Long gone are the days of penny arcade rooms and basic computer games. Multi-million dollar blockbusters have since taken hold and given way to a worldwide industry generating nearly $100 billion annually. Mobile games, retail games, free-to-play games, virtual reality, and esports are all segments of an industry that shows no signage of stopping.

When accounting for inflation, gaming has never been cheaper. A 2013 article by IGN details the high cost of gaming in the past compared to today. Cartridges for the Nintendo 64 that once cost $70 would require the equivalent of $100 at the time of writing in 2013. The Atari 2600 cost $199.99 in 1977 and with inflation that same console would cost $771.83.

Inflation aside, programs such as BestBuy’s “Gamers Club” which shaves 20% on new video games and the rise of second-hand stores such as GameStop have allowed gamers of all financial statures to participate.

As the decades have passed not only have games become theoretically cheaper, but their production values have increased as well. The 8-bit sprites of yesteryear have since moved on to high-resolution graphics that parallel real life. These graphics are often matched by movie-like stories and gameplay segments. But, as production values have increased exponentially so have the cost of creating video games.

For example: Star Wars: The Old Republic which released in 2011 had a development budget of nearly $200 million according to a story published by the Los Angeles Times. Grand Theft Auto V cost $265 million and the reboot of Tomb Raider carried a reported budget of $100 million.

How viable are such microtransactions? Very. This is why publishers ditched expansions in favor of them. In some cases publishers doubled down and now offer both.

The numbers above represent production costs and in some cases, do not reflect the amount needed to properly market the game, or the cost to keep the game alive post-launch. Many of these games carry multiplayer features which require continued maintenance and upkeep.

More so, the above games only represent a fraction of dozens of titles released annually. When looking at Game Informer’s 2017 release calendar, an average of 2-3 AAA quality videogames are released monthly. In peak months such as the summer, that number can quickly rise to over five.

With such a high cost of production and dozens of videogames on the market, video game publishers find themselves in need of generating revenue past the initial $59.99 entry point. To generate more revenue to meet the rising costs of games, publishers have employed all sorts of tactics including, post-release content and pay-for cosmetic items, however, have since moved on to what is being deemed as predatory tactics in the form of loot boxes. These contents of these boxes are entirely random and can provide in-game boosts to lucky players. The battle between publishers, gamers, and now the governments of the world has the power to change the landscape of gaming forever.

Fifa 18 costs 59.99, but to truly be competitive, one must buy into the game. Coins and other items to get marquee players are sold at retailers and within the games themselves.

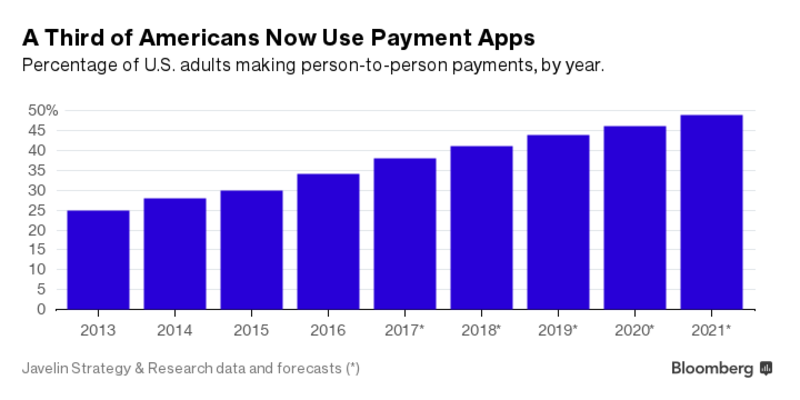

Originally video games were items that you bought once, however, publishers now see video games as a service. In the same vein that fans of Netflix original shows subscribe to the service above Hulu, avid fans will continue to pay into the game for added content. The shift in the landscape has tripled the value of the industry according to VG247. At the same time this idea creates strife in that, if games are indeed a service, where fans buy into a game over time, then the game should not cost as much as it does upfront. It’s unreasonable to expect someone to purchase a game once and devote that same amount of money into it through microtransactions to remain competitive.

