If you’ve walked into a grocery store in the past six months, you might notice that your usual purchase seems pretty inexpensive.

According to the US Bureau of Labor Statistics, this current period is the longest period of falling food prices since the 1960s.

Experts believe that the price of food will continue to decline into early 2017 as well.

So, why are the prices on staples like milk and eggs so low?

Many believe that this is due to the lowering cost of oil and the health of the American economy.

Because the agricultural industry is so reliant on oil for operating machinery and transporting the food, the cost of global oil can directly affect the price of food in our local grocery stores.

However, some people might not feel a different in their weekly grocery runs, as it is estimated that prices have declined 2.2% from September 2015 to September 2016. While this seems like a relatively small amount, some commodities have changed in price dramatically.

Some major grocery companies, like Kroger, have even reduced their annual earnings predictions due to the deflation of food prices.

For example, milk prices are very low. In early 2016, milk producers threw out 43 million gallons of milk because there was a lack of demand for the product. Also, producers overestimated the trade potential of milk to deliver to China and Russia, as demand was high last year but has decreased dramatically.

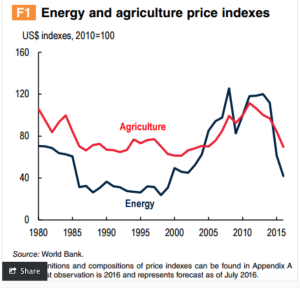

There is a direct correlation between oil prices and agricultural product prices. When the price of the cost of oil declines, so does the price of food products.

According to ED&F Man, an agricultural commodities firm, more than 20% of the cost of food is determined from the price of oil.

In 2014, the price of oil began to decline. This is due to the increased production of US oil, lessening the reliance on foreign oil.

By 2015, the United States had begun to produce 9.2 million barrels of oil per day, reaching a high in production levels since 1970.

Even though the US began to increase production, OPEC countries like Saudi Arabia refused to cut production to maintain market share, increasing the global supply of oil.

By producing more oil in the US and not engaging in as much trade with OPEC countries as previously done, the reliance on other countries has declined and the supply of oil has increased, making global oil prices much cheaper than in the past few years.

Although oil prices are expected to remain low into the beginning of next year, it is estimated that they will gradually rise, as Saudi Arabia and other OPEC begin to lower production, therefore lessening the supply of oil in our world.

https://www.ceicdata.com/en/blog/impact-low-oil-prices-food-and-other-commodities

https://www.thebalance.com/what-is-opec-its-members-and-history-3305872

http://www.marketwatch.com/story/why-you-can-thank-low-oil-prices-for-cheaper-food-2016-07-26

Kroger Blames Low Food Prices for Decrease in Sales

http://oilprice.com/Energy/Oil-Prices/How-Oil-Prices-Affect-The-Price-Of-Food.html