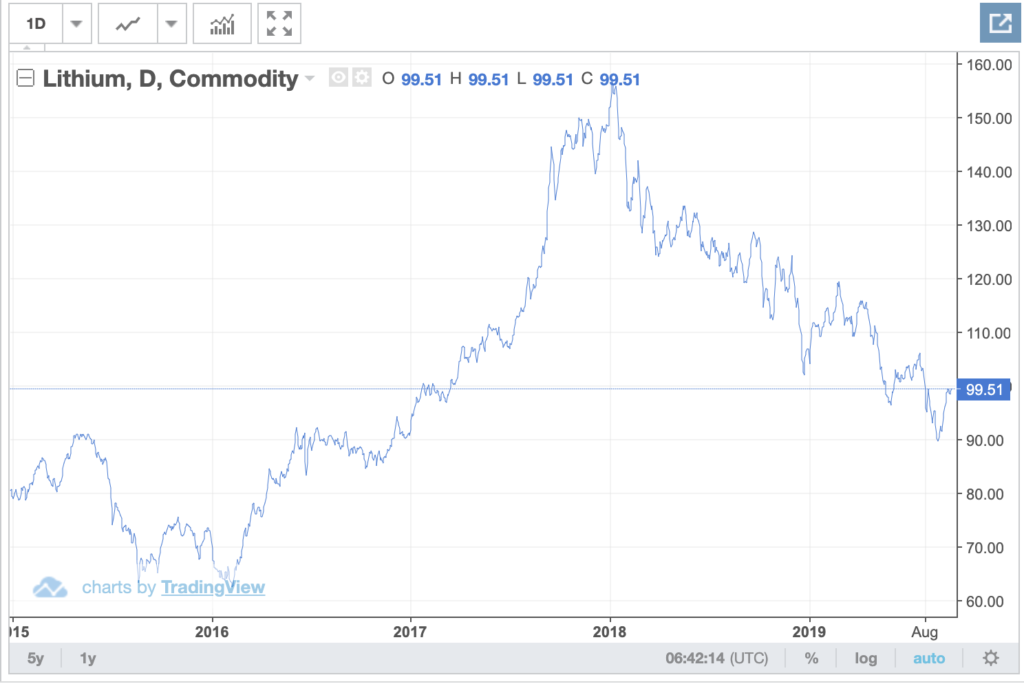

The decreasing battery price in the U.S. reflects a larger picture in the global battery market. The leading factors? Cobalt and lithium, two major components of the electric car battery – are becoming cheaper and cheaper.

Lithium experienced dramatic price movements, rapid demand growth, and supply deficit for refined products in recent years. However, prices are expected to fall in 2019 and after.

Lithium’s price is expected to fall in 2019 and after.

The cobalt industry also experienced a huge price surge in 2017 due to the growing sales of electric cars. It hit a 10-year peak of more than $40 a pound in April 2018 and fell back to $13 a pound in March in 2019. And its price is expected to continue to drop.

Cobalt’s price is expected to continue to drop.

According to Henry Sanderson from Financial Times, the dramatic rise in prices in 2017 was driven in part by stockpiling in China. This year, much of that inventory has come on to the market, pushing down prices.

With the continuous slide of prices for these raw materials, it is possible that the suppliers may cut their supply until the prices go up to their expected level. But in the short-term, the shrinking cost battery will further push down the electric car price tags.

However, considering China’s grip on the lithium needed for batteries – a single Chinese company has “effective control over nearly half the current global production of lithium” – the trade war could greatly hurt American batteries and the electric car industry. Same for the cobalt. China was the world’s leading producer of refined cobalt and a leading supplier of cobalt imports to the United States. Unless Tesla comes up with new technology to reduce cobalt usage in its car battery, the U.S.-China tension will not help the U.S. electric car industry.

Meanwhile, China seems to be benefiting more from the price drop of cobalt and lithium. Because China, not Tesla, is driving the electric-car revolution globally.

Since the beginning of the EV project in the early 21st century, the Chinese government has been backing up the industry by spending billions of dollars to subsidize manufacturing of electric vehicles and batteries and encouraging consumption. By 2015, electric vehicle sales in China had surpassed U.S. levels. In 2018, Chinese sales topped 1.1 million cars, more than 55% of all electric vehicles sold in the world.

Moreover, China has been aiming at the American market and challenging Tesla by introducing Chinese electric cars to the U.S. So far they have been largely successful until yesterday when Nio, a Shanghai-based Tesla-challenger, faced consecutive huge losses under the government-backed bursting bubble.

To help the industry stand on its own and avoid a bubble, China has gradually scaled back subsidies since 2017 and is phasing out the subsidy program by the end of 2020. While it seems to lead to a hard time for Nio, it is unknown how much impact this decision will have on the overall Chinese EV industry.

Another potential backfire resides in resource and sustainability. The huge market for electric cars fuels the expanding demand for these raw materials – and the market (so does the demand) seems to be expanding exponentially. However, there is a limited amount of minerals on earth. Especially for cobalt, most of which came from Congo, exhaustion is predictable under such avaricious exploitation. Additionally, the illegal use of child labor, the contaminated environment, and the threatened human rights for Congolese add to the complexity of the issue. If the unlimited desire exceeds the limited amount of resources someday, we will likely face another mineral resource crisis.

Reference:

“After US$5 Billion in Losses, China’s Tesla Fights to Survive.” South China Morning Post, 23 Sept. 2019, https://www.scmp.com/tech/big-tech/article/3029968/after-us5-billion-losses-chinas-tesla-challenger-nio-fights-survive.

Clemente, Jude. “Trade War With China Exposes U.S. Mineral Import Problem.” Forbes, Forbes Magazine, 11 July 2018, https://www.forbes.com/sites/judeclemente/2018/07/11/trade-war-with-china-exposes-u-s-mineral-import-problem/#be6c9cb21044.

“Cobalt.” OEC, https://oec.world/en/profile/hs92/8105/.

“Cobalt.” Cobalt | 2019 | Data | Chart | Calendar | Forecast | News, https://tradingeconomics.com/commodity/cobalt.

Coren, Michael J. “The Median Electric Car in the US Is Getting Cheaper.” Quartz, Quartz, 6 Sept. 2019, https://qz.com/1695602/the-average-electric-vehicle-is-getting-cheaper-in-the-us/#targetText=The median electric car in the US is getting cheaper&targetText=Data analyzed by research house,price of $38,990 before incentives.

Evarts, Eric C. “Electric Car Sales Boom in California, as Plug-in Hybrids and Small Cars Sputter.” Green Car Reports, 4 Sept. 2019, https://www.greencarreports.com/news/1124891_electric-car-sales-boom-in-california-as-plug-in-hybrids-and-small-cars-sputter.

“Expanding Electric-Vehicle Adoption despite Early Growing Pains.” McKinsey & Company, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/expanding-electric-vehicle-adoption-despite-early-growing-pains#targetText=What is the Electric Vehicle,plug-in hybrid EVs).

“Import Price Index (Harmonized System): Electric Motors and Generators (Excludes Generating Sets).” FRED, 13 Sept. 2019, https://fred.stlouisfed.org/series/IP8501.

“Lithium.” Lithium | 2019 | Data | Chart | Calendar | Forecast | News, https://tradingeconomics.com/commodity/lithium.

“US EV Sales Surpass 2% In 2018 – 9 EV Sales Charts.” CleanTechnica, 13 Jan. 2019, https://cleantechnica.com/2019/01/12/us-ev-sales-surpass-2-for-2018-8-more-sales-charts/.