Kaká has sadly been left out of Brazil’s roster for the upcoming 2014 World Cup but he still very much on the list of prospective players to move to the MLS later on this summer. Along with the AC Milan midfielder, Anderlecht midfielder Sacha Kljestan’s name was “tossed around the rumor mill” according to a Fox Sports article.

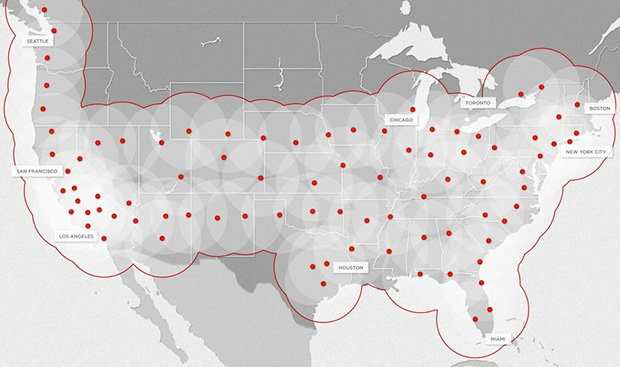

Many successful international players have migrated from the European league to Major League Soccer. David Beckham had a great run with the Los Angeles Galaxy. Theiry Henry is still enjoying his time with the New York Red Bulls.

The European soccer season is slowly coming to an end, and with the attention slowly turning to the American soccer league (leaving out the World Cup from this discussion), now is the best time to compare the two leagues and how both handle their transfer windows.

The European Transfer Market

The common rationality for any transfer window is that Team A offers a certain amount for a specific player, the player’s current team (Team B) negotiates the prices offered, negotiations reach a certain agreement and finally Team A obtains the player that they desired.

It’s simple, right? Not quite.

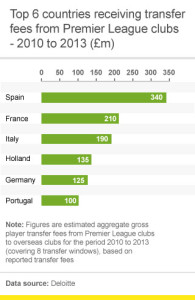

The European transfer market is one of the most expensive markets in the world, millions of Euros are exchanged every season. Speculations influence transfers; dozens of media stories being released on who might be sold, sports analysts doing multiple segments on the subject and now, social media users voice their opinions on which players are the best fit for their teams.

But aside from speculation is the freedom that the European leagues offer. For one, there is no salary cap. Teams can spend as much money as they want on the player and resources of their choice. Back in 2003, Roman Abramovich bought Chelsea and took over west London with his one billion euro investment. This sort of “big money” is not just seen in the English league, but in Spanish and Italian leagues as well.

The other factor is the contingency that allows players to leave their clubs at any time—before, during or after the transfer window—and the club is responsible for making those arrangements happen. The most recent example of this was when Juan Mata, unhappy with Chelsea, was able to leave and be traded to Manchester United for 37.1 million Euros.

While this trade still occurred during the time of the transfer window, it does prove a point when it comes to the freedom that players, even big commodities such as Juan Mata, have when it comes to playing for the teams of their choice.

But as previously mentioned, players are able to leave regardless of the “boundaries” that the transfer window claims to have.

As the English Premiere League website states:

There are two transfer windows in each Barclays Premier League season.

The first commences at midnight on the last day of the season and ends on 31 August if a working day – or, if not, on the first working day thereafter, at a time determined by the Board.

The second transfer window commences at midnight on the 31 December and ends on the 31 January if a working day, and again, if not, on the first working day thereafter, at a time determined by the Board.

Temporary transfers can be made permanent outside of the transfer windows. For further information please see the rules in the Premier League Handbook.

This, also, is the same framework used in other European soccer leagues.

The Dilemma

As the rule with materialistic items is “the more exotic, the more expensive” the same rule is somewhat used when it comes to soccer players. Soccer players prices are based on one thing more than anything: location, location, location—in this case, where they were born (or what country they decided to nationalize themselves in). Neymar is a great example of this. His performance as a player was impressive but him being Brazilian was what made him that much more valuable. South American players are a big commodity as well as European players, but there is hardly demand for players from Canada or even Russia.

