The economic indicator of housing vacancies and homeownership delves into the overall status of homeowners and renters, particularly the vacant rates. Rental and homeowner vacancy rates are obtainable for U.S. regions, states and for the 75 largest Metropolitan Statistical Areas (MSAs), and information about geographies are accessible both quarterly and annually, according to census.gov.

The real question is, how do we decipher these rates in the short term (the past few years) and in the long term (a decade or longer)? What does an understanding of these rates tell us about housing issues in the United States?

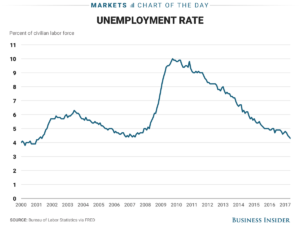

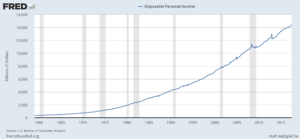

As of July 27, 2017, the rental vacancy rate was 7.3 percent, and the homeowner vacancy rate was 1.5 percent. These numbers have noticeably improved (decreased) since 2010. In fact, from 1995 to 2017, the rental vacancy rate hit its highest number in 2010, a 10.23 percent average in all four quarters. The homeowner vacancy rate was usually around 1.5 percent over that time span, but it obviously rose when the U.S. economy entered a recession in late 2007 and spiked close to 3 percent.

Since 1995, the rental and homeowner vacancy rates are able to stay more or less intact even though the median asking rent has continuously increased, while the median asking sales price for vacant houses can increase and decrease in somewhat of a cyclical fashion, falling when the prices get too high and outweigh demand. Via information from the United States Census Bureau, the median asking sales prices for vacant units climbed up to around $200,000 but began a steep decline once the 2007 recession arrived.

After leveling out for a few years, the median asking sales price has begun the upward trend again and, measured at $177,200 in the second quarter of 2017, is on pace to eclipse $200,000. Rental and homeowner vacancy rates can continue to stay low, but if the numbers compiled on the graphs of recent years tell us something, it’s that troughs follow peaks, even if skyrocketing prices and lower unemployment rates make the economy seem like it’s booming.

Rental and homeowner vacancy rates help describe important characteristics which define value in a marketplace: supply and demand. If more and more people are buying and renting houses, you’d expect the vacancy rates to be lower. In this case, the supply of housing is getting less and less, and the demand for housing is likely higher. Therefore, rental and home sales prices should increase, making the housing market unkind to a significant portion of regular people.

“The irony of the modern housing market is that the places where we are seeing wage growth are places where people can’t live because they are too un-affordable,” said Nela Richardson, chief economist at real estate brokerage Redfin, per Forbes.

Now, economists must deal with the possibility of housing prices becoming overinflated, as they hope for the market to stay stable over the next decade or two.

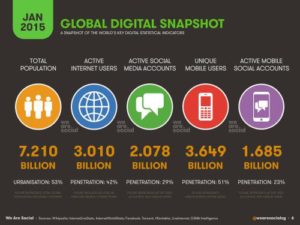

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.