At the highest levels of power in the finance industry, there is one gold standard, one unifying symbol that binds together all titans in the industry: the Patagonia vest with an embroidered corporate logo, also known as, “the Power Vest.”

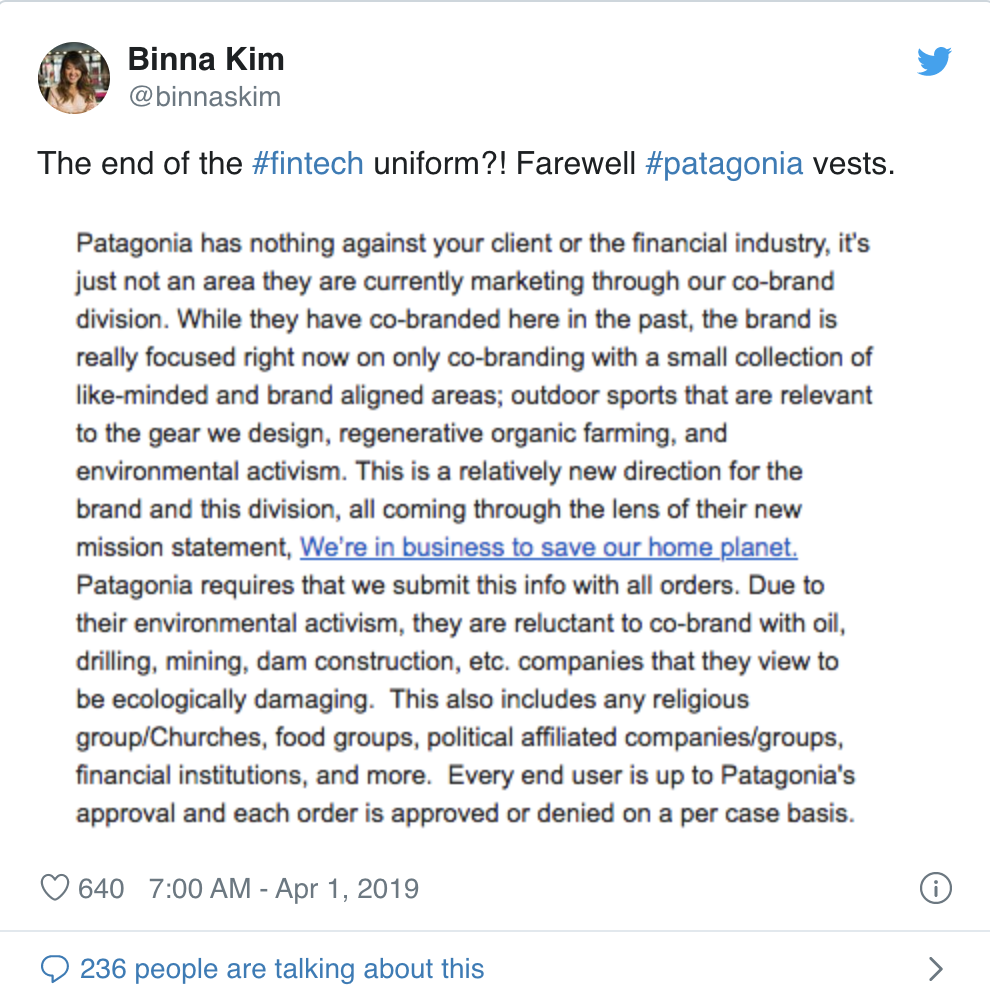

The vest may now vanish to distant memory, similar to Gordon Gekko’s pinstriped suits, due to a shift in policy at Patagonia. This shift in policy was first reported by Binna Kim, president of the communications agency Vested, whose order of branded vests for a hedge-fund client, something her firm had done in the past through a reseller for Patagonia’s corporate sales, was rejected.

“Patagonia has nothing against your client or the finance industry, it’s just not an area they are currently marketing through our co-brand division,” read a corporate statement Kim tweeted. “While they have co-branded here in the past, the brand is really focused right now on only co-branding with a small collection of like-minded and brand aligned areas; outdoor sports that are relevant to the gear we design, regenerative organic farming, and environmental activism,” it continued.

The statement, which came not from Patagonia but from an unnamed retail partner, said the company’s shift in focus is meant to align with Patagonia’s new mission statement, “We’re in business to save our home planet.”

The statement continues, stating that Patagonia is “reluctant to co-brand with oil, drilling, dam construction, etc. companies that they view to be ecologically damaging” and while orders are approved on a case-by-case basis, this includes “financial institutions.”

