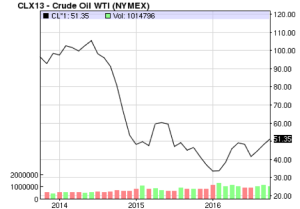

There are few things that have a bigger influence in global markets than swings in oil prices. However, the ripple effects these swings have are hardly ever clear cut. In order to understand how swings in oil prices can influence global markets, we must first understand how these prices can increase or decrease.

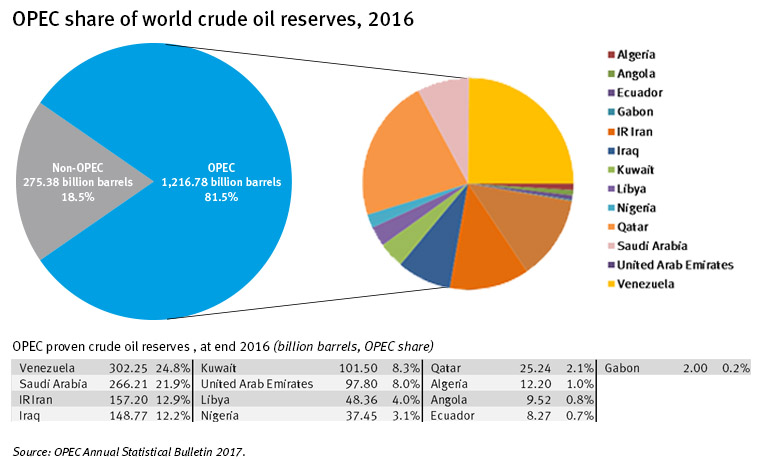

Oil is a commodity that tends to fluctuate throughout time. One of the largest influencers of these fluctuations is the Organization of Petroleum Exporting (OPEC). The OPEC is an organization that includes 13 countries; Algeria, Angola, Ecuador, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates and Venezuela. According to their website, as of 2016, “81.5% of the world’s proven crude oil reserves are located in OPEC Member Countries, with the bulk of OPEC oil reserves in the Middle East, amounting to 65.5% of the OPEC total” (http://www.opec.org/opec_web/en/data_graphs/330.htm). They have production levels that meet global demand, and are able to control prices by increasing or decreasing production.

