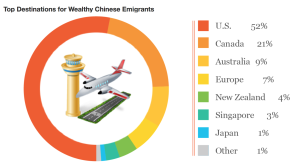

Since the beginning of this century, China’s economy has grown at a notable rate, reporting double-digit GDP growth each year. As a result, there have been massive levels of wealth and a new population of Chinese billionaires. However, in the last five years, the Chinese immigrant population in the United States has increased by about 400,000 people, with about 25,000 of them being millionaires (China File, 2015). This causes economists to examine why so many wealthy Chinese are moving to the United States and how their movement is affecting the U.S. economy.

Although China has one of the world’s largest economies by measure of GDP, with consumption making up 71% and a debt exceeding 250% of their GDP, China’s economy proves to be anything but stable (The Hindu, 2016). Much of this instability is backed by the fact that the Chinese government has been inflating their GDP data through massive rates of increased spending. It also has to do with the fact that there is decreasing momentum in the service sector and a steep decline in the manufacturing sector. Since these sectors make up the largest part of China’s economy, it has made millionaires desperate to get their money overseas because they are unsure of the value that their fortunes will hold in years to come.

Another reason why Chinese millionaires are wary is because of the massive crackdown on corruption that was started in 2013, when President Xi Jinping came into power. This decision was intended to boost citizen morale by reducing the harsh divide between ordinary Chinese and party officials (Williams-Grut, 2016). However, since this crackdown, about 300,000 government officials have been punished for “allegations of bribery, abuse of power or other corrupt practices,” causing many of them to worry about the fate of their fortunes (BBC, 2016). Therefore, in order to protect themselves, many officials are trying to hide the money they earned illegally by investing it abroad.

Karen Weise, a reporter from Bloomberg, found that Chinese nationals hold around $660 billion in personal wealth offshore, with $22 billion of that being spent on homes. This movement of Chinese money, especially in the housing market, is present all over the United States and shows no signs of slowing down. These Chinese invest in American real estate because it is a safe market and many cities offer benefits like great neighborhoods and schooling. Therefore, in response, real estate has had to cater to the incoming Chinese millionaires by changing city landscapes, which, in turn, has affected many cities existing demographics.

As of 2015, it was reported that 64% of China’s 1.3 million millionaires have emigrated or have plans to move to the United States in the next five years (China File, 2015). These immigrants are moving all over the country; however, one of the most concentrated examples of a city adapting to wealthy Chinese immigration can be seen in Arcadia, CA.

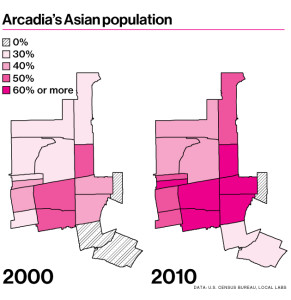

Arcadia is a city 20 miles northeast of Downtown Los Angeles that has become a haven for wealthy Chinese residents. In 2016, it was reported that 59% of Arcadia’s 56,000 residents were Asian. This compares to 2000, when Asian’s only made up 45% of the population, 34% of that percentage being Chinese (U.S. Consensus). Over the last 16 years, Arcadia has attracted tens-of-thousands of Chinese millionaires by offering a first-class schooling system, large homes to live in, a nice neighborhood to raise children, and a pre-existing Asian population. These services have not only transformed the city’s landscape, but have also created great changes in Arcadia’s real estate sector.

As Chinese immigrants started to immigrate to California, realtors saw this as the perfect opportunity for financial gain. Therefore, to attract this specific Chinese market, architects and developers changed Arcadia’s landscape by building similar styled mansions ranging anywhere from $2 million to $7 million all over the city. Most of the homes reflect the Chinese philosophy of feng shui and face the south, which are two important aspects of Chinese culture (Hawthorne, 2014). Chinese culture is deeply rooted in tradition; therefore, Chinese immigrants are often more attracted to the mansions that honor their culture. Real estate developers also try to attract Chinese millionaires by creating mansions that include wine cellars, theaters, double-height entry halls, elevators, many master bedrooms, and a separate wok kitchen (Hawthorne, 2014). Architects and developers make a conscious effort to build these Arcadia mansions to appeal to wealthy Chinese immigrants in the hopes of earning a large profit.

Just in 2013, one Arcadia realtor, Peggy Fong Chen, sold over $71 million worth of homes in Arcadia (The Chinese Beverly Hills, 2014). According to Jue Wang, Chinese millionaires have been moving to America because they feel uneasy about their real estate investments in China’s unstable real estate market. Also, because of the income and wealth disparities in China, rich people have come to feel unsafe, causing homes in America to look even more attractive. However, for the most part, she said that these large Mc-mansions are in high demand because it gives millionaires a place to store their money.

While many of the mansions in Arcadia have semi-circular driveways lined with Range Rover’s and Porches, when getting a closer look, many of the homes actually appear to be unoccupied. A member of The Arcadia Homeowner’s Association estimated that 20% of these new mansions sit empty (Weise, 2014). This confirms that many Chinese are using these homes as a place to store their money. Realtor, Peggy Fong Chen, said that many of the million dollar homes she sells are paid for in cash. By paying in cash, Chinese millionaires are making it almost impossible for the Chinese government to trace the money that is being invested overseas.

