On Nov. 4th, 2019, Apple announced a $2.5 billion plan aimed at ameliorating the Bay Area’s housing availability and affordability crisis. Amidst the economic and cultural renaissance that has occurred following the tech boom in the San Francisco Bay Area, a myriad of devastating issues have spiraled out of control. Some of these issues, which the big names in tech like Google and Apple have publicly pledged to fight, have become a popular topic amongst both the media and the general public.

While many professionals and Bay Area residents are in a constant debate regarding whether tech companies should be vilified as the sole root cause of the Bay Area’s housing crisis, one thing is resolute: their presence has exacerbated the crisis to a devastating degree. Their presence has bled into and negatively impacted other regions of the Bay Area’s economy beyond simply the housing market, such as the small retail sector. Moreover, the debate regarding the negative influence of tech companies in regards to the housing crisis has highlighted that it’s up to far more than large tech donations to authentically and successfully absolve the region of this crisis.

The housing crisis

Before examining the outshoots of the housing crisis and the solutions that institutions and organizations outside of the tech industry can help instill, it’s imperative to understand the current landscape of the housing crisis itself.

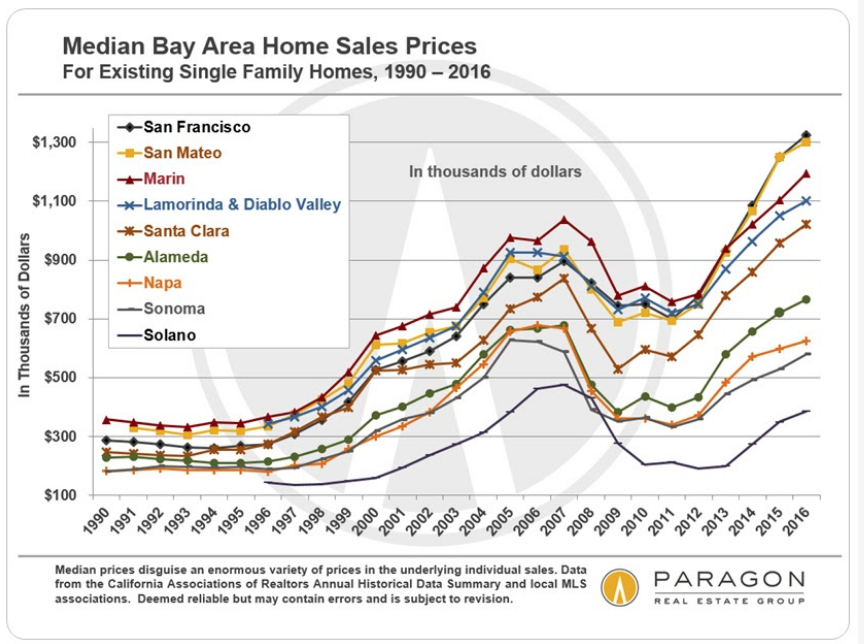

According to cnbc, the Bay Area’s population increased 8.4% between 2010 and 2018, however the number of housing units rose by less than 5%. Even more shocking, between the same time frame, rents jumped 21% when adjusted for inflation, according to cnbc. Marketplace notes that currently, a homeless population of 7,000 exists in San Francisco while in San Jose, the average home value is over $1 million. As a result of the influx of high-paid tech workers into San Francisco and the surrounding regions like Silicon Valley and the East Bay, rents have increased, pushing out middle and low-income workers. In fact, five Bay Area counties have been named five out of the six most expensive places to live in the country. In response, Oakland will produce 50% more housing units this year and San Francisco plans to complete 4,700 units, according the City Journal. While the private development in the East Bay is up 15 times from 2018, MarketPlace notes that surrounding cities like San Jose have issued only 134 permits for affordable housing.

While the supply of affordable housing continuously fails to meet the demand, the issue of homeless in the region continues to worsen. The Bay Area now houses the third largest population of people experiencing homelessness in the U.S, ranking just behind New York and Los Angeles, according to cnbc.

Impact on local retail

The demand for expensive housing fueled by the influx of tech employees earning high wages has done far more than perpetuate the issue of homelessness and the dire need for affordable housing. The soaring rent costs have left small businesses extremely vulnerable to the presence of large tech companies.

Consequently, as the tech industry is booming, the small retail industry is struggling. The Bay Area, known for its cultural and social diversity, is home to a plethora of mom-and-pop shops. The neighborhoods that together amalgamate to make the Bay Area are each individually inspired by the unique populations, architecture and geographical locations that define their purpose and culture. However, with property and housing rents increasing at such fast rates, the smaller, local businesses in the Bay Area are finding themselves unfit to prosper and persist.