Country of origin is not the only thing that defines a player’s value but there is also the factor of what club owns the player. Continuing with Neymar, he started his career off playing with Santos FC in Brazil. If he had decided to continue there, his value as a player would not have been as significant. The level he had and the competition he played against also play into this as well (performance being the third factor). So when Barcelona FC (one of the top teams in the Spanish league) purchased him, his value as a player soared through the roof.

While Neymar’s stories is a “Cinderella story” that is continuously seen not just in soccer, but in sports in general, these factors are what create a giant gap between different nations and clubs. The role that the transfer market plays creates a hierarchy of clubs that will always be at the top of the table that the “poorer” clubs will never be able to catch up to. Note: it is important to mention that performance for clubs has nothing to do with the system per se. Even though Manchester United did horrible doing this season in the Premiere League, they are still one of the richest teams in the EPL and will continue to stay in that position.

Continuing with the Neymar example, there is no regulation on the amount of money that is being spent. This led to Barcelona sparking a media frenzy regarding the purchase of Neymar.

American Soccer Transfer Market

The transfer window for Major League Soccer (MLS) works a bit differently than Europe’s.

For one, MLS works as a close league and not the European open league. Players are not able to leave clubs when they please and to even the playing field more and avoid this gap of rich and poor clubs, there is a draft is held around the time of the two transfer windows that occur during mid-February and another that opens on July 8th. Teams’ position in the draft is based on: their performance and what the standing was in the previous season.

As with other American sports, the highest pick goes to the worst performing team and the best teams find their slot at the very bottom. These teams draft in rounds, which goes from #1 to however many rounds indicated.

This allows for something that occurs in the MLS draft that does not appear in the European market at all—the role of trading draft picks. So, a team somewhere towards the bottom can trade their pick in the draft with a team that is a little higher up.

Another difference between the European transfer market and the MLS is the salary cap. As the MLS “Roster Rules and Regulations” states:

- Players occupying roster spots 1-20 count against the club’s 2014 salary budget of $3,100,000, and are referred to collectively as the club’s Salary Budget Players.

- Roster spots 19 and 20 are not required to be filled, and teams may spread their salary budget across only 18 Salary Budget Players. A minimum salary budget charge will be imputed against a team’s salary budget for each unfilled senior roster slot below 18.

- The maximum budget charge for a single player is $387,500.*

* See section entitled Allocation Money below, under Player Acquisition Mechanisms, for details on buying down a player’s budget charge.

As one can see, there is a budget that is upheld within the MLS; there is accountability for each player and how much can go when it comes to salary. That is not seen in European (as is evidence with the large amount of money that soccer stars such as Messi and Cristiano Ronaldo are paid).

The MLS looks to have a more even playing field and does so by regulating all aspects of the transfer window. This also helps to create greater competition for teams, regardless of how much money they have, because they have a better chance of obtaining a good player.

The Dilemma

The dilemma with the American transfer window is the role of politics. Players are not given as much freedom as there is in the European market when it comes to where and when players want to play. Though there is a disparity in income with European players, American players have very strict contracts with their teams that are often too expensive for any team to simply pay off to get that specific player.

As is noted:

- A Team may buy out one (1) guaranteed player (including a DP’s) contract during the off-season and free up the corresponding budget space. Such a buyout is at the particular MLS Team’s own expense.

- A Team may not free up budget space with a buyout of a player’s salary budget charge during the season. Such a buyout will be conducted by the League and count on a Club’s budget in a manner consistent with current MLS guidelines.

As with anything, is a very strict, orderly procedure that takes place for the buyout to even occur.

Nothing happens outside the transfer window that is not seriously examined for a long time.

Conclusion

Both the European and the American soccer transfer markets have their flaws. One seems to have a very free and open place that creates disparity while the other seems too strict to even try to mention the word “freedom.” What is important to note though is the simple question about the love of the game. The American soccer league is very strict about making sure they make a profit or do not spend any more than they have to to avoid a deficit. However, what is important to note about the European market is this lack of salary cap that allows for people to waste so much without a worry; they simply do it for “the love of game.” Going back to Roman Abramovich and his purchase of Chelsea, economically it is seen as a bad investment. But from a pride standpoint, the investment was definitely worth it (it brought a Champions League Cup, two League Cups and two FA Cup wins).

So whether you enjoy soccer from an economic standpoint or for the love of the game, both have their flaws but both also have their benefits.