The idea of games as a service and loot boxes boiled over during the release of Star Wars Battlefront 2. The game aimed to improve on all the misgivings of its previous entry, but it was everything but that. Following the current trend, it carried loot boxes. The loot boxes would carry cards that help enhance a player’s ability. It was an entirely possible to play the game without ever buying them, but it was just as possible for people to get ahead quickly, creating an uneven playing ground. The game in short resembled mobile games and their pay-to-win aspects.

EA would remove the feature to purchase with real cash after gamers spoke out in droves, but those who had already acted in the lead up to the game were free to keep their earned items. It is still possible to purchase said boxes, only with in-game currency earned from playing.

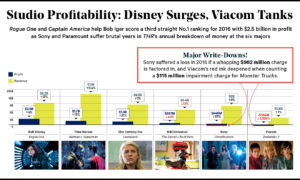

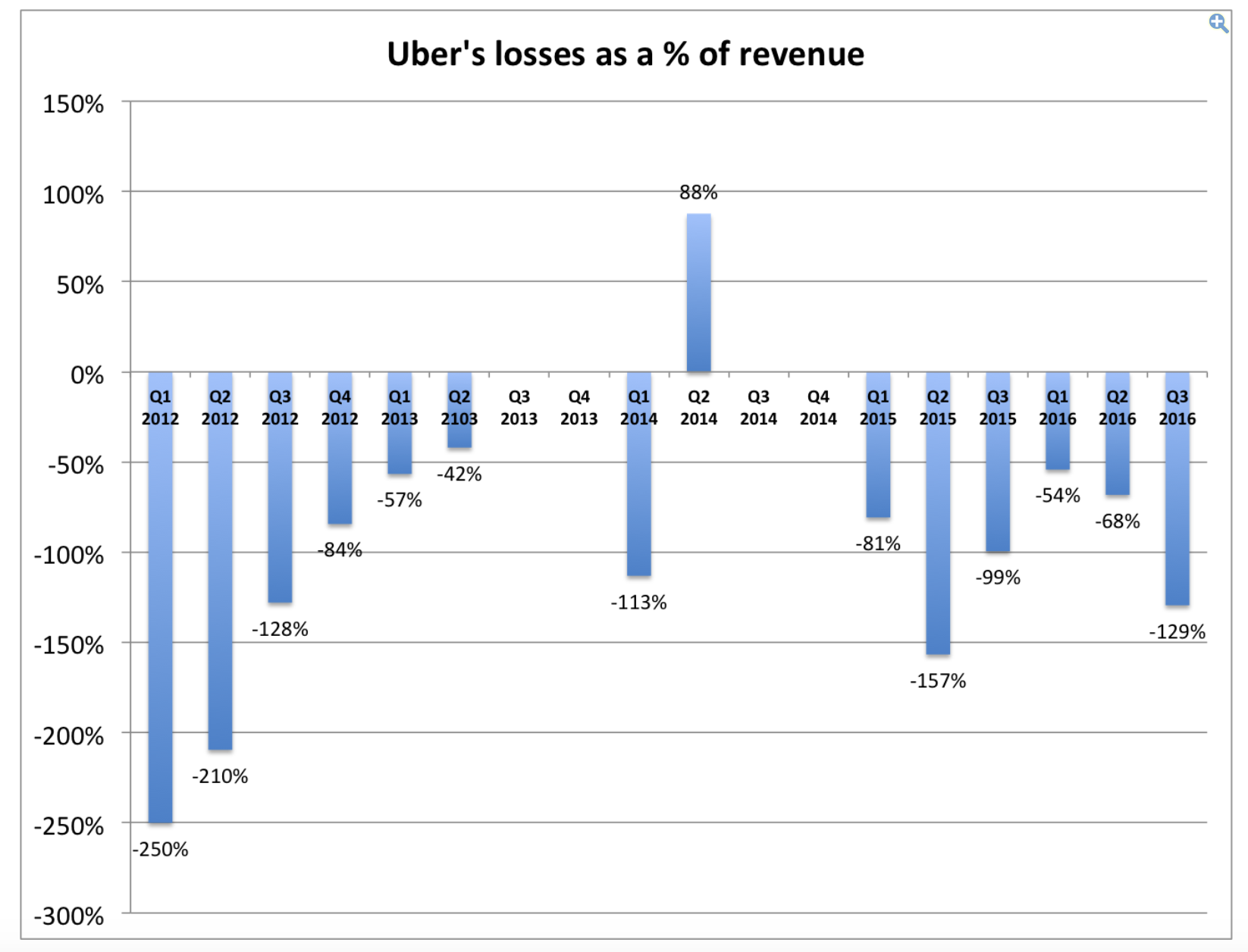

As a result, it has been reported by CNBC that EA’s stock has been wiped of 3.1 billion. Still, even with such a high magnitude loss, the company is still up 39% year to date because Star Wars is only one of its many franchises and is not the only game to feature such transactions that boost revenue.

In the time since, many governments have been attempting to deal with how to tackle the issue. Loot boxes by nature tread the line of gambling. Much like a slot machine, a player pays for the box and through RNG, three or more items appear in the same vein that numbers would in casinos. And just like a casino, the odds of winning the big one, or in this case the best perks are never disclosed. More so, unlike casinos there is no oversight.

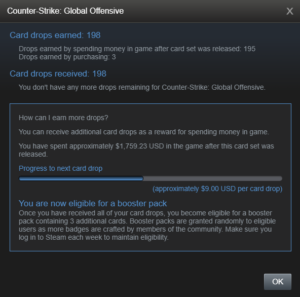

In China, the Commerce Government requires that the odds of loot boxes are disclosed to gamers. Where games such as StarCraft and League of Legends are most popular, players found that the odds of getting rare items were slim. In Dota 2, it was revealed that an epic skin, had a 2% chance of dropping. Unfortunately, publishers have found a loophole as only the Chinese version is required to do so and it is possible for such drop rates to be boosted.

Other governments have also hopped on board including Belgium where the Gaming Commission announced it has opened a case regarding the boxes and their gambling nature. Companies involved with gambling are required to have a license to operate. More so, minors and those suffering from addiction are forbidden to play or purchase

How did loot boxes come about? It wasn’t overnight. Honest post-release content became an unreliable source of income in the wake of multiple AAA titles being released monthly.