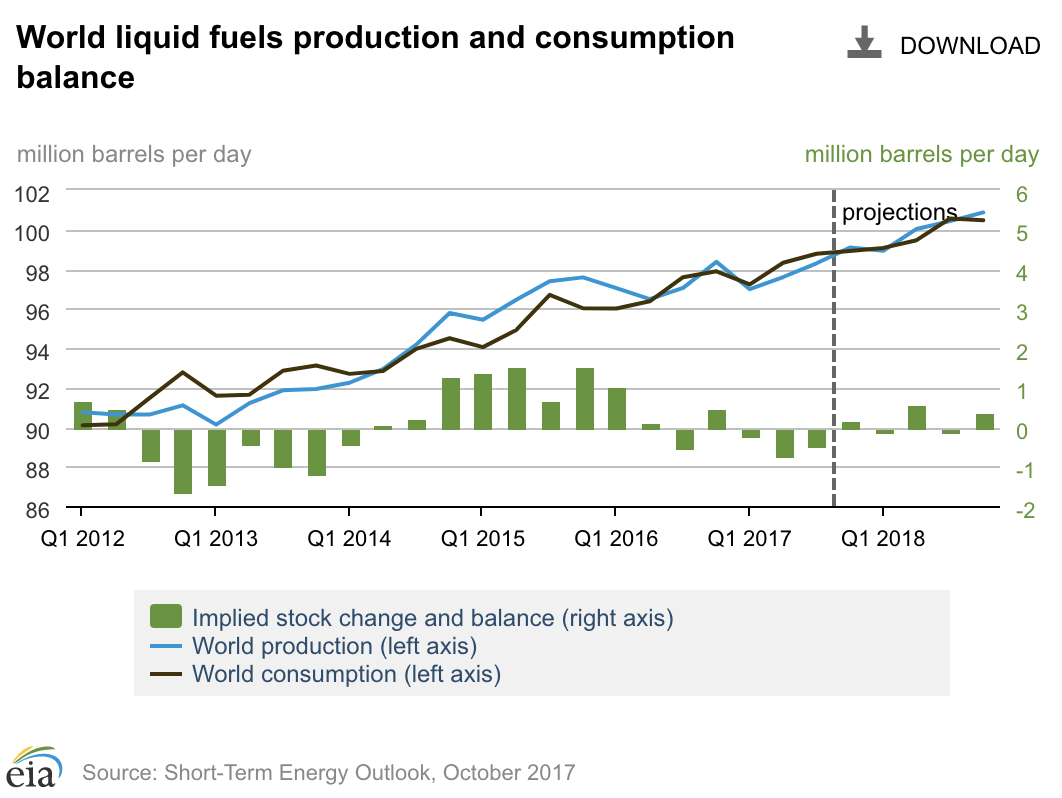

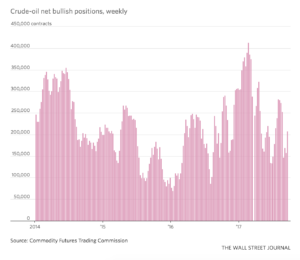

Just like the stock market, the laws of supply and demand play a crucial role for commodities as well. If supply of oil were to pass demand, the price of the oil must decrease, and if demand were to pass supply, prices will increase. For example, if there is lower demand for oil in Europe and China, but there is continuous supply of oil from the OPEC, the price of oil will fall due to the surplus of oil supply. Although supply and demand do affect oil prices, the future of oil and reserves are what actually sets the price. Future contracts allow purchasers of oil to buy at a fixed price in the future on a specific date. Other influencers of oil prices include natural disasters, such as hurricanes or earthquakes, production costs, and political instability.

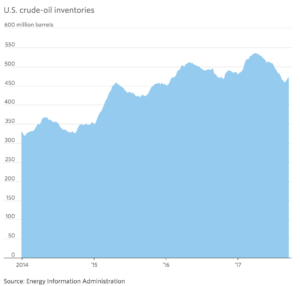

Although weaker demand is what can drive prices lower, the growth rate in China, which is the world’s largest net importer of oil, has caused significant changes to the price of oil. This is due to the slowdown of growth in China. Also, the OPEC has promised to reduce its production of oil, which can drive up the demand. However, with competitors entering the market, the OPEC has kept its production levels up to compete in the market and hold market share.

For many industries in the market, oil prices are really important to pay attention to. Fluctuations in prices can have a large influence on different sectors of the economy. One of the main sectors that is highly influenced by oil prices is the airline industry.

Every traveler can agree that the cost to fly from one place to another has become a crucial factor in making the decision to travel. Like most industries, the airline industry is constantly itching to find new streams of revenue. Airfare fees used to cut it, but now surcharges have been placed on almost every bit of customer service offered by the airline company. This includes seat selection, checked bags, meals, and sometimes carry-on bags, and they are not cheap. These surcharges first began as something to depend on when fuel prices increased, as well as increasing ticket costs.

