“I miss the price of my hair service in Beijing,” said Yuyuhou Li, a graduate student from the University of Southern California studying Strategic Public Relations, after her recent pricy experience in Korean Town. The total cost of having her hair dyed was “about $280, including tips.” In other words, having her hair dyed once in Los Angeles equals to three hair-dyeing appointments at a similar salon in Beijing.

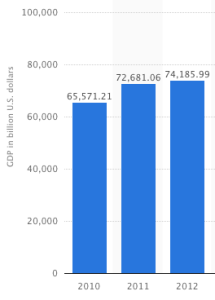

No wonder it seems that living in America is quite expensive, at least in most Chinese people’s eyes. China’s economy is growing at an impressive pace. In the past decade and half, China has risen from ranking second in the world in nominal GDP, to pulling itself from poverty at least in its southern coast. “Made-in-China” label is being used worldwide and the grand hosting of the Beijing Olympic Games shows China’s economic power. Even the great Uncle Sam started to fear the rising eastern star.

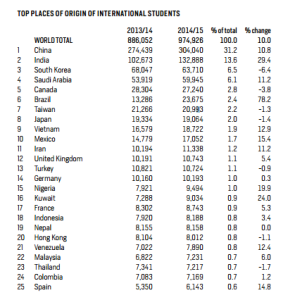

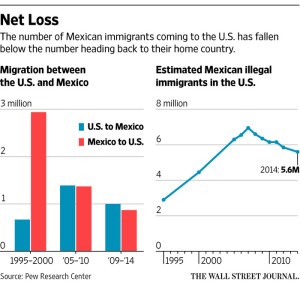

Meanwhile, in the hopes of receiving a better education and a better life in the future, Chinese students are rushing to pursue academic degrees in the United States. The most recent figures, from the 2014-15 academic year, show that 304,040 international students in the US hailed from China – far more than from any other country, a 10.8% higher than previous 2013-14 academic year.

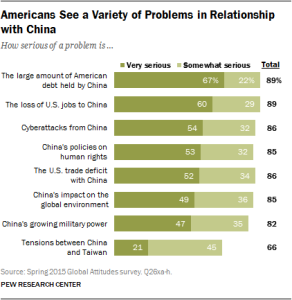

Faced with the army of ambitious up-and-coming Chinese professionals, are Americans worried? Yes, they are. The loss of jobs is one of the top three problems that are rated as a very serious problem by approximately 60 percent of the American public, according to a survey in 2015.

Undoubtedly, China is in need of fresh blood for a consistent and steady growth. On the one hand, China is experiencing its reorganization and optimization in industrial structure from labor-intensive industry to high-tech industry. Without those young talents, the process will be much slower. On the other hand, China’s rising wages calls for increasing productivity, which cannot be achieved without technological advancement. Therefore, enticing young talents to come back and contribute is significant.

However, a massive loss of talent for China is endangering the long-term development of the rising country. An estimated number of 2.64 million Chinese have moved overseas to study since 1978, but only 272,900 students returned to China over the forty years, according to the Ministry of Education. Moreover, a 2014 report by Oak Ridge Institute shows that 85 percent of the 4,121 Chinese students who received doctorates in science and engineering from American universities in 2006 were still in the U.S. five years later. The stay rate was 98 percent a decade earlier, which actually marks an improvement.

Such a brain drain seems to indicate that living in the States are more appealing than living in China, especially for a young and upcoming generation. How to make a decision when choosing a country to live and work? Living in an affordable place and working in a promising place are two important factors.

Living Cost & Purchasing Power Parity (PPP)

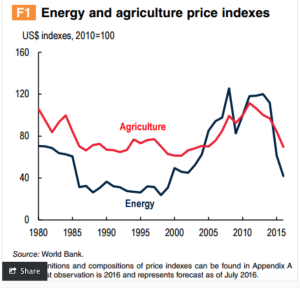

Pick up an apple from a Walmart in Shenzhen, one of the most developed coastal cities in China, and read the price tag carefully. Those lovely red apples are sold at ¥4.98 (=$0.75)per 500g. Now let’s move the scene to a Walmart in Los Angeles, where a large price tag reading $2.47/lb ($2.24 per 500g) sits on top of those made-in-America apples.

It is not uncommon to see an almost triple price difference between consumer products made in the most developed cities in China and those produced in America. A box of 12 cage-free eggs are sold at ¥12.9(=$1.93)in the Shenzhen Walmart, while eggs in the LA Walmart are more than double that price. Not only groceries, but also basic necessities such as toilet paper and laundry detergent suffer from the huge price gap. For example, Tide detergents of the same size in both China and the US do not break the spell of the three-times price difference.

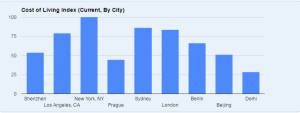

Both Shenzhen and Los Angeles are coastal cities with a high volume of port trade and technology-intensive industries. However, as the chart below is shown, people would need around ¥35,143.95 ($5,266.80) in Los Angeles to maintain the same standard of life that they can have with ¥21,000.00 ($3123.60) in Shenzhen (assuming you rent in both cities). As the chart below shows, Shenzhen’s living cost is higher than Beijing’s, but still falls way behind Los Angeles’.