According to a study done by the state Economic Development Department, the number of retail businesses in the Bay Area has dropped significantly in the last 10 years. Moreover, the study reports that the average rent per square foot for retail properties has risen approximately 9% between 2015 and 2017. Specifically, 9% in Oakland and 5% in San Francisco. For the small shops and businesses that function on thin profit margins, these large incremental rent hikes are quite threatening.

The primary manner in which these rent hikes impact these small, local businesses is that they make employees unable to dwell in close proximity to their jobs. As a result, employees are forced to commute, in some cases, multiple hours to get to their low-wage jobs. These long commutes cause them to reevaluate and assess whether or not it’s economically sustainable for them to live so far for a job that overtime, will pay less and less. In most cases, employees find that it’s not. Dennis King, executive director of Small Business Development Center in Silicon Valley, reports that this no longer cost-effective equation amounts to an unreliable workforce that is diminishing, according to Mercury News.

Microbusinesses, businesses with 9 or fewer employees, have declined 8.1% in San Jose between 2007 and 2017, according to data from the Economic Development Department. The same data indicates that the drop was even more sharp in the San Jose metro area, where microbusinesses declined 12.7%. In both the San Francisco and Oakland metro areas, the number decreased by 6.1%. Statewide, the total decrease in microbusinesses marks at 4.2%.

Monisha Murray, owner of a small vintage clothing store in San Jose, was forced to move her store’s location to a new part of the city as a result of a sharp rise in rent. Originally, Murray paid around $9,000 a month for 5,500 square feet that housed her store Black and Brown, which sold clothing and accessories. However, in an interview with Mercury News, Murray revealed that her landlord raised the rent to almost $20,000 a month. While she was able to talk it down to $13,000, the cost was still far too pricey for her business that operated with only nine employees.

As a result, Murray moved her business to a 4,500 square foot space on West San Carlos Ave, where she now pays $7,000 a month. While Murray was able to avoid these rent hikes, when her 10 month lease ends, she faces the possibility of yet another rent hike. Murray stated that, should this be the case, she may be forced to close her store’s doors and instead, move it online.

A similar story is seen with Talbot Cyclery, a famous bicycle shop in San Mateo. Although quite famous and popular, the bicycle store permanently closed this past June. Former Owner Gary Moore originally wanted to sell the building, however he had no one to pass the building down to. Moore told Mercury News that had circumstances been easier for small businesses, he would’ve retired already, seeing as he was 66 prior to the stores termination.

Before he closed his business’ doors, Moore reported that over preceding years, he lost many employees in their 20’s and 30’s because they simply couldn’t afford to live in the San Francisco Peninsula. He also noted that people would come into his shop, find a bike, then look it up on their smartphones and buy it for a cheaper price. This trend, while indicative of shifts impacting the retail industry on a national level, is another force that is disruptive to the survival of mom-and-pop shops in the Bay Area.

So why care? The decline of these mom and pop shops is both salient and pressing, considering microbusinesses account for 62.3% of all retail businesses and 12.4% of retail employees, according to the Economic Development Department. This decline is spreading into the larger retail industry of the Bay Area as well. Between the years of 2007 and 2017, the recorded number of retail businesses in the San Jose metro area declined by 4.4%.

Similar to the issue of the housing crisis as a whole, the mere geographical presence of tech companies can not be deemed the sole scapegoat for the decline in Bay Area’s microbusinesses. That being said, the technological inventions of these tech companies are surely impacting the success of Bay Area microbusinesses, in addition to those nationwide. Apps like Instacart, Amazon Prime, Caviar, UberEats and Tinder are, in general, creating less foot traffic in cities all around the U.S. and the globe. With less people on the streets comes less window shopping and cross-population for local shops, like Murray’s vintage clothing store and Moore’s bike shop. While these apps exist nationwide and are not only impacting the Bay Area, perhaps the wealthier, tech-oriented demographic that the Bay Area now houses means that the employment and popularity of these apps is drastically higher in the San Francisco Bay Area.

How California can help

Following the announcement of Apple’s multi-billion dollar pledge, professionals and government officials alike voiced their doubts regarding how sustainable and impactful these hefty donations would truly be in fighting the Bay Area’s housing crisis.

Many believe that these large donations are not independently capable of resolving the housing crisis. Current legislation and city regulations in the Bay Area are hindering the capability of both large donations and housing plans from actually spouting change. As a result, both residential voters and local governments play an integral role in ensuring that the Bay Area makes the appropriate strides that adequately resolve the housing crisis.