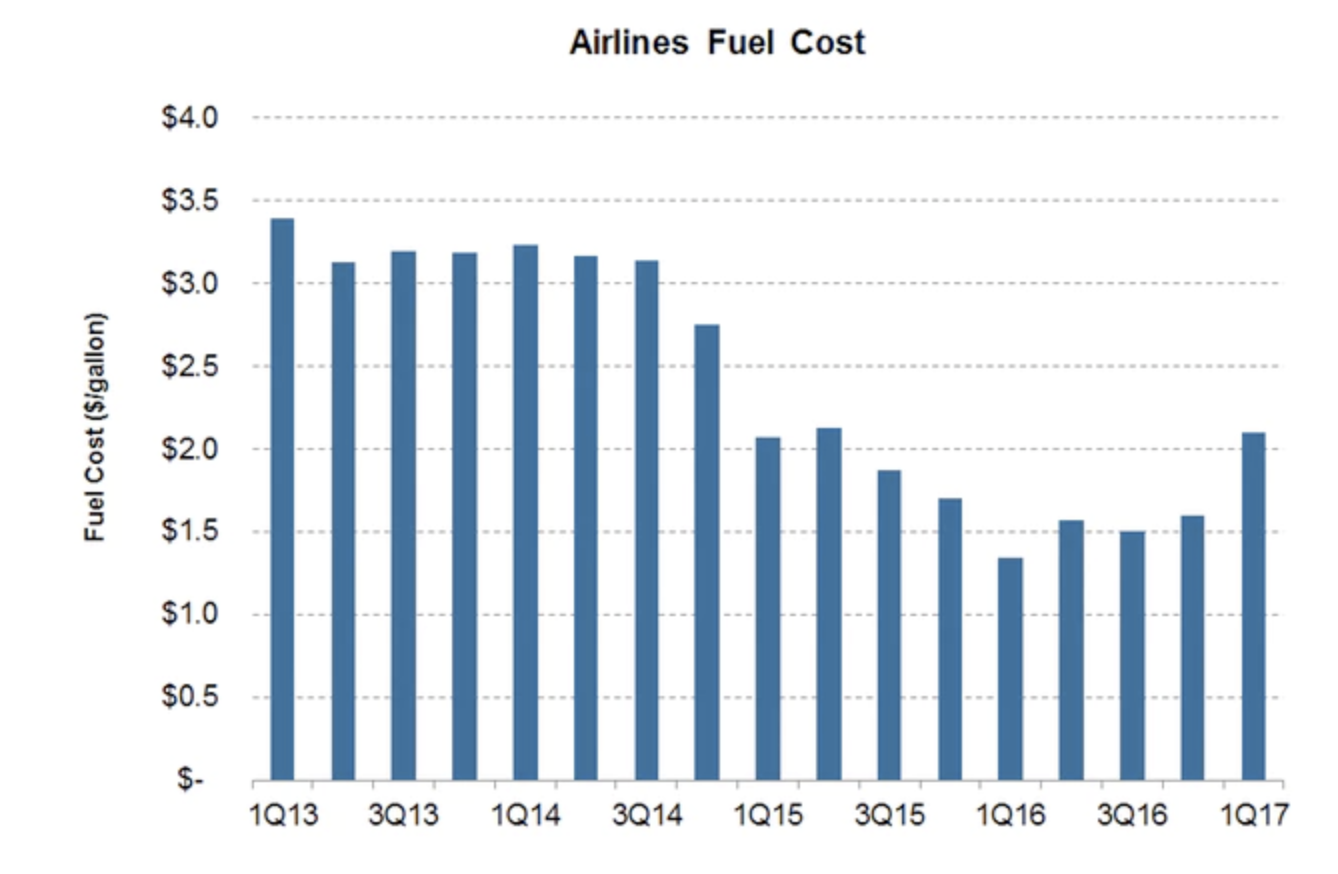

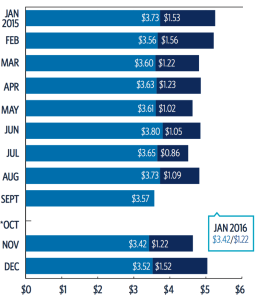

Overall, crude oil prices have significantly dropped as a result of a surplus of supply. For the airline industry, a decrease of oil prices is great news. This means that they will have lower costs on fuel, which is one of their major costs, and will potentially lead to an increase in profits. The decrease in oil prices have caused airline companies to restructure their fleets, buy back stocks to show better earnings, and also look into expanding their routes in areas that seemed less feasible. This has also benefited travelers, due to the decrease in airfare costs.

Crude prices had recovered in the first quarter of 2017. This resulted in most airline fuel costs to rise. According to Ally Schmidt, “Delta Air Lines’ fuel costs rose 26.4% YoY to $1.6 billion. American Airlines’ fuel cost rose 37.8% YoY to $1.7 billion, and United Continental’s fuel costs rose 28.1% YoY to $1.6 billion. Alaska Air’s fuel cost rose 103% YoY to $339 million, including the impact of its Virgin America merger. Southwest’s fuel cost rose 13.6% to $959 million. JetBlue’s fuel cost rose 50% to $323 million. Spirit Airlines’ fuel expense rose 62.2% YoY to $139 million” (http://marketrealist.com/2017/08/analyzing-crude-oils-impact-on-airlines-fuel-costs/).

With the news of the OPEC and a few other non-OPEC nations slowing oil production rates until March of 2018, the oil prices rose to about $51.50 per barrel (http://marketrealist.com/2017/06/how-crude-oil-prices-impact-airlines-fuel-costs/). However, the impact of Hurricane Harvey had caused oil prices to fall to $47 per barrel. The capacity Texas has of oil is about 5.6 million barrels per day, and Louisiana has about 3.3 million barrels per day. The loss faced by both of these states resulted in a decrease in crude prices.

We know an increase in crude oil prices negatively impacts the industry’s largest cost. However, a decrease in crude oil prices can also cause problems to the airline industry. Lowering the oil costs can enhance profits, but also lowers airfares. This increases demand for traveling, which forces airline companies to find ways to increase capacity. Adding too many routes or dramatically increasing their fleet can cause airline companies to hurt their potential profits when oil prices bounce back. Therefore, it is very important for them to make every move a smart one. Major airline companies have recently done a good job of finding the right balance between adding capacity and still keeping demand steady.