Patagonia confirmed this change to its corporate program, saying the company “recently shifted the focus of this program to increase the number of Certified B Corporations, 1% For The Planet members and other mission-driven companies that prioritize the planet. This shift does not affect current customers in our corporate sales program.”

The individual behind the Instagram @MidtownUniform, the founder of the term “Midtown Uniform,” which refers to the button-up, vest and slacks combination, stated, “In light of its big branding moves toward awareness of environmental issues, I was wondering when Patagonia would be putting the kibosh on outfitting the finance world. It was only a matter of time.”

The Origin of the Power Vest

The Midtown Uniform appears to have taken hold post-2008, when many financial firms loosened their once-strict suit-and-tie dress code. The message was: We know your salary is down, but at least you get to dress casual on Friday.

“The payouts regressed, so just like every industry that has payment difficulties, they find other ways to satisfy employees and dress is one of the easiest ones,” said a 35-year-old stock trader in New York City. He was on the floor during the 2008 recession and described how the sport coats and wool slacks gave way to vests and cotton chinos in its aftermath.

Though midtown New York has now become especially associated with this new dress code, the vest’s roots lie in Silicon Valley. “If you go to the Whole Foods here, you’re going to see [the vest] everywhere,” said Christina Mongini, the costume designer for HBO’s parodic sitcom “Silicon Valley” and a Bay Area native.

Jared Dunn, the show’s type-A COO, wears a fleece vest over a button-down in nearly every scene in which his character appears. “Jared’s style is really perceived as the normal basic understated business-casual attire,” said Mongini.

Outdoorsy fleece vests match the youthful, countercultural Silicon Valley spirit in a way suits and ties never did. Bay Area C-suite executives, such as Apple’s Tim Cook, Facebook’s Mark Zuckerberg and PayPal cofounder Max Levchin have boasted of cycling or hiking during the work week. As Mongini said, “You can hop on your bike and throw your vest on and head over to Santa Cruz on your lunch break if you wanted to.”

Across the nation, the vest was an easy sell. “It’s very difficult to just sit there and work in a suit jacket,” said the 35-year-old stock trader. In a vest, “I can sit at my desk and feel a little bit more comfortable.” Aiding and abetting the trend toward sleevelessness, a couple of years ago brokerage houses and trading platforms shrewdly started giving away the vests as a freebie to entice traders. The vests’ low cost was a way around financial regulations, which cap gifts to traders at $100, and the wearable promotions were more functional than the giveaways they replaced, such as candy tins and Nerf Footballs. These promotional vests, with “Equifax” or “Merrill Lynch” embroidered along the chest, are now a common sight in New York.

The trend has become self-perpetuating: People wear the vest because it is what people wear. “Now it’s the new thing: It’s not suspenders and a Bengal-striped shirt,” said Will Crowley, a 25-year-old investment banker who lives in Hoboken, N.J. “It’s a Patagonia vest and a button-down shirt.” He added that the “bro culture” of finance has helped reinforce this look, with its scores of men following the same path from prep school to an Ivy League college to a job in finance. Looking like your peers is part of the package. “If you want to be successful, part of it is wanting to fit in,” said Crowley.

Patagonia’s Place Among the Vest Industry

Although many companies, including The North Face, make fleece vests, the Patagonia fleece vests quickly became, as Jeffrey Leeds, co-founder of Leeds Equity Partners and longtime fleece-wearer, said, “the Tiffany blue box” of the culture: an immediately recognizable visual sign of elite status. Part of this can be attributed to the co-branding – the Patagonia name on one side and a company name on the other.