Although this is an issue for the Chinese government and their economy, the U.S. has truly benefitted from the billions of dollars that Chinese foreigners have spent on American soil. For example, in 2014, Arcadia brought in a record revenue of $7.9 million just from fees for building permits and developments, which is a 72% increase from the previous year (Weise, 2014). Wealthy Chinese immigrants also helped the U.S. economy during the recession of 2009. During this time, China’s elites were affected but held on to the bulk of their wealth. Therefore, as America was facing a time of dramatic economic downturn, Chinese millionaires continued to move to the U.S., bringing millions of dollars with them. This money was then used to hire workers, pay for goods and services, and to help keep businesses afloat.

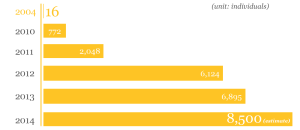

The United States government understands the influence that wealthy Chinese immigrants can have on the American economy. Therefore, in the hopes of sparking American investment, the U.S. government created a program to attract wealthy foreigners in 1990. The program states that if wealthy foreigners invest at least $500,000 in an American business and employ at least 10 American workers, they are eligible to apply for a green card known as the EB-5 Visa. As of 2014, Chinese nationals received 85% of the 10,000 American visas offered. Therefore, through this plan, the U.S. was able to generate at least $4,250,000,000 in investments, not including the money Chinese immigrants spent once they were in the U.S.

As much as this influx of wealthy Chinese immigrants can be beneficial to a city, it can also create problems throughout society. One problem is with long-term residents who feel like their cities are being commercialized solely for the purpose of financial gain. For example, people who have grown up in Arcadia have watched their hometown turn into a “Chinese Beverly Hills” lined with mansions that are not even occupied. As stated before, since 2000, Arcadia has experienced a 14% increase in their Asian population. This means that 14% of the former, mostly white, residents have moved out of Arcadia, many of them moving because developers have offered high prices to flip their average homes into Mc-mansions. In this case, it is clear that the wealthy Chinese immigrant population contributes to the gentrification of Arcadia by replacing the homes of it’s former citizens with giant mansions that better meet the needs of the new Asian millionaires. This not only promotes sentiments of elitism, but it also angers residents who feel like their city is being commercialized for the sole purpose of financial gain.

Another potential problem to be considered is that Arcadia is experiencing growth at an extremely fast rate that does not seem to be sustainable. Developers must be conscious because the amount of money that is being poured into these projects could be contributing to a real estate bubble. For example, on Zillow, there was a one-story home that was purchased in 2012 for $980,000. Then in 2013, a 5-bed room, 6-bath home popped up at the same address for $3,438,000, showing that developers are buying cheap homes and then replacing them with multi-million dollar to please the incoming Asian population.

Another example is just a few blocks away at a 3 bedroom, 2-bath house that was sold for $428,000 in 2012. Just this month, the same house was listed for about $2 million. This shows that because of multi-million dollar mansions that popping up throughout the city, the prices of the smaller homes are starting to rise as well. If developers continue building mansions we will eventually end up running out of resources or buyers. Therefore, developers must make a cautious effort to only create supply when there is demand, to avoid a real estate bubble.

Works Cited:

“Arcadia Population and Demographics (Arcadia, CA).” Arcadia Population and Demographics

(Arcadia, CA). Web. 22 Oct. 2016.

Bertrand, Natasha. “This California Suburb Has Become a Haven for Wealthy Chinese

Residents.” Business Insider. Business Insider, Inc, 02 Feb. 2015. Web. 6 Oct. 2016.

Hawthorne, Christopher. “How Arcadia Is Remarking Itself As A Magnet for Chinese Money.”

Los Angeles Times. Los Angeles Times, 3 Dec. 2014. Web. 9 Oct. 2016.

Hooper, Kate, and Jeanne Batalova. “Chinese Immigrants in the United States.”

Migrationpolicy.org. 05 Feb. 2015. Web. 18 Oct. 2016.

Scutt, David. “China’s Economy Is ‘still Weak and Unstable'” Business Insider. Business Insider,

Inc, 02 Mar. 2016. Web. 12 Oct. 2016.

VocativVideo. “The California Town Where Chinese Millionaires House Their Kids-and

Mistresses.” YouTube. YouTube, 05 Dec. 2014. Web. 2 Oct. 2016.

Wang, Jue. “Chinese Homebuyers Heat up LA’s Real Estate Market.” US-China Today. 4 Apr.

- Web. 10 Oct. 2016.

“Wealthy Chinese Are Fleeing the Country Like Mad.” ChinaFile. 3 Feb. 2015. Web. 10 Oct.

2016.

Wei, Lingling. “China Challenged to Keep Yuan Stable as Dollar Rises.” WSJ. Wsj.com, 16 May

- Web. 10 Oct. 2016.

Weise, Karen. “Why Are Chinese Millionaires Buying Mansions in an L.A. Suburb?”

Bloomberg.com. Bloomberg, 14 Oct. 2015. Web. 11 Oct. 2016.

Williams-Grut, Oscar. “China’s Corruption Crackdown Is so Strict That Even 2,400 Anti-bribery

Officials Were Probed.” Business Insider. Business Insider, Inc, 25 Jan. 2016. Web. 16 Oct. 2016.