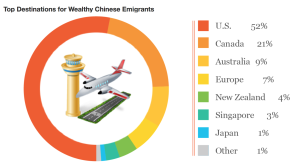

In the last five years there has been a measurable increase in the amount of wealthy Chinese that have immigrated to the United States. The instability of the Chinese currency and increase in government regulation has caused some of the wealthiest Chinese citizens to worry about the fate of their fortunes. Therefore, since money is not a problem for many of these individuals, a large number of Chinese invest in American real estate to ensure that their money will be protected under the more stable U.S. dollar. Chinese immigrants have been settling all over United States; however, California is the clear winner when it comes to who has the highest number of wealthy Chinese immigrants. As a Pasadena native, I have been able to see the increasing number of Chinese immigrants in surrounding cities, which is why I will be discussing the growing Asian population in Arcadia, CA.

China is known for being the country with the largest population, being a global leader in trade, production and manufacturing, and housing hundreds of billion-dollar companies that directly compete with, and often dominate, international markets. So why have 2/3 of China’s millionaires emigrated or have plans to move to the U.S. in the next 5 years (Weise, 2014)?

One reason is because of the increased amount of government regulation in China. In recent years, the Chinese government has started to crack down on corrupt Chinese business practices. Knowing this, many wealthy Chinese citizens who earned their fortunes illegally have been trying to hide their money in foreign assets and investments, so they do not get caught.

According to Christopher Hawthorne from the Los Angeles Times, questionable business practices in China are motivating people to move to the U.S. [which, includes] stashing their money overseas and in mansions and other assets. This creates a problem for the Chinese government because with so many citizens moving large amounts of cash overseas, at a rapid pace, the government is not able to keep track of where all of the money is going.

Another reason why many Chinese elites are investing their money in American assets is because China’s currency is relatively weak compared to the dollar. In the beginning of the year, the dollar was not as strong as it usually is, which gave China the opportunity to try and stabilize the yuan (Wei, 2016). However, Lingling Wei from the Wall Street Journal reported that in April of this 2016, the yuan actually depreciated 0.6% against the dollar, causing the Chinese government, along with wealthy Chinese citizens, to panic. These feelings of panic have been occurring for years, causing wealthy Chinese businesspersons to think about where they can move their money to make sure that it retains its value.

Their solution: investing their millions into real estate in the U.S. Karen Weise, a reporter from Bloomberg, found that Chinese nationals hold around $660 billion in personal wealth offshore, with $22 billion of that being spent on homes. For the past 10 years, real estate has catered to wealthy Chinese populations all over the country, with the most concentrated example being in Arcadia, CA.

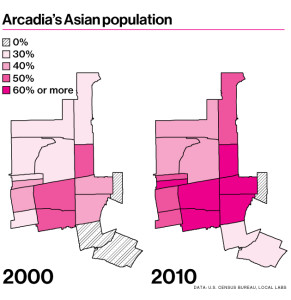

Arcadia is a city 20 miles northeast of Downtown Los Angeles that has become a haven for wealthy Chinese residents. Residents are attracted to Arcadia because of its first-class schooling, nice neighborhood, large homes, lenient building codes, and a pre-existing Asian population. As a result to an influx of Chinese millionaires, Arcadia has become a city categorized by new mansions that cost anywhere from $2 million to $7 million. You would think these ridiculous asking prices would discourage Chinese citizens from emigrating. However, it has done the complete opposite.

Just in 2013, one realtor, Peggy Fong Chen, sold over $71 million worth of homes in Arcadia (The Chinese Beverly Hills, 2014). For the most part, these large Arcadian mansions are in high demand because it gives millionaires a place to store their money. Because of China’s shifting real estate policies and the social instability caused by income and wealth inequality in China, rich people have come to feel unsafe, said reporter Jue Wang (2014). For this reason, these Chinese immigrants often pay for their million dollar homes in cash in order to shorten the money trail, with the hopes of hiding their money more effectively from the Chinese government.

When driving through the streets of Arcadia, you are able to large mansions with semi-circular driveways, lined with Range Rovers and Porches. However, when examining the houses closely many seem like they are unoccupied. A member of Arcadia’s homeowner’s association estimated that 20% of these new homes sit empty (Weise, 2014). The main reasoning behind this is that the Chinese are just using these homes to store cash. However, other reasons can be because the mansions are being used as vacation homes, or because many homes are purchased for millionaire’s children, parents, or mistresses, or because language barriers have actually caused Chinese residents to move back to Asia or elsewhere.

The fact that Chinese immigrants are leaving Arcadia because of a language barrier proves that, certain cities and amenities do not appeal to all Chinese elites. However, people are highly aware of the potential profits these immigrants could generate. Therefore, people have had to come up with specific ways to attract wealthy Chinese immigrants.

To attract this specific Chinese market, architects and developers have been building and crafting million-dollar mansions with similar styles, which has drastically changed Arcadia’s city landscape. Most of the homes architects create reflect the Chinese philosophy of feng shui and face the south, which are two important aspects of Chinese culture (Hawthorne, 2014). Chinese culture is deeply rooted in tradition, therefore, Chinese citizens are often more attracted to homes that represent and honor their culture. Arcadian architects also try to attract Chinese millionaires by creating mansions that include: wine cellars, theaters, double-height entry halls, elevators, many master bedrooms, and a separate wok kitchen (Hawthorne, 2014). Architects and developers make a conscious effort to build these Arcadia mansions to appeal to wealthy Chinese immigrants, in the hopes of earning a large profit.