.

No ruling has been met, however, a transcription from Belgian news site RTBF and a concurrent report states that the country recognizes the difficulty in regulation utilizing current laws. It calls for “closer cooperation between governments, software developers, and rating agencies.” It also states that “with the right rules and consistent enforcement,” it should be possible to “protect players from the harmful effects of gambling without compromising,” the games.

In the United States, Representative Chris Lee (D) of Hawaii held a press conference days after the release of Battlefront 2. In it he denounced the predatory tactics utilized by EA and hoped to introduce legislation to combat of boxes found not only in Star Wars, but other games as well.

Lee, an avid gamer, said in an interview, “There’s a huge portion of the population outside what we might consider the die-hard gaming community.” Citing large discounts on video games during the holidays Lee continued, “…They’re looking for good deals on Christmas gifts not knowing what kind of mechanisms are built into games and ultimately systems their unaware of. It’s that large market space that continues to drive revenue.”

In a video published on YouTube, Lee outlined his proposed legislation, which includes prohibiting videogame sales containing “gambling mechanisms” to anyone under the age of 21. It would cover titles that carry a “percentage chance” of obtaining an item, rather than the item itself. He’s also seeking an “accountability piece” to ensure that drop rate changes do not occur, almost ensuring that such rates be revealed like in China. Lee hopes that other states can join in to help drive change.

Grand Theft Auto’s “Shark Card” currency is utilized to buy new clothes for characters and vehicles. It has no impact on the game whatsoever, but is a cash cow. Now imagine if such cash did have an impact on play.

Currently, the Entertainment and Software Rating Board does not label games with such features as gambling. The ESRB which assigns ratings to games from E for Everyone to M for Mature with descriptors has categories for both Real and Simulated Gambling. The criteria for them to be utilized would necessitate that real cash be involved or that players can wager without real cash. Any game with either would receive an Adults Only rating which prohibits anyone under the age of 18 from purchasing. Just as major movie theatres shy away from showcasing NC-17 films, major retailers refuse to sell AO rated games.

