The miracle

On Valentine’s Day, groups of Chinese young people waited for a Chinese movie, “Beijing Love Story” in Monterey Park AMC Theater, which was released day-and-date with China. The film made a strong opening weekend in North America earning128, 000 dollars from a limited release in nine screens over its first three days in the market following a Valentine’s Day premiere. Moreover, the film set a single-day record for a 2D film in China with16.1 million yuan.

“It’s a golden age. China film market is experiencing a prosperous development now…China’s local movies beat Hollywood movies and became to lead the market in the past few years…I remembered that 60% revenues are from our local movies, which could not be imagined in the past,” said Long Wan, Founder of Fire Rock Global Media. Wan is doing pre-production as the supervisor producer for a US-China co-production film, which is going to be filmed in Las Vegas this summer.

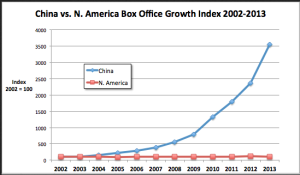

“Beijing Love Story” is only one of the “miracles” made in February, the Chinese New-year month. Another blockbuster, “ The Monkey King”, has earned 1.02 billion yuan since it released, which became the third movie in one-billion club in the mainland China. According to box-office record from Huxiu technology blog, China’s February box-office revenues hit 2.96 billion yuan (about 50 million US dollars). Experts predicted that the number would probably hit 30 billion yuan at the end of 2014.

The second largest film market

According to a report from Motion Picture Association of America in March, China overtook Japan to become the second largest film market after America, with box-office receipts of around 17 billion yuan (about 2.8 billion dollars).

More than 5,000 new cinema screens were added last year, and a massive 903 new complexes were opened. The State General Administration of Press, Publication, Radio, Film and Television reported that China now has 4,582 cinema complexes and 18,195 screens, increasing of 25 percent and 39 percent respectively.

The data also shows that cinema visits per head of population are approximately 0.5 per person per year (given that China has a population of some 1.3 billion). That is low compared with China’s neighbors in Asia – South Koreans buy an average of 4 tickets each year – and with developed country markets, according to Variety.

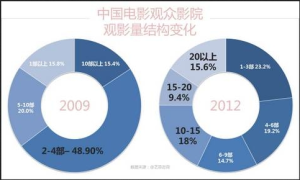

In the past five years, the demographic structures and habits of Chinese audience have been changed a lot. Below the chart shows that 48.9 percent of audience watched two to four films in 2009, but in 2012, we can see that the number of films has been diversity, which means more people choose to watch films in cinemas.

The high price of movie tickets never stops people’s steps into cinemas. In Shanghai, an ordinary movie ticket costs 100 yuan (around 15 dollars) and a 3D movie ticket costs 150 yuan(around 25 dollars), according to Want China Time. China’s movie ticket prices are reportedly the most expensive in the world.

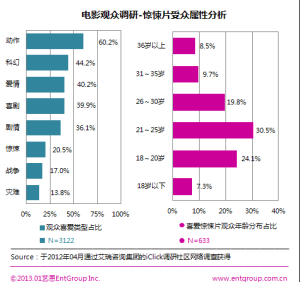

In China, 30.5 percent audiences are 21-25 years old, which are the main-power consumers. “Do you know the average age of our audience is 22….Do you understand those young people born in 90s?” Wei Liang said to the Chinese director veterans in an interview. Liang’s film marketing company, Magilm Pictures, is one of the pioneers marketing companies in China.

China’s cultural market & Propaganda

China has a long history of propaganda on both news media and cultural market. In 1942, Chairman Mao Zedong gave a speech in a cultural panel meeting in Yan’an, which emphasized that literature and art should serve for workers, peasants, soldiers and proletariat. And movies are the tools of propaganda for educating people “right things” and also have to express right political views. At that time, Chinese film market experienced a period of downturn.