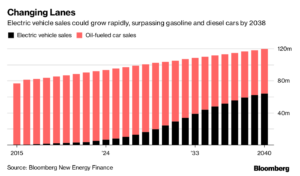

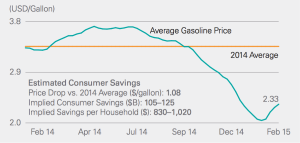

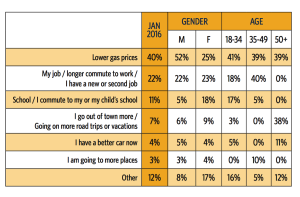

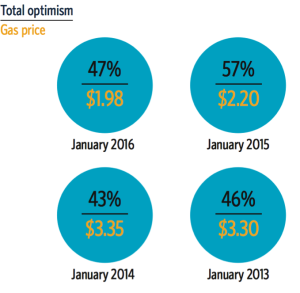

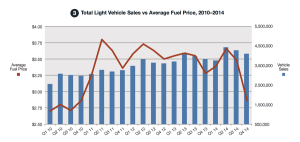

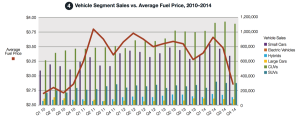

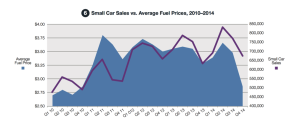

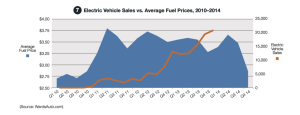

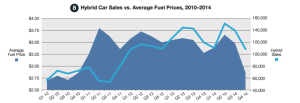

Another industry that is impacted by the fluctuations of oil prices is the auto industry. Automobiles and petroleum are considered to be complimentary goods, which are goods that are associated with one another. Gasoline is a petroleum-based product; therefore, price fluctuations in crude oil can directly impact the price. A fall in oil prices is great for automotive companies. This means that vehicle sales will rise, as gas prices are cheaper, and more people have leftover income to spend. The extra income that people have could be used to lease or purchase a new car. As the cost to drive becomes cheaper overall, car ownership becomes more attractive to the population.

However, the impact oil prices have on the auto industry does depend on the market and the nation. For example, people who live in high fuel-tax areas may experience an overall lower percent change in the price. Therefore, it will not appear as significant as it will to someone who lives in a lower fuel-tax area. This can change the perspective one has towards purchasing a vehicle during a time where oil prices have decreased.

Some argue that the constant volatility of oil prices causes uncertainty about if and when the oil prices will increase again in the future. Therefore, this can impact the decision-making process of an individual wanting to finance or purchase a car. This perspective suggests that the future expectations of oil prices are what reflect car sales, rather than the actual price. However, most industry experts are directly correlating an increase in sales with the recent low gas prices.

Some argue that the constant volatility of oil prices causes uncertainty about if and when the oil prices will increase again in the future. Therefore, this can impact the decision-making process of an individual wanting to finance or purchase a car. This perspective suggests that the future expectations of oil prices are what reflect car sales, rather than the actual price. However, most industry experts are directly correlating an increase in sales with the recent low gas prices.

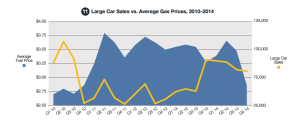

The increase of automobile sales due to lower gas prices has had a larger impact on the gas-guzzling vehicles than the fuel-efficient ones. These vehicles tend to be more expensive in general, allowing automobile companies to generate more revenue. Also, profit margins on smaller vehicles are usually less than the larger vehicles, and gas-guzzling vehicles are generally on the larger side, including trucks and SUVs.

Fluctuations in oil prices can affect many companies in different sectors. Low prices can benefit industries that rely on oil as a key input, but other industries may hurt. Upstream oil producers are the ones that take the largest hit when their costs to produce the oil passes the market price, and they have to operate at a loss. However, downstream companies can hurt as well. These include industrial producers and other companies that build drilling operations, as they support the energy sector. Also, investors that hold bonds from oil producing firms also take a hit. As mentioned, this is also true for the exact opposite; an increase in oil prices. High oil prices can significantly hurt industries, such as the airline and auto industry. However, upstream oil producers and industrial companies that support the energy sector can benefit from an increase in oil prices.

It is difficult to accurately predict what the future holds for oil prices. The U.S. Energy Information Administration predicts that crude oil prices will average $52 per barrel in 2018. The reports show that volatility will not be as bad as it was in 2016. Commodity traders are able to predict the price of oil due to their future contracts. Their predictions state that price could be anywhere from $39 per barrel to $63 per barrel by December of 2017 (https://www.eia.gov/outlooks/steo/report/global_oil.cfm). It is important to remember that any perceived shortages, such as a hurricane, can cause these traders to panic and prices to increase. However, prices tend to moderate in the long run, while heavily impacting industries in the short run.

Sources:

https://www.eia.gov/outlooks/steo/report/global_oil.cfm

http://www.opec.org/opec_web/en/data_graphs/330.htm

http://marketrealist.com/2017/08/analyzing-crude-oils-impact-on-airlines-fuel-costs/

http://marketrealist.com/2017/06/how-crude-oil-prices-impact-airlines-fuel-costs/