While many are questioning the legitimacy of the ratings due to the nature of the boxes, a spokesperson said in a statement to Kotaku: “While there’s an element of chance in these mechanics, the player is always guaranteed to receive in-game content (even if the player unfortunately receives something they don’t want). We think of it as a similar principle to collectible card games.”

However, unlike collectible card games, the items received in such boxes do not have much, if any resale value. EA’s Ultimate Team mode allows the resale of lesser tier cards for values less than the initial purchase, while other games do not.

A few lucky players received cards that made the Boba Fett character nearly invincible. Other players who rolled loot boxes received emotes which do not boost the in-game abilities of players. RNG mechanics help determine the winners and losers.

What’s most concerning about videogame ratings is that the ESRB is an organization part of the larger Entertainment Software Agency. The ESA is a trade industry that carries members from the top publishers and developers in the world.

While the governments of the world work towards outlawing such predatory tactics, gamers across the globe currently find themselves stuck in the middle. While it would appear easy enough to not purchase a game like Star Wars Battlefront 2, it is difficult for avid fans to stay away.

Joseph Mellinger, a student at Penn State University and Star Wars fanatic has staved off buying the latest release in response to the loot box controversy. Still, he admits to having participated in the practice before, particularly in EA’s “Madden” series of titles. “That rush of possibly pulling something great grabbed me.”

That risk-reward nature is what grabs players and what governments are trying to combat. The hope of getting something good after receiving less than stellar items is what drives them to continue buying. It’s what drove players such as Reddit user, Kensgold to dump over $10,000 into microtransactions. Players like him are classified as ‘whales’ and according to Venture Beat make up less than 2 percent of gamers, but drive more than half the revenue through microtransaction purchases.

Kensgold posted an open letter on Reddit denouncing the loot boxes in Battlefront 2, citing his own experiences as cause for concern. In an interview he said, “At that point I had already set the precedent that dropping 100 bucks was not all that big a deal…I was in high school with almost no bills to speak of.”

He hopes that publishers can take note of stories like his and help push the industry forward positively. “I would love to see publishers as a whole take a step back and look at what methods and strategies they are using to make money, how those strategies work, and what positive or negative effects they can have on their consumer base.”

The next few weeks and months of gaming will prove to be highly interesting. While EA has stated on record that they will bring back the microtransactions present in Star Wars Battlefront 2, it has yet to be seen when they will do so. It can be inferred that they are waiting for the theatrical release of the Last Jedi to boil over before doing so.

It will be equally as interesting to see what occurs in next year’s slate of titles. EA will once again be releasing its annual slate of sports titles, all of which will continue the trend. Likewise, games such as Call of Duty, which recently incorporated such boxes will also be released.

Finally, as we head to the future, should such practices be outlawed, it remains to be seen how games will be priced or developed to generate profit. It is entirely plausible that games become more expensive to make up for money lost. Likewise, it is equally as plausible that production values of games drop.

For an industry that shows no signs of stopping it has quite the dilemma on its hands.

SOURCES:

https://kotaku.com/ea-temporarily-removes-microtransactions-from-star-wars-1820528445

https://kotaku.com/battlefront-overwatchs-loot-boxes-under-investigation-1820486239

https://kotaku.com/hawaii-wants-to-fight-the-predatory-behavior-of-loot-1820664617

http://www.pcgamer.com/belgium-says-loot-boxes-are-gambling-wants-them-banned-in-europe/

https://www.rtbf.be/info/medias/detail_non-la-belgique-n-a-pas-qualifie-star-wars-battlefront-ii-de-jeu-de-hasard?id=9769751

https://ds1.static.rtbf.be/uploader/pdf/d/d/b/rtbfinfo_5c742f9b8996afe274e39ad9b4acb453.pdf

https://www.cnbc.com/2017/11/28/eas-day-of-reckoning-is-here-after-star-wars-game-uproar.html