Architects and developers are not the only ones trying to bring Chinese millionaires to America. The U.S. government recognizes the money that wealthy foreigners have, and wants them to spend it on American soil. Therefore, in 1990 the U.S. government created a program to attract foreign investments, in the hopes of sparking investment. It requires that if wealthy foreigners invest at least $500,000 in an American business, they are eligible to apply for a green card known as the EB-5 Visa. As of this year, Chinese nationals allocated 85% of the 10,000 visas offered. Therefore, through this plan, the U.S. was able to generate $4,250,000,000 in investments; in addition to the money foreigners spent once they came to the U.S.

The influx of wealthy Chinese immigrants has brought a lot of business, investment, and money to the United States. For example, in 2014, Arcadia brought in a record revenue of $7.9 million just from fees for building permits and developments, which is a 72% increase from the previous year (Weise, 2014). Wealthy Chinese immigrants also helped with the U.S. economy during the recession of 2009. During this time, China elites were slightly affected but still stayed wealthy. Therefore, as America was facing a time of dramatic economic downturn, Chinese millionaires continued to move to the U.S., bringing millions of dollars with them. This money was then used to hire workers, pay for goods and services, and to help keep businesses afloat.

As much as this influx of wealthy Chinese immigrants can be beneficial it can also create problems in society. One problem is with long-term residents who feel like their cities are being commercialized solely for the purpose of financial gain. For example, people that have grown up in Arcadia have watched their hometown turn into a “Chinese Beverly Hill” with mansions that are not even occupied. As of 2010, it was reported that than 44% of Arcadia’s residents were Chinese (Bertrand, 2015). This report just shows how the Chinese population is starting to take over cities, which could further upset city natives. Therefore, it is evident that the thousands of wealthy Chinese immigrants that have settled in the U.S. have disrupted cities by attracting commercial development and expunging any remnants of a city’s history.

Another potential problem that should be considered is that the growth that Arcadia is experiencing is not normal. The building of mansions has grown at a rate that does not seem to be sustainable. Therefore, we want to be conscious about how much money we are pouring into these projects, so that we can avoid any real estate bubbles in the future. If we continue building mansions we will either run out of resources or run out of buyers. Therefore, we must make a cautious effort to focus on only creating supply when there is demand.

As you can see, there are pros and cons surrounding the immigration of Chinese millionaires. Regardless, it is important to recognize the impact they have on the U.S. economy and society, in the hopes of finding a harmonious balance between the two. Immigration is a great way to encourage diversity and change; however, we do not want to promote too much diversity in a way that will drive out the people who inhabited an area first. Therefore, this balance is essential to creating a world where everyone can prosper

Works Cited:

Bertrand, Natasha. “This California Suburb Has Become a Haven for Wealthy Chinese

Residents.” Business Insider. Business Insider, Inc, 02 Feb. 2015. Web. 6 Oct. 2016.

Hawthorne, Christopher. “How Arcadia Is Remarking Itself As A Magnet for Chinese Money.”

Los Angeles Times. Los Angeles Times, 3 Dec. 2014. Web. 9 Oct. 2016.

VocativVideo. “The California Town Where Chinese Millionaires House Their Kids-and

Mistresses.” YouTube. YouTube, 05 Dec. 2014. Web. 2 Oct. 2016.

Wang, Jue. “Chinese Homebuyers Heat up LA’s Real Estate Market.” US-China Today. 4 Apr.

- Web. 10 Oct. 2016.

Wei, Lingling. “China Challenged to Keep Yuan Stable as Dollar Rises.” WSJ. Wsj.com, 16 May

- Web. 10 Oct. 2016.

Weise, Karen. “Why Are Chinese Millionaires Buying Mansions in an L.A. Suburb?”

Bloomberg.com. Bloomberg, 14 Oct. 2015. Web. 11 Oct. 2016.

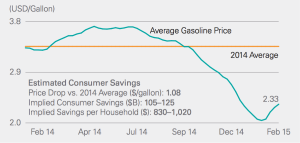

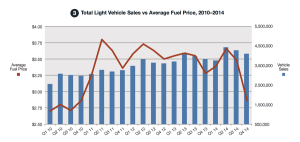

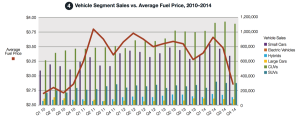

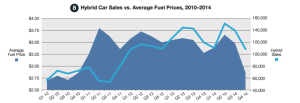

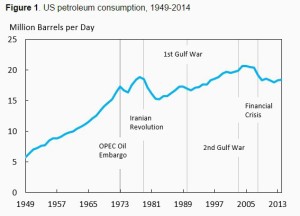

stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the

stments that they saved all the extra money they had for necessities. People decided to make the switch from driving their own cars to using public transit as a means to save money. As seen in Figure 1, the