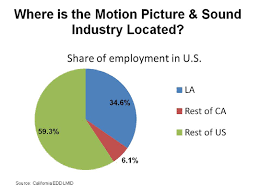

Runaway production is when film and television productions are filmed and produced outside of the U.S. or outside of Los Angeles. Productions are being lured in all directions to leave Hollywood due to film tax incentive programs. It is estimated the California lost over $9.8 billion dollars due to runaway production before crafting their own film tax incentive programs. The original California Film & Television Tax Credit Program that was passed in 2009 to be effective from 2011 to 2014 was a $100 million-per-year incentive plan. The program included a 20% tax credit for feature films and new television series and independent film. This plan had a cap of $50 million for the films. The eligible films to receive the tax credits were chosen through a lottery system. This program is administered by State Film Commission called the California Film Commission (CFC). Their responsibility is to attract and retain motion picture production in California.

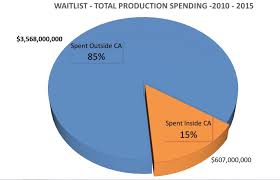

After the first program was made, filming in the LA region bounced back. According to the CFC, 229 projects were completed during the first film tax credit program and these projects received $447 million worth of tax credits. These projects went towards the total production spending in California that went up to $3.7 billion during that time period. The total, including the incomplete projects that received tax credits during the program, was that the $800 million tax credits under the program could be partly responsible for the $6.1 billion production spending in California between 2011 and 2014. But, it is estimated that about a third of the projects that received tax credits from the first program would have been made in California either way. This is what makes this program unclear of whether it was actually worth the money.

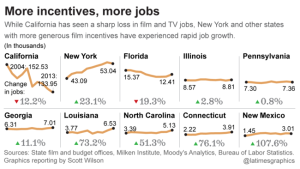

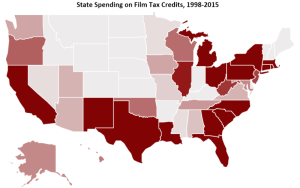

This whole concept of California having a film tax incentive program stemmed from having to keep up with other states that created these programs first. Starting in the early 2000s states such as New Mexico, Georgia, New York, Louisiana and North Carolina started making film tax incentives. These states created these programs in hopes to start a new industry in their state to create new jobs and in turn boost their state’s economy.

Georgia’s first tax incentive program was introduced in 2002. The state’s second and most progressive tax incentive, the Georgia Entertainment Industry Investment Act began in May 2005 and was later updated in May 2008. Their program has a 30% tax credit for films. The amount of tax credits Georgia has included in their programs has grown from $10.3 in their original Act to $504 million currently.

Another state that had a program early on was Louisiana. They enacted the Louisiana Motion Picture Tax Incentive Act in July of 2002. Their program included the the Investor Tax Credit of 30% for films with no cap and the Labor Tax Credit of 5% credit for payroll expenditures on Louisiana residents. From these aspects, this stimulated filming in the state and employment of their own residents.

As these states continued to tweak their programs, California wanted to tweak their original program as well. Hollywood wanted to pass a new incentive plan that included more money for films but it was difficult to show tax payers that the initial plan was worth the money in the first place and now it is even more difficult because the amount they wanted to include increased a lot. In order to evaluate the economic effects of a film tax credit program it is important to separate the new spending resulting from it and the spending that would have happened regardless of the credit program existed. In efforts to separate these and give tax credits to the projects that they actually need to target, their new incentive plan was tailored further. This plan further specified which project would get the tax credits in order for it to be more reasonable and effective in reaching its goal. The goal of the new program, the California Film & Television Tax Credit Program 2.0, is to keep the productions that are currently filming in California there and for new productions to choose to film in California. Another hope is for these financial incentives to make California competitive enough amongst other states and countries to show executives the benefits of filming in the L.A. region because of the access to experienced crews and the element of being close to their L.A. homes since the business is run out of Hollywood.

The program is a $330 million-per-year incentive plan which started in 2015 after being passed ultimately in August 2014.

