And then he said…”we’re moving!”

In America, the taller the skyscraper, the more successful you are. As companies blossom, it is not unusual for CEO’s to announce moving on to bigger and better things. However, the fate of these companies is often destroyed by the terrifying curse that haunts those with lofty goals of a shiny new building.

Economic indicators are all around us. Unemployment, GDP, and CPI are the ones that grab our attention but because our economy is so massive, it is easy to miss the little signs here and there. So why would moving to new headquarters be problematic when business has never been better? In many of these cases, the company did not properly attempt to look into the future and consider what could go wrong. Nonetheless, for some of these companies, they never could have predicted bleeding money for years after the fact.

Back in 2000, The New York Times doubted the strength of the internet. Although it was clear as day that the world would never be able to turn its back from the internet, what wasn’t clear was the fact that more accessible news lead to lower print sales. By 2007 they should have figured it out but alas, they still moved into shiny new building which led to an extremely uncomfortable financial situation. Let’s just say the accountants went gray real quick trying to crunch those numbers. The only solution was to sell the building and hope for the best.

MySpace? What’s that? Oh right that social media site that got destroyed by Facebook. Thanks Zuckerberg. In 2008, MySpace naively believed they would continue to dominate. Naturally an upgrade was necessary to house the increasing amount of employees. Of course, MySpace declined quickly after moving to new HQ, and today MySpace is owned by Time Inc. It technically still exists but as an entertainment site for music and videos rather than social media.

In these cases, perhaps the outcome of losing money could have been foreseen. However, one must remember the economy is its own animal. The ebb and flow of the market cannot be controlled as much as we like. In business, risk is unavoidable and therefore moving to new HQ isn’t the worst idea. The issue is timing. The curse will remain for all those eager CEO’s trying to jump ship because it is an enormous risk to take. Only the lucky few will go on unscathed, all we can do is watch preferably with popcorn and economic outlook sheets in hand.

http://www.businessinsider.com/poorly-timed-headquarters-2009-11?op=1/#space-3

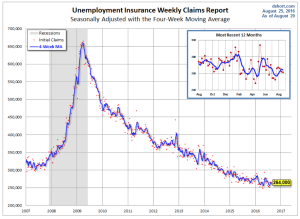

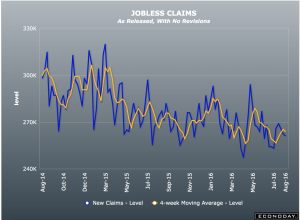

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.