Donald Trump says that his economic vision is that “all economic policy must be geared towards making it easier to hire, invest, build, grow and produce in America – creating a level playing field for our workers and businesses in global competition, and creating jobs here, not overseas.” He puts this into five categories, very briefly summarized below:

- Tax reform- lowering taxes for everyone

- Regulatory reform- repeal many business regulations and pause any new regulations

- Trade reform- narrow the U.S. trade deficit and place high tariffs “to countries that cheat”

- Energy reform- lift restrictions on American energy

- Other reforms- repeal Obamacare, increase infrastructure, childcare, reduce homicides

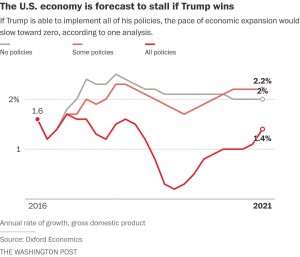

According to a recent report by Oxford Economics, if all of Trump’s proposed policies are implemented, it could erase as much as $1 trillion off of the forecasted U.S. economy in 2021. After two years of his policies, economic growth would slow to about 0.3 percent annually. That would be the worst pace since the recession ended.

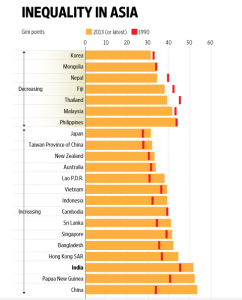

Trump’s trade reform policy includes imposing tariffs on goods from China and Mexico. Additionally he wants to remove large numbers of undocumented immigrants from the United States. By imposing high tariffs on Chinese and Mexican goods, it could also have large impacts on other countries. Jamie Thompson, head of macro scenarios at Oxford Economics, argues that Trump could likely hurt the workers that he says he is going to help in the manufacturing sector. A 35% tariff on Mexican goods, like cars and air conditioners, would negatively impact the American economy because almost half of the parts in those cars and air conditioners come from U.S. suppliers. Therefore, U.S. manufacturers could lose customers if the U.S. imposes a tariff on the Mexican products that they contribute to.

Similar stories came from denim manufacturers in South Carolina. They send a significant amount of denim to Mexico to be manufactured into jeans that are then sold in America. NAFTA, which Trump wants to renegotiate, is critical to keeping these types of manufacturers in business. These manufacturers are also large employers. The denim plant, run by Rich Turner, in South Carolina alone employs 2,700 people. Oxford Economics forecasts consumer spending to decline by 4.4% over four years in Trump’s plans are initiated. Even the price of groceries, a basic necessity for all Americans, rich or poor, would increase with tariffs placed on other countries goods.

In addition to Trump’s specific economic policies that could slow or even reverse economic growth, the mere shock of him winning the presidency would affect confidence in the United States worldwide. Confidence and communication about the economy have a huge influence. Even countries and businesses that are not directly impacted by Trump’s policies would react. Weakened confidence in the U.S. economy “would most likely result in the scaling back of business investment plans, accompanied by the postponement of major household purchases,” according to Oxford economists. A Trump victory would likely result in