By Sarah Montgomery

Last month, almost 200 major corporations signed a pledge to prioritize their workers, customers, suppliers, and communities over shareholders. Jeff Bezos is already defecting.

Bezos is the owner of Amazon, which owns several other companies, notably Whole Foods. This is important because recently Whole Foods announced that, coming Jan. 1, employees working 20-30 hours per week will lose the company health plan. This is contradictory to the pledge.

Whole Foods told Business Insider that the decision was made in order to improve efficiency within the company. They also claim that they are providing their affected workforce with resources to find alternative healthcare or to explore positions that are healthcare-eligible.

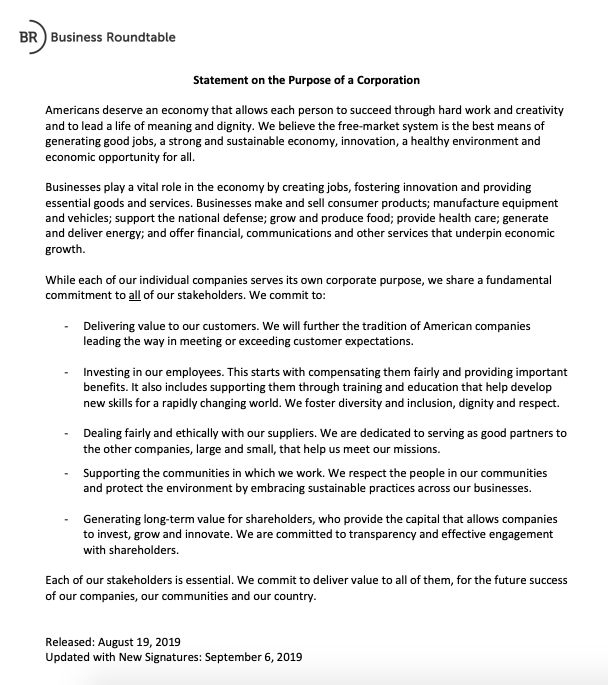

The Business Roundtable, a large corporate lobbying organization, wanted this pledge to serve as a new approach to the “purpose of the corporation.” The goal was to get rid of the prevailing idea that the maximization of shareholder value is what businesses should strive for. This concept, propagated by conservative economist Milton Friedman, has been the commonplace corporate ideology since the 1970’s. Though this pledge is a welcome change, it is important to know that there is no mechanism in place for supervision or enforcement—nothing is committing these CEOs to the pledge other than their word.

Many economists doubted that companies would hold true to the pledge in the first place. Nell Minow pointed to the lack of substance in the pledge and its inherent contradiction to capitalism, amongst other reasons, as to why she does not trust these CEOs. Some pointed out that corporations have a responsibility to pay taxes, which many have avoided— also under the guise of helping their employees, but in reality done in the interest of lining their own pockets. Jack Kelly, Senior Contributor at Forbes, writes “signing the agreement to be better was the perfect public relations stunt to earn kudos for their supposed new ‘woke’ view.”

Stanley Litow, an expert on corporate social responsibility, argues that corporations do not need to neglect the needs of shareholders in order to produce good behavior. After all, shareholders do not want to be part of an abusive company that will inevitably be burned by regulators.

This shareholder-first mentality has been so pervasive in the corporate culture for so long that it seems like an essential component. “No one is quite sure how to rebalance corporate priorities so that greater shareholder value is seen as a byproduct of socially responsible behavior rather than the primary goal,” LA Times journalist Michael Hiltzik writes.

Other high-profile CEOs include Tim Cook of Apple and Ginni Rometty of IBM, amongst dozens of other influential business leaders. Only time will tell if they follow Bezos’s path.