Some new features of the plan varying from the original:

-The length of the program is now a longer period of 5 years

-It expanded eligibility to films with larger budgets (over $75 million), TV pilots and 1 hour TV series

-It has a new ranking system for selection based on jobs and other criteria instead of the original lottery which could select any project randomly (this is a focus on job creation)

-Projects being filmed 30 miles outside of the Hollywood area would get a 5% boost to keep them in-state (this is targeted towards visual effects and sound studios in the Bay Area)

-It caps the amount of a movie’s budget that can earn tax credits at $100 million

From this program, the hope is also for these financial incentives to make California competitive enough amongst other states and countries to draw executives to see the benefits in filming in the L.A. region because of the access to experienced crews and the element of being close to their L.A. homes since the business is run out of Hollywood.

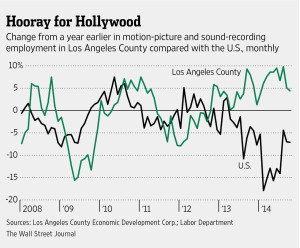

According to FilmLA, since the 2.0 program was enacted overall filming in L.A. went up by 11.4% in the first quarter of 2016 in comparison to the first quarter of 2015 when the new program began. They reported that L.A. had a total of 9,703 shooting days since it was enacted and the total shooting days in all of 2015 was 8,707 days. The peak was in 1996 with 14,000 shooting days (this can be a goal to hopefully get back to). The local unions in Los Angeles have reported that they have reached capacity employment as well according to FilmLA.

But, California’s program has very tough competition currently. Georgia has recently developed its own $2 billion film industry, which has led to the start of being coined as “Y’allywood”, or the Hollywood of the South. Georgia is ranked third in the U.S. for film production now and it is the fifth in the world. This can largely be due to the Georgia Entertainment Industry Investment Act which was most recently modified in 2008. From this Act, Georgia gives a 20% tax credit to any film that spends $500,000 or more there during production and 10% tax credit supply for including the state logo in the film’s credits. So Georgia gives a total of 30% in tax credits. This is just the baseline for those films starting at $500,000, a big difference in comparison to California’s plan. Other factors working for Georgia right now include its international airport, the biodiversity in their land for shooting and many new sound stages that have been built.

But, Georgia’s goal varies from California’s. Georgia hopes to make film a new industry in their state. This plan’s ultimate goal from the tax credits is to eventually attract enough companies and productions that will stay in Georgia long-term, instead of being in California or other competing states.

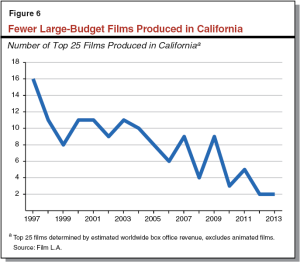

(California Film & Television Tax Credit Program 2.0. – made to counter-act the outcomes shown in the graphic above)

And it seems to be working so far. Ledger Enquirer newspaper states that, ” The state’s estimated $53 million tax credit for 2013 added over $6 billion to Georgia’s economic activity, with a growth rate of 55 percent. That’s quite a return on investment”. But the growth in Georgia could be seen as too much, because the film industry is growing so fast that there is a shortage of crew members for the productions. Local universities are adjusting their curriculum to prepare more workers for production jobs in the state, according to AJC Newspaper.

It is hard for California’s program to compete with theirs because they do not cap, more money is allocated to the program and it spans a longer period of time.

A drawback of the results so far from California’s 2.0 program is that even though there are more films being shot in California again, it is not the large ones. This is because of the cap. So these films still seek out the states or countries that do not cap their tax credit programs.

The tax credits included in the program are able to create below-the-line jobs (which are jobs such as lighting technicians, drivers, location managers etc.). The program doesn’t consider the expenditures on the talent which is a big part of a film’s budget (lead actors, directors and producers). The CEO of Independent Studio Services, Greg Bilson, stresses the importance of the consideration of “above-the-line” costs in tax incentive programs, “On an average $100 million film, 80 percent of that is above-the-line. That number will change depending on who’s in it, but even if it’s just 50 percent of the film, if the incentive doesn’t apply to half of a $100 million film, the California incentive compared to other incentives out-of-state and out-of-country is effectively half or less”. This is a contributing factor to why California’s program isn’t keeping large films in the state, the program doesn’t account for a huge portion of the budgets for those films. The high prices for permits, processing and fire department reviews in order to film on location in California are also inconvenient for production and can lead production to go elsewhere.