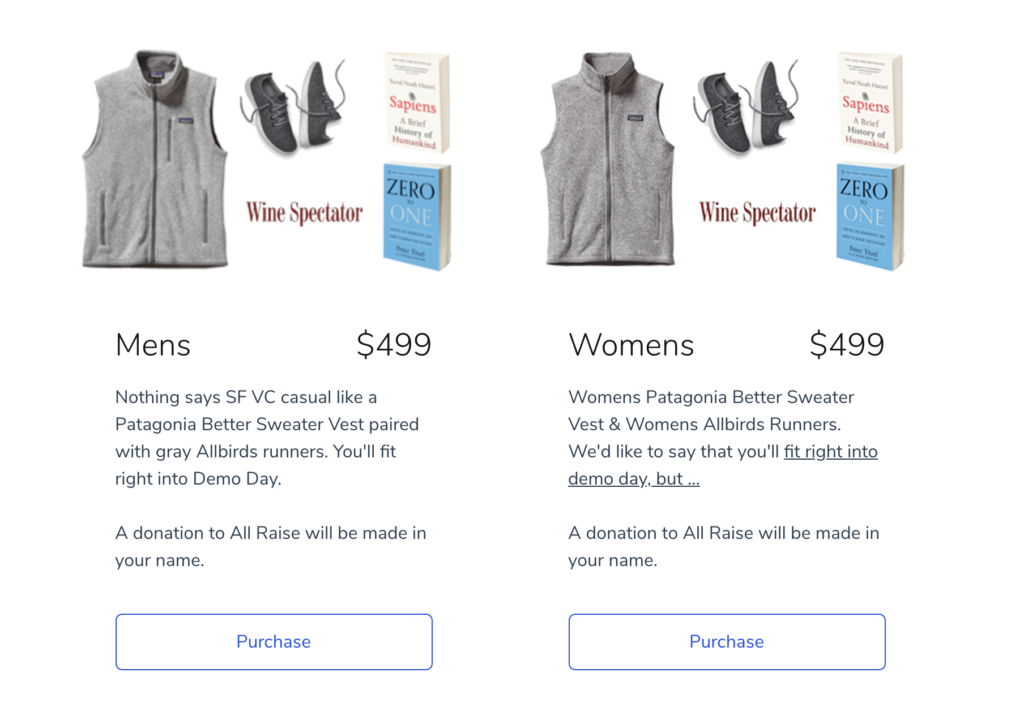

Patagonia became so linked to the financial sector uniform that one website poked fun at the whole thing by offering a “VC starter kit” for $499. “Nothing says SF VC casual like a Patagonia Better Sweater Vest paired with gray Allbirds runners. You’ll fit right into Demo Day,” the promo read.

The Timing of Patagonia’s Decision

Patagonia’s shift in policy to focus on increasing the number of Certified B Corporations, 1% For The Planet members and other mission-driven companies that prioritize the planet seems to align with Patagonia’s brand, especially with its relatively new mission statement. However, it is interesting to note the macroscopic view of the timing of this decision.

In November 2018, Patagonia received $10 million as a result of what it called an ‘irresponsible tax cut” by President Donald Trump. The Activist Company, as Patagonia calls itself, promptly donated the money to environmental charities.

Since 2017, Patagonia has also been sharply critical of President Trump’s decision to drastically reduce the size of some national monuments. In the case of Bears Ears National Monument in southeast Utah – shrunk an astounding 85 percent – the company has put up resources to fight in court.

“We have to fight like hell to keep every inch of public land,” Patagonia CEO Rose Marcario told HuffPost in 2017, shortly after the Bears Ears decision was announced. “I don’t have a lot of faith in politics and politicians right now.”

Although Patagonia’s history of environmental activism spans longer than its efforts in the Bears Ears decision, its relatively recent shift in focus to stop working with the finance industry in its corporate sales program seems abrupt in Patagonia’s macroscopic timeline.

Jake Flanagin, a reporter for Esquire, wrote a piece about why all of these business bros were wearing the same vest. His article was released on July 9, 2018. When writing the article, he contacted Patagonia to inquire about their marketing relationship with the financial sector, and the response he received was less than enthusiastic. This was approximately 10 months before Patagonia’s shift in policy became publicized.

In a rather terse email from Patagonia’s communications team, Flanagin was told they have “no idea” how or why the vests became so popular with the young corporate set – they build their products specifically for “environmentalists and laborers who work in the elements.”

In April 2019, Binna Kim then released a set of tweets that publicized Patagonia’s corporate shift in policy, which affected all of its retail partners and future clientele. Patagonia, however, never released an official statement announcing this decision prior to the tweets. Rather in response to Kim’s tweets and the conversation that ensued afterward, Patagonia confirmed its shift in policy to specific news outlets that asked about it.

Patagonia’s decision to shift the focus of its corporate sales program seems abrupt, and the lack of marketing Patagonia conducted for it seems like Patagonia was correcting what should have been occurring in the first place: the vest should have never been a part of the Midtown Uniform in the first place.

Patagonia’s Intersection Between Ethics and Business

Patagonia’s shift in policy to increase the share of its corporate partners that make environmentalism a top priority only affects any new corporate clients that wanted to work with Patagonia and did not have any corporate social responsibility toward environmentalism. Therefore, the power vest will not be disappearing since its existing corporate customers will not be affected.

