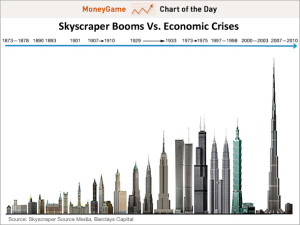

Real estate development has always and still does account for a fairly large proportion of GDP of every sizeable economy. The development of tall skyscrapers has historically been offset during times of economic expansion and booms when funds and monetary resources are more easily accessible, and there is assurance of profitability, naturally. Also, skyscrapers are fairly lucrative by nature because they create more space horizontally in the same plot of land. However, skyscrapers are often just conjectural development projects that are built without any concrete plans relating to usage of the space being created. However, the completions of tall skyscraper buildings seem to have formed a recurring pattern, in the past century or so, of often being pre-cursors to economic recession or financial crises. This correlation between the construction of tall skyscrapers and economic business cycles that ended in recession was first studied in the 1930s, around the time of the Great Depression in the United States. Historical examples of this from the past century include the completion of the Empire State Building in the 1931 when the Great Depression had just started, the completion of the Petrnoas Twin Towers in Malaysia in 1996, which was when the Asian financial crisis began, and of course, the completion of the Burj Khalifa in Dubai in 2010 which was right after the 2008 worldwide financial crisis. Another key example would be the construction of the Sears Towers and the World Trade Center Towers that were built in 1973, during both the 1973 stock market crash and the 1973 oil crisis. According to substantial research done by economists, and there are conflicting opinions about weather there seems to be a correlation between skyscrapers and economic business cycles. While there are some rational explanations as to why the constructions of skyscrapers began during economic booms and ended during major financial crises, opposing research has also shown that there is almost no correlation between construction of skyscrapers and economic conditions, and that past events have been, to an extent, coincidence. Economists who concur with the fact that there is an important association between constructions of skyscrapers reinforce the Skyscraper Index, which was created by Andrew Lawrence in 1999. It states that tall skyscrapers have escalated right before or after serious economic downturns. It is self-evident that large projects like building one of the tallest skyscrapers in the world would get investment during an economic boom, due to lower interest rates, higher demands and easier access to monetary resources. However what’s interesting is that all of these components reach a peak during the growth or construction period of the building of a skyscraper, and this right when the economy has already reached its peak and is about to go into a recession. On the other hand, there are also exceptions to this and there are many economists who would agree that the skyscraper index is not a good enough economic indicator. But it is still an intriguing concept. There are numerous skyscraper projects coming up in the world’s fastest growing and high potential economies, India and China and it would be gripping to see how the completion of the new structures could be correlated to economic conditions in the future.

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.