The Video Game Loot Box Problem Goes Deeper Than Star Wars: Battlefront II

http://www.gamesindustry.biz/articles/2016-03-02-eas-ultimate-team-earning-around-usd650-million-a-year

Battlefront II goofed, but gamers are still spending more on additional content

https://www.giantbomb.com/dlc-season-pass/3015-7186/

https://www.thedailybeast.com/an-obituary-for-the-online-pass-why-you-cant-charge-us-for-used-video-games

http://www.eurogamer.net/articles/2013-03-26-tomb-raider-has-sold-3-4-million-copies-failed-to-hit-expectations

Worldwide game industry hits $91 billion in revenues in 2016, with mobile the clear leader

https://kotaku.com/how-much-does-it-cost-to-make-a-big-video-game-1501413649

Star Wars: The Old Republic — the story behind a galactic gamble

https://www.cinemablend.com/games/Capcom-Gets-Busted-Disc-DLC-Discovered-Street-Fighter-X-Tekken-40114.html

http://www.rollingstone.com/glixel/features/loot-boxes-never-ending-games-and-always-paying-players-w511655

What it means to be a ‘whale’ — and why social gamers are just gamers

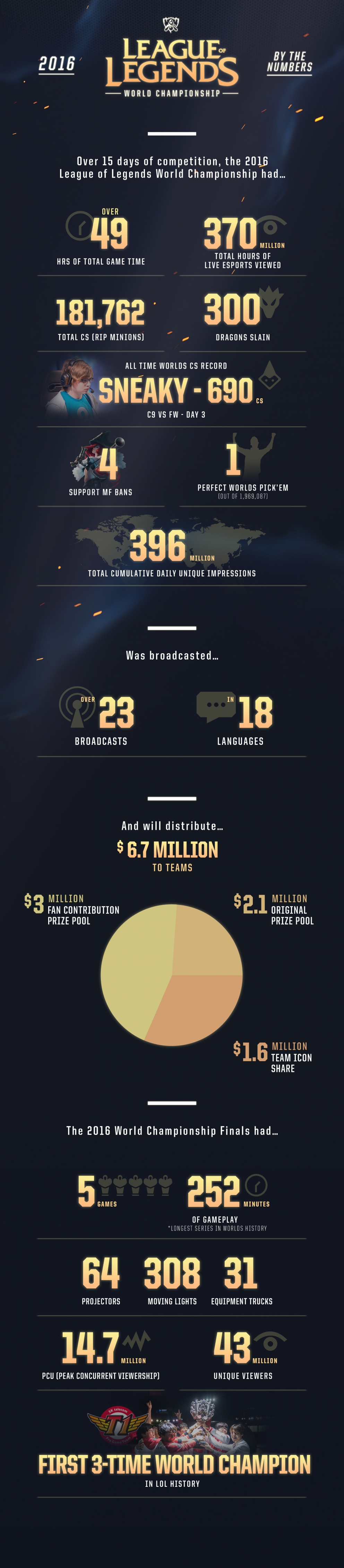

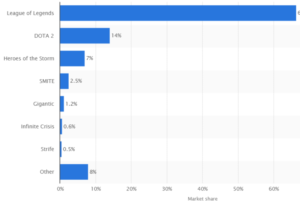

League of Legends is vital to E-Sports because it showcased how serious the professional gaming can be through the outstanding number of viewers over the world. League of Legends is a free-to-play online competitive multiplayer game developed by Riot Games in 2009. Two teams of five players are required to play the game and one match lasts about 35-45 minuets. Since its release, League of Legends has been gathering monthly active users in a very fast pace. The monthly active users have

League of Legends is vital to E-Sports because it showcased how serious the professional gaming can be through the outstanding number of viewers over the world. League of Legends is a free-to-play online competitive multiplayer game developed by Riot Games in 2009. Two teams of five players are required to play the game and one match lasts about 35-45 minuets. Since its release, League of Legends has been gathering monthly active users in a very fast pace. The monthly active users have

emergence of Overwatch mean the downfall of League of Legends? According to major video game news outlet

emergence of Overwatch mean the downfall of League of Legends? According to major video game news outlet