During the Cultural Revolution, the film industry was severely restricted. Most of previous films were banned, only a few new ones were produced. The most notable ballet version of the revolutionary opera was “The Red Detachment of Women” (1971). Film production revived after 1972 under the strict jurisdiction of the Gang of Four until 1976, when they were overthrown. The few films that were produced during this period, such as 1975’s Breaking with Old Ideas, were highly regulated in terms of plot and characterization, according to Wikipedia.

China’s economic reform and opening in 1979 gave a new birth to the whole country as well as movie market. The government film distribution reform project, which was released at the same year, said that film distribution companies could keep 80 percent for developing new projects and pay 20 percent of film revenues to central government.

The film industry flourished for a short time as a medium of popular entertainment after the reform project. Around 29 billion audiences went into cinema in 1979, according to historical record. The planned economic mechanism played an important role during the flourished period.

In 1993, Chinese government released a new reform report to doors for private film companies to produce movies. The newly formed SARFT, State’s Administration Radio, Film and Television strengthened supervision over production. Propaganda never stops. “The Founding of a Republic” produced by DMG is one example of new style of mainstream Chinese films in 2009.

Foreign films restrictions & Co-production

Since 1994, China set up an import quota system and started to import ten Hollywood movies every year. “China places a strong emphasis on censorship not only to ensure compliance with the political aims, but also because the country lacks a rating system. The SARFT censorship board regulates the content of movies to make them suitable for the entire national audience”, according to “Government Allocation of Import Quota Slots to US Films in China’s Cinematic Movie Market”.

This board consists of 40 members including government officials, filmmakers, academics, and representatives from interest groups. The Hollywood films, which apply for a quota slot, must submit either a script or a finished film to the board. If it is passed, then making edits for the film eligible release. The SARFT reviews the finished product before passing it for cinematic release.

In 2008, the SARFT published a list of offensive content that would not be allowed in any imported films, which includes “disparaging the image of the people’s army,” “murder, violence, terror, ghosts and the supernatural,” and “showing excessive drinking, smoking, and other bad habits”, according to “Government Allocation of Import Quota Slots to US Films in China’s Cinematic Movie Market”.

Each Hollywood studio expects to get four to six studio films each per year in to China through the revenue-sharing quota system that expanded from 20 per year in 2011 to 34 in early 2012. The expanded total includes an additional 14 Imax and special category movies, according to Variety.

“Every week, there is at least one Hollywood producer asks me if there is any good co-production projects in China…They are eager to producing co-production films with China,” said Wan.

The main point of co-production films is that they have the same right to share revenues with cinemas as local movies, around 43 percent of revenues, but imported quota films only share 25 percent. “The Expendables” ever “lost” a lot of revenues from China after selling copyright to a Chinese distribution company.

“They want Chinese culture to spread around the world so that they are known and have influence. So we look at the problem from the macro level to figure out what we need to do so that all our partners—U.S. and Chinese—feel like their needs are being met,” Dan Mintz said to The Hollywood Reporter, CEO of DMG Entertainment Company.

“The Growing Pains”

Expansion was the key word of China’s economic development in the past years as well as film market. Hot money played roles in movie production industry and lots of non-professional enterprises such as coal companies entered into film market accelerating the bubbles. Moreover, Genre films became main powers in the market like fast-food movies, fans movies and young idol movies, which lack of deep cultural elements. Most of Chinese moviemakers follow the trend of popular topics and hardly create real art. Most of Chinese movies lose money and only a quarter of them are shown into theatres.

Chinese audiences used to watching films in cinemas recent years but still don’t get used to thinking deeper. Examination style education kills the ability of creative and critical thinking among the new generations in China.

Where is the future?

Economic austerity is the policy that China released for the new planning years in 2013. It is hard to predict if there is any influence on Chinese film market in the future.

“It’s actually really hard to tell one movie produced by one specific country…there are co-productions all over the world,” said Bo Guan, international selection committee member of FIRST International Film Festival.

More Chinese students choose to study film production in US and they will be the main power of China’s new generation filmmakers.

“I want to learn the technology and the ways they tell stories from US film school and then tell Chinese stories to the whole world,” said Chen Feng, a student in US film school.