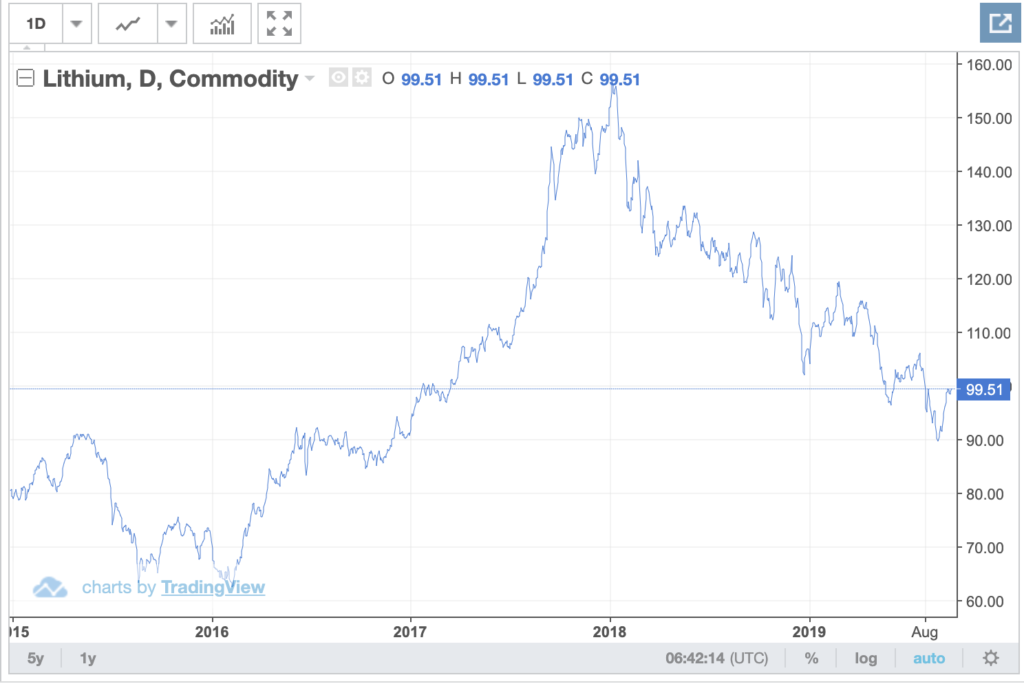

Traditionally, recessions result in higher unemployment rates, lower incomes, and downturns in business opportunities. The exception to these trends is unexpected—movie theatre ticket sales. The entertainment industry accounts for a significant portion of consumer spending in the United States. According to Statista.com, the United States film business will generate $35.3 billion in revenue in 2019. In times of financial crisis, box-office sales increase and the entertainment industry reaps the benefits of the United States’ economic turmoil. Historically, the entertainment industry has performed better than other industries during financial downturns. A 2019 Variety Magazine article notes that box-office sales increased during five of the last eight recessions and set domestic records in 2001 and 2009, both of which were years of significant recession in the United States.

Photo Courtesy of The Hollywood Reporter

The surge in box-office ticket sales during economic downturns seems counterintuitive, but the logic behind the sales boosts is sound. Economists have surmised that this trend likely occurs because going to the theatre is one of the cheapest forms of entertainment available in times of economic uncertainty. When Americans want to escape from the dreary reality of financial instability, the movies provide a cost-effective solution. The entertainment industry tends to lean into this concept when producing movies during times of economic hardship, opting for feel-good content rather than somber, depressing films.

In the most recent United States recession that spanned from December 2007 to June 2009, Hollywood thrived, with both movie ticket sales and attendance increasing. According to The New York Times, box office sales increased 17.5 percent, to $1.7 billion in sales, and attendance jumped up 16 percent within the first few months of 2009. Meanwhile, the general economy struggled to stabilize and most other business’s profits steadily declined.

Photo Courtesy of The Hollywood Reporter

The economy is currently showing signs of a potential upcoming recession. As the country considers the possibility of an economic downturn, many industry insiders are nervous about box-office performance moving forward. According to a 2019 article posted by The Hollywood Reporter, the average price of a movie ticket has increased from $8.97 in 2017 to $9.11 in 2018. In addition to this median cost, many theaters charge extra for premium seating, 3D and 4XD showings, and additional amenities. At LA Live Regal Cinema, the theatre closest to USC campus, adult tickets cost $17.50. For context, the cost of a standard subscription to Netflix for a month is only $12.99, according to Business Insider.

As movies begin to present a greater price barrier, the idea of going to theatres as a cost-effective entertainment avenue is becoming more far-fetched. Entertainment conglomerates such as Comcast and Disney continue to accrue debt through company and content acquisitions, which could result in financial strain if this economic indicator fails to hold up during a future recession. According to Variety Magazine, industry leaders such as Adam Aron, CEO of AMC, and Jeff Goldstein, head of domestic distribution at Warner Bros., maintain that regardless of shifting factors, the movie industry will continue to prosper in recessions and prove to be a steadfast economic indicator in years to come.

Sources

Cieply, Michael, and Brooks Barnes. “In Downturn, Americans Flock to the Movies.” The New York Times, The New York Times, 28 Feb. 2009, https://www.nytimes.com/2009/03/01/movies/01films.html.

Fuller, Steve. “Topic: Movie Industry.” Www.statista.com, https://www.statista.com/topics/964/film/.

Griffith, Lou. “Data.” NATO, 24 July 2018, https://www.natoonline.org/data/.

Johnson, Dave. “’How Much Does Netflix Cost?’: All of Netflix’s Subscription Plans, Explained.” Business Insider, Business Insider, 30 May 2019, https://www.businessinsider.com/how-much-is-netflix.

Jones, Candice Lee. “10 Quirky Economic Indicators.” Www.kiplinger.com, Kiplingers Personal Finance, 13 June 2009, https://www.kiplinger.com/ article/business/T019-C000-S001-10-quirky-economic-indicators.html.

Lang, Brent, and Rebecca Rubin. “Recession Fears Grip Hollywood: Can the Movie Biz Survive a Downturn?” Variety, 2 Jan. 2019, https://variety.com/ 2019/biz/news/recession-hollywood-movie-business-trump-1203096883/.

L.A. Live, “Movies.” L.A. LIVE, https://www.lalive.com/movies.

McClintock, Pamela. “Average Price of a Movie Ticket Rises to $9.11 in 2018.” The Hollywood Reporter, 23 Jan. 2019, https://www.hollywoodreporter.com/news/average-price-a-movie-ticket-soars-911-2018-1178410.