(Source: Numbeo)

Purchasing Power Parity (PPP) plays a vital role in evaluating the living cost in the respective country. PPP is arguably more useful than nominal GDP when assessing a nation’s domestic market because PPP takes into account the relative cost of local goods, services and inflation rates of the country, rather than using international market exchange rates, which may distort the real differences in per capita income.

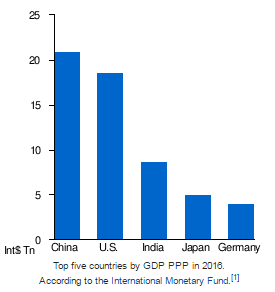

According to the International Monetary Fund, China’s economy surpassed the U.S. in purchasing power for the first time in 2014 and continued to rank in first place in 2015.

(Source:IMF)

With the same amount of money, you can enjoy more goods and services in China than in the United States. For example, Yuyuhou Li can buy the same detergent and enjoy similar hair dyeing services in both Shenzhen and Los Angeles; but in China, where labor and rent are lower, dyeing her hair and purchasing basic daily necessities cost much less than she pays in the U.S.

This round, China beats America by a huge margin.

Per Capita Personal Income

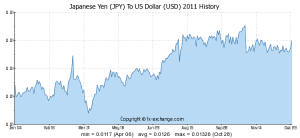

“If I am making money in dollars, living in the United States won’t be that expensive,” said Yutian, Li, a graduate student studying in USC with a major in computer science. There’s no doubt that computer science is one of the most well-paid jobs in the United States. But earning dollars and spending yuan is very tempting because the exchange rate between the yuan and dollar is more than 6:1.

“You earn a lot less money in China, but you can save more,” said Robert Little, who used to teach English at the University of International Business and Economics in Beijing. “America is much more expensive to live in because the cost of living is much higher,” he added.

The National Bureau of Statistics of China reveals that the average per capita personal income in Shenzhen was 73,492 yuan (=11,010.45USD) in 2014. The latest data shows that the average per capita income in Los Angeles County is 42,042 USD, almost 4 times higher than in Shenzhen.

If we divide the items sold at the Walmart in both cities by the average per capita personal income, interestingly, the percentages are so similar.

| Los Angeles | Shenzhen | |

| Apple | 0.006% | 0.007% |

| Egg | 0.01% | 0.018% |

| Toilet paper | 0.03% | 0.03% |

| Tide detergent | 0.02% | 0.03% |

| Hair dyeing | 0.67% | 0.82% |

But what causes Los Angeles’ cost of living to run ahead of Shenzhen’s? Although the overheated property market in China has driven the prices up and up, rent prices in Shenzhen are 50.93% lower than in Los Angeles. “My living cost per month is about $3,000,” said Jake Davidson, a senior from Los Angeles studying accounting at USC. According to Jake, he has to pay $1,600, almost half of his living cost, for his rent. In that case, people living in major cities in the United States such as Los Angeles and New York actually suffer more renting pressure.

However, Shenzhen’s hair dyeing services, when compared against average incomes, run higher than Los Angeles’. The comparatively high percentage meets a current trend of more expensive service industry in China’s big cities.

Opportunities Matter

“I prefer to work in the United States,” said Caixin Yang, a sophomore who comes from Chongqing City and now studies economics in America. For her, the United States has more advanced and mature financial systems and markets. “China is under transformation and everything is in a mess,” she said.

The same answer goes with Yuyuhou Li, who thinks highly of a well-established public relations career path in America. “Although the living cost is really high here, especially in LA, working in the United States represents a more stable life,” she added.

In spite of skyrocketing living cost, especially the rent in the United States, Chinese students are eager to earn a degree in the United States. What entices Chinese students who receive education in the United States to choose to make a life in a foreign country even though China has become the second largest economy? Free work culture, decent income and better welfare treatment could be the answer.

“High living cost is not something I value if I choose to stay in the United States or in China,” said Yiling Jiang, 23, studying communication management at USC. He values personal development, opportunities, lifestyle, family, and friends when judging which country is more appealing. Not only Yiling, but all of the five interviewees studying in USC with footprints in both China and America agreed that the U.S. living cost is high but not a huge problem. In fact, the highly rigid bureaucratic working ethics, complicated relationship (guanxi) and unfair career treatment are three main factors that prevent young professionals coming back to China.

In addition, as living environment worsens, China’s most well-educated have begun fleeing the country. Caixin Yang also mentioned her concern in her interview about the long-lasting severe pollution in some Chinese metropolitan cities such as Beijing, the Capital of China.

At the same time, there is still a number of Chinese students who pursue degrees in America prefer to go back to China. Yutian admitted that current American life is more attractive in terms of advanced education and career training, but in the future, living in China will be more appealing to him, as the country’s pace of change is accelerating.

“China has a lot more potential in development and I am willing to be a contributor in this process,” said Yutian Li.