(Photo credit to Kweichow Moutai’s official website)

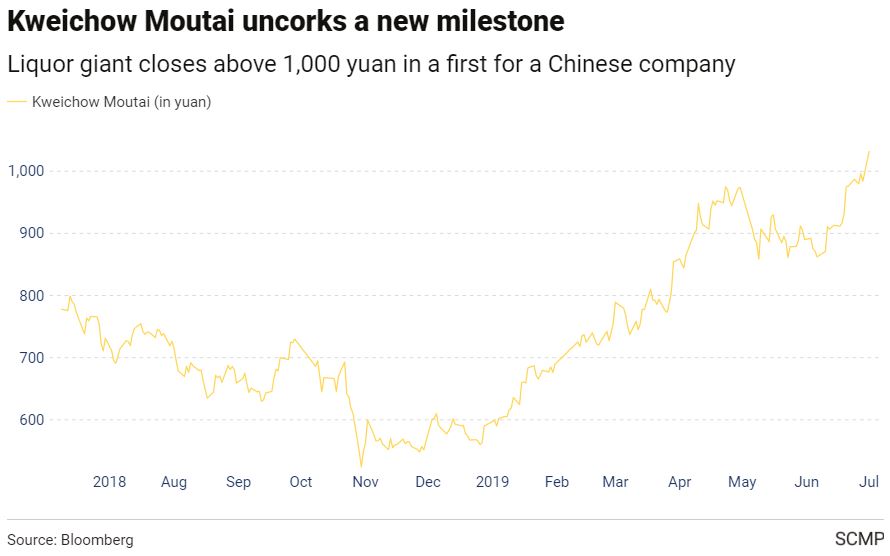

After exceeding 1,000 yuan ($145) per share, Kweichow Moutai, the Chinese liquor giant’s share became the most expensive stock in China’s A-share market on June 27, 2019, aided by ever-growing demand.

While investors and analysts were not surprised by the strong performance of Moutai. Analysts from both Bloomberg and China International Capital Corp. Ltd. were optimistic about the continuous growth of Moutai’s share and raised their expected price of the stock.

A last-year forecast from Bloomberg predicted that Moutai’s share would hit the 1,000-yuan mark in 2019. Moreover, Tingzhi Xing, an analyst of China International Capital Corp. Ltd., also forecasted that 1,250 yuan would be the target price within 12 months.

Kweichow Moutai is a distillery from Moutai town in southwestern China’s Guizhou province. Moutai is famous for its iconic premium baijiu, a sorghum-based liquor, and it is usually used to serve at business meetings and official banquets. In 1972, Moutai was used to entertain President Richard Nixon on his historic visit to China.

Just as the western world’s obsession with premium wines, Chinese consumers are fond of baijiu. Thus, the consumption of high-quality baijiu in China is vast and still growing. As a representative of high-end baijiu, Moutai creates considerable profits.

According to the data cited by China Daily, an official Chinese English-language newspaper, the total revenue was 75 billion yuan, and its net profit was 34 billion yuan in 2018. Both its total revenue and net profit increased 23% over the previous year. Furthermore, the sales of Moutai rose 14% over 2018 to 100 billion yuan in total, and its net profit achieved by 45 billion yuan.

Another report released by China’s Guizhou province shows that the overall GDP of Guizhou province is 1.48 trillion yuan, and Moutai’s value now attained 1.24 trillion yuan in 2018. It means that the value of Moutai dominates nearly 85% of provincial GDP.

Besides being the most valuable stock in China’s A-share market, Kweichow Moutai also surpassed Diageo in 2017 and became the most valuable liquor company in the world, according to Refinitiv, a financial technology and data company based in London. Diageo is a British multinational drinks company and the owner of Johnnie Walker.

Due to the generous profits and ever-increasing demands of Moutai, analysts foresaw that the price of Moutai’s share would keep going in the future. “I can’t see any growth cap on the company in the long run, unless the Chinese don’t drink one day,” fund manager Dai Ming told WARC, the global specialist information company, in a marketing report. “The liquor culture is deep-rooted in China, and when you do business here, you drink. It’s a product with demand outstripping supply, so growth is quite visible.”