In recent years, California has made some rather paramount strides in fighting the housing crisis. For example, in 2018, Bay Area voters helped pass both statewide propositions 1 and 2, which helped make billions in funding available to the region for more housing. Similarly, electing Gavin Newsom to Governor of California has pushed the Bay Area in the right direction. Prior to winning the election, Newsom pledged to add $3.5 million in housing to California by 2025. In fact, Apples recent pledge was created in conjunction with Gavin Newsom.

Additionally, in Berkeley, CA, voters helped pass Measure O, a $135 million bond measure allocated for funding affordable housing units for both low-income and working households made up of teachers, seniors and those with disabilities. Continuing the progress that these bills and legislations have brought to the table will only strengthen the fight against the housing crisis.

This past September, California State Legislature successfully passed AB 1487, which, in the near future, will hopefully transform the manner in which local Bay Area governments finance affordable housing projects, according to The Daily Californian. AB 1487 certifies the creation of the Bay Area Housing Financial Authority, which is intentioned to raise and grant funds for affordable housing. Moreover, the bill marks the first regional approach to combating the issue of housing availability and affordability in the Bay Area. The approach that AB 1487 presents is far more coordinated, targeted and strategic, in accordance to its ability to distribute funds on a regional basis, The Daily Californian notes. Now, it is up to Gavin Newsom to decide whether or not to sign the bill. Should he sign, the Bay Area Housing Authority pledges to work alongside surrounding Bay Area government agencies and institutions to help gather needed funds and reestablish flawed affordable housing measures. It’s a great feat that this bill passed, however if Newsom does not sign off on it, these progressive efforts will be reversed.

Moreover, there is still quite a lot of lobbying and reform that needs to take place. First and foremost, Council of Community Housing Organization Peter Cohen states that local officials and voters need to support ballot measures that will bring in money towards housing efforts, according to ABC7. Similarly, voters who neighbor the prospective plans for affordable housing construction ought to stop legally challenging proposed developments in order to lessen the vast responsibility that the city of San Francisco has in relation to the housing crisis.

It is also imperative that local policymakers address the zoning and building regulations that have previously impeded developer’s success in actually constructing new homes, according to MarketPlace.

Former San Jose Mayor Chuck Reed emphasizes that the structures and equations pertaining to the housing crisis ought to change as well. Reed told the California Globe that during his time in office, existing state structures made it rather difficult for the local governments to actually get projects approved. He argues that if the state added a fiscal incentive for local governments, this would motivate them to get more involved and at least potentially be able to break even on expensive housing projects. One of the most important things Reed emphasizes is that he urges all Bay Area residents to vote. By voting on and staying educated on bills, legislation and the actions of policymakers, Bay Area voters will be able to truly push forward the necessary progress that the Bay Area needs in this decade.

We should all care

In conclusion, the Bay Area’s housing crisis is quite multifaceted and at its core, the crisis faces many roadblocks that are and may continue to prevent the issue from truly being resolved. Beyond the economic shifts that the housing crisis is feeding, such as the housing and retail markets, the crisis is additionally homogenizing a region that is founded on and known for its diversity. Should living in the Bay Area continue to come at a pretty hefty price tag, one of the most unique and foundational aspects of the Bay Area will irreversibly be compromised. That is, its socially and culturally diverse collection of people. The ethnically diverse pockets of the region may unfortunately disappear if policymakers, local governments and voters don’t take necessary action towards preserving the people and communities that form the Bay Area’s backbone. This phenomenon is not only impacting the Bay Area, but also is harming the nation as a whole. Going forward, preventing the homogenization of urban populations nationwide presents itself as an issue we should all collectively care about and work towards fighting.

Sources

- https://www.cnbc.com/2019/12/01/amazon-google-apple-seek-fix-for-housing-crisis-they-helped-create.html

- https://www.mercurynews.com/2019/06/09/in-bay-area-small-retail-struggles-while-tech-booms/

- https://abc7news.com/society/how-to-solve-san-franciscos-housing-crisis/5642051/

- https://www.mercurynews.com/2018/11/08/editorial-housing/

- https://www.marketwatch.com/story/apple-facebook-google-and-amazon-are-putting-billions-of-dollars-toward-affordable-housing-but-that-money-may-be-too-little-too-late-2019-11-08

- https://www.dailycal.org/2019/09/25/bill-aimed-at-tackling-bay-area-housing-crisis-passes-ca-state-legislature/

- https://californiaglobe.com/section-2/state-government-in-the-way-of-california-cities-and-new-housing-goals/