According to the film industry trade publications such as The Hollywood Reporter, Deadline Hollywood and The Wrap, many states are decreasing the amount of tax credits in their programs. In my opinion, as other states drawback their own incentive programs, California should too. This is because California’s purpose of creating their program wasn’t to create a new industry in the state, like these states’ intention. Its purpose was to compete with the other states’ incentive offers, so if they are bringing down the level of the playing field, California should bring down their incentive program to that level.

Also, I believe that one of the ways to make California’s plan the most effective is if they gave producers something they can rely on for the future. With the plan only spanning over five years, the tax credit situation in California isn’t very dependable for a producer. Now, large productions can take a very long time to make and films can be in development for years while they are in the decision making process of where to film. If the program was over a longer term more companies would also want to invest in the film industry in California specifically and not elsewhere. Because digital media and streaming services have also started to take-off, possibly credits to keep them in California being added on-to the program could be a good idea for preventative measures so they do not leave in the future.

After the results and assessment of the 2.0 I do not think that the same program will be re-approved. I think that a new, scaled-down program involving less money will be made or the 2.0 will gain additions such as tax credits for digital and a longer time period. But, it is difficult to tell now what moves will be made with the effectiveness of the 2.0 being uncertain.

Works Cited

“Are Film Tax Credits Cost Effective?” The Los Angeles Times. N.p., n.d. Web.

By Julia Wick in Arts & Entertainment on Apr 19, 2016 10:37 Am. “Film Production In L.A. On The Rebound Thanks To Tax Credit.” LAist. N.p., n.d. Web. 11 Oct. 2016.

“California Analysts Office Report.” N.p., n.d. Web.

“California and Runaway Production.” Variety. N.p., n.d. Web.

“Costs and Benefits of Film Taxes.” Business Journals. N.p., n.d. Web. 11 Oct. 2016.

“Georgia’s New Hollywood.” Movie Pilot. N.p., n.d. Web.

“Irresistible Film Tax Credits.” Oz Magazine. N.p., n.d. Web.

Johnson, Ted. “Producers Say High Fees at L.A. County Parks Are Hurting Location Filming.” Variety. N.p., 22 Oct. 2014. Web. 11 Oct. 2016.

Lodderhose, Diana. “Runaways Welcome: Countries Offer Incentives to Lure Productions Fleeing Hollywood.” Variety. N.p., 29 Aug. 2013. Web. 11 Oct. 2016.

Michael Thom. “Fade to Black? Exploring Policy Enactment and Termination Through the Rise and Fall of State Tax Incentives for the Motion Picture Industry.” N.p., n.d. Web.

Michael Thom. “Lights, Camera, but No Action? Tax and Economic Development Lessons From State Motion Picture Incentive Programs.” Sage Journals. N.p., n.d. Web.

Paul Caron. “Starstruck States Squander $10 Billion In Film Tax Incentives Producing Minimal Economic Returns.” Tax Prof. N.p., n.d. Web.

“Runaway Production.” Wikipedia. Wikimedia Foundation, n.d. Web. 11 Oct. 2016.

Strauss, Bob. “California Film Incentives Take Spotlight, but Blockbusters Need Greenlight.” California Film IncentivesTake Spotlight, but Blockbusters Need Greenlight. N.p., 06 Aug. 2016. Web. 11 Oct. 2016.

Center, California, and July 2010. Film Flight: Lost Production and Its Economic Impact on California (n.d.): n. pag. Web.

Hall, Gina. “Why Is California Tripling Film and TV Tax Credits While Other States Slash Them?” TheWrap. N.p., 28 Aug. 2014. Web. 04 Nov. 2016.

Office, Legislative Analyst’s. California’s First Film Tax Credit Program (n.d.): n. pag. Web.

Leave a Reply

You must be logged in to post a comment.