Patagonia’s decision, however, does serve as an example of the various ways businesses are making their social stances part of how they operate and of how Patagonia in particular weaves its ethics into business.

Before, companies would try to stay neutral on politics. Recently, that is not much of an option says Daniel Korschun, an associate marketing professor at Drexel University who studies corporate political activism. “Consumers and employees are looking for deeper purpose from companies,” he says, and Korschun calls Patagonia the “gold standard in corporate activism” because it has consistently aligned itself with issues that make sense for the brand and that its customers care about.

Although Patagonia may be seen as the gold standard in corporate activism, it is not the only outdoor retailer weaving ethics into business.

The North Face, one of the three most popular outdoor retailers among Patagonia and Columbia, recently refused to fill an oil company’s vest order saying, “There are times when we choose not to engage with other companies or organizations because they do not align with our brand values and mission to move the world forward through exploration.”

Some industry watchers have criticized Patagonia for taking political stances that are too “uncompromising.” While Marcario admits that occasionally the company has heard from customers who disagree with Patagonia’s actions, she says the response for its unapologetically political stance has been “overwhelmingly positive.” When viewing Patagonia’s revenue and profit these past few years, this sentiment does reign true.

Marcario took up the CEO role for Patagonia in 2014, and since then Patagonia has seen its revenue and profit quadruple. The company will not disclose its exact revenue, but the CEO said in March last year that sales were approaching $1 billion. Marcario has helped nurture new lines of business, including its Patagonia Provisions food line, used goods program Worn Wear, and the venture fund Tin Shed Ventures, which has at least $75 million to help environmentally responsible startups.

As a result, the founder of Patagonia, Yvon Chouinard, has called Marcario the best leader the company has ever had. Since Marcario took leadership of the company, Patagonia has leaned further into its self-appointed role as the Activist Company.

Although the finance industry will not necessarily be left out in the cold without their coveted vests, Patagonia’s decision to shift its focus and lose a large market share of potential clients shows the importance of staying true to its brand identity in today’s times and how it pays off to do so.

Sources

- https://www.inc.com/lindsay-blakely/patagonia-2018-company-of-the-year-nominee.html

- https://nypost.com/2018/04/25/viral-instagram-account-mocks-nyc-bros-midtown-uniform/

- https://www.vogue.com/article/year-of-the-bro-2016-new-york-city

- https://www.patagonia.com/the-activist-company.html

- https://www.buzzfeednews.com/article/katienotopoulos/patagonia-power-vest-policy-change

- https://twitter.com/binnaskim/status/1112731360244961283?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed&ref_url=https%3A%2F%2Fwww.buzzfeednews.com%2Farticle%2Fkatienotopoulos%2Fpatagonia-power-vest-policy-change

- https://www.cbsnews.com/news/midtown-uniform-patagonia-will-no-longer-sell-vests-with-finance-firms-logos-on-them/

- https://www.thecut.com/2019/04/patagonia-stops-selling-fleece-vests-to-finance-firms.html

- https://www.wsj.com/articles/patagonia-triggers-a-market-panic-over-new-rules-on-its-power-vests-11554736920

- https://www.esquire.com/style/mens-fashion/a22089261/midtown-uniform-vest-business-style/

- https://www.marketplace.org/2019/04/19/how-vest-became-wall-streets-bulletproof-armor/

- https://guestofaguest.com/new-york/instagram/finance-bros-beware-this-popular-instagram-account-is-mocking-your-midtown-uniform

- https://www.outsideonline.com/2394182/patagonia-fleece-vest-wall-street-controversy

- https://www.fastcompany.com/40525452/how-patagonia-grows-every-time-it-amplifies-its-social-mission

- https://www.marketwatch.com/story/why-are-patagonia-power-vests-with-goldman-sachs-and-jp-morgan-logos-selling-for-200-on-ebay-2019-04-23

- https://www.nytimes.com/2019/04/05/fashion/patagonia-fleece-fintech-banking.html

- https://www.huffpost.com/entry/patagonia-co-brand-vest-program_n_5ca4c058e4b07982402592ae

- https://www.huffpost.com/entry/patagonia-public-lands_n_59440a8ee4b01eab7a2d51e0

- https://qz.com/work/1586523/patagonia-thinks-finance-bros-arent-a-fit-for-its-fleece-vests/

- https://www.lamag.com/culturefiles/patagonia-vests/