Every two years a country from anywhere in the world is strategically chosen to host the Olympics. I say strategically because being given the honor to host the Olympics greatly effects a country’s reputation, residents, and, most importantly, its economy. Therefore, to account for this major event, economists at Bespoke Investment Group came up with the Olympic Indicator to measure the state of the economy during this exciting time.

The Olympic Indicator shows that markets tend to prosper during the Olympic games. Bespoke Investment Group explains this by saying that the excitement of the  games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

This summer in Rio de Janeiro marked the 31st Summer Olympics. However,  there were a lot of concerns leading up to the games on whether Rio could afford the Olympics, issues with their government and city safety, the presence of the Zika Virus, issues with severe water pollution and if the Olympic buildings were even going to be finished on time.

there were a lot of concerns leading up to the games on whether Rio could afford the Olympics, issues with their government and city safety, the presence of the Zika Virus, issues with severe water pollution and if the Olympic buildings were even going to be finished on time.

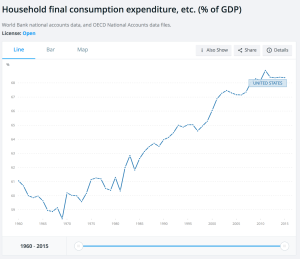

However, with all these problems, the U.S. economy still seemed to benefit from the games. By looking at the chart below it is evident that the Dow Jones Average spiked from 18.352.05 on August 4 to 18.543.53 on August 5, which was the day of the Opening Ceremonies in Rio. Although the average fluctuated during the Olympics, ever since August 21, the date of the Closing Ceremonies, the average is almost back at where it started on August 4.

Although the Dow Jones Average shows that the American stock market did improve during the 3 weeks of the Olympics, the Olympic Indicator does not actually prove that the games distract investors. Therefore, the economic growth that occurs during the Olympics can also be explained by looking at the money that is entering markets around the world. For example, NBC Universal paid $1.2 billion for the right to broadcast the Olympics in Rio, which is chump change to Rio’s estimated $12-20 billion they spent on hosting the games. All of this money promotes consumer spending and puts money into the economy that was not there before, which in turn, betters the economy.

Sources:

http://www.marketplace.org/2016/08/05/world/let-s-do-numbers-what-has-been-spent-rio-olympics

http://www.marketplace.org/2016/08/05/world/let-s-do-numbers-what-has-been-spent-rio-olympics

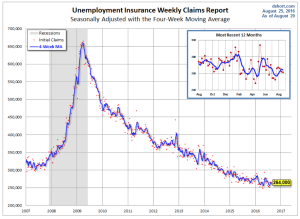

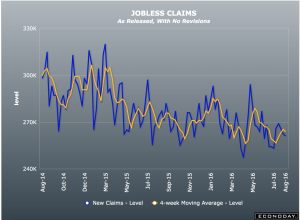

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.

alysts believe that the jobless claims numbers will continue to remain similar throughout the next few months, as the economy continues to grow and the labor market improves.