In today’s climate, music is very easy to consume. We are able to access any type of music through the phones that we carry around with us at all times and are able to pick and choose each individual song we want to listen to.

Many music industry experts believe that this year, 2016, will be the year that our current music climate changes. They believe that this year will be the year that the market will correct and stabilize and will determine which firms will be able to survive the consolidation of the music consumption streaming market.

Although there are many various streaming companies currently in the market, they all offer slightly different benefits for the consumer and attract different sectors of the population.

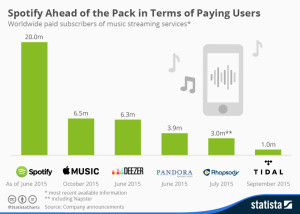

One of the obvious current leaders is Spotify. Founded in 2006, Spotify is the largest streaming service in the United States today, with over 40 million paid subscribers.

Competitor, Apple Music, which has only been released for about a year, has 17 million paid subscribers for comparison.

While the streaming services were once considered enemies of the record labels, today, the major record labels have all created partnerships with the services for exclusive releases and deals for their artists.

While the amount of physical record sales has declined dramatically since the creation of iTunes, for the past year, record labels and the music industry as a whole have showed dramatic growth.

According to recent numbers published by Billboard, the industry is looking to have the highest numbers of growth and sales since 2009. Currently, over 411 million units, measured in “total album consumption units” have been sold in the first three quarters of 2016. These numbers are set to meet 2013 album sales total (415.4 million) and surpass the 2009 sales number set at over 489.8 million albums.

The Recording Industry Association of America (RIAA) midyear report found that the overall industry, not just record sales, was up over 8.15% since 2015 as well.

Many attribute this growth and success to streaming services, as they have created alternative revenue sources for the artists and music industry. A few years ago, many downloaded their music illegally and no profits were shared with the artists. Today, streaming services pay out the artists who have songs on their platforms.

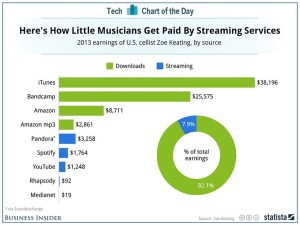

However, one of the biggest problems and criticisms of the music industry today is that the profits from streaming are nowhere near the physical streaming sales numbers. Although Spotify nor Apple Music does not release the actual payout numbers to artists, leaked reports reveal payments of $0.006 per stream by Apple Music. Additionally, according to Spotify, they pay out 70% of revenue to rights holders for each stream, which averages out to $0.006 and $0.0084 per stream.

These numbers per stream are tiny; it is estimated that the payout for each stream is between $0.004 and $0.008 depending on each service. For the larger artists who receive radio play and are on major labels, this can be a huge revenue stream, with annual payouts ranging from $100,000 to $500,000 per year. However, for the small artists who might only have a few thousand fans on  Spotify or Apple Music, this can be detrimental to their income and ability to survive, as they are receiving little money based on their amount of streams and exposure.

Spotify or Apple Music, this can be detrimental to their income and ability to survive, as they are receiving little money based on their amount of streams and exposure.

Many smaller artists have criticized streaming services for their lack of payout, and believe that the streaming services should change their compensation models. However, it is not just small, indie artists that believe this should change.

In June 2015, Taylor Swift posted a Tweet criticizing the Apple Music launch. She believed that the service should pay out artists during the three-month trial period, which at the time, they were not planning to do. In a letter entitled, “To Apple, Love Taylor,” she wrote, “I’m sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing, and completely unlike this historically progressive and generous company.”

Apple VP Eddy Cue responded, on Father’s Day nonetheless, that Apple would be compensating the artists during the trial period. With this single tweet, Swift was able to alter the business model of a huge media and tech conglomerate like Apple and was able to stand up for all of the smaller artists who do not have a voice as powerful and as large as Swift, creating a larger change in the streaming industry.

While there are many who are outspoken against streaming, for many artists, platforms like Spotify have helped to launch their careers and gain exposure that they could only previously dream of.

For example, Hozier, an unknown artist previously, was able to launch his career with the help of Spotify. In 2013, he was introduced into a Spotify artist discovery program and added to a playlist, and eventually was added to more, increasing his daily streams from an initial 15,000 streams worldwide per day to over 2 million a day (Billboard). With the support and push of Spotify, Hozier was introduced to over 11 million new fans over the course of two years.

Streaming services can provide success to the lesser-known artists, but many people are weary of the services, as there is an influx of firms in the market that has is constantly changing and evolving.

At today’s current point, the streaming services in the market are still in the development and start-up stage. Many, including Spotify, are not yet profitable and are having a difficult time remaining present in the current market. Even companies like Pandora, which has been in business since 2000 has reported losses of millions in the past few quarters.

So, if the companies aren’t making money but have millions and millions of customers, how will they ever make money?

The solution, many industry executives and trend predictors believe, is to move away from a “freemium model” and transition to one that is only paid. In the current economic climate, “freemium” means that companies like Spotify and Pandora offer a free, ad-supported version as well as a paid version for their customers. Many believe this will begin to vanish very soon, as Apple Music only offers a paid version and profits would largely increase if everyone was forced to pay for a streaming service if they wanted access to it.

With these new changes, some services like Pandora and Spotify will change, encouraging and pressuring consumers to pay for access to a streaming service. However, will new players in the market choose to create a free model to play with these tech giants?

SoundCloud, a popular site for remixes and unofficial music, is  being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

being seen as the next purchase for Spotify. Many believe this would be a smart move, as SoundCloud needs help finanacially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

While there has been no decision released for Spotify to purchase SoundCloud, the industry is constantly evolving. There are many players in the market currently and it will be important for the consumers to accurately express their wants and needs in the streaming market so that the companies best suited for the consumer and industry survive.

Three years ago, Spotify and streaming were words that were uncommon in our everyday vernacular.

Sources

http://www.billboard.com/articles/business/6656722/spotify-spotlight-support-major-lazer-hozier

http://fortune.com/2016/09/29/spotify-soundcloud-acquisition/

http://www.digitaltrends.com/music/apple-music-vs-spotify/

http://www.digitalmusicnews.com/2016/05/24/apple-music-pays-every-country-worldwide/

http://time.com/3940500/apple-music-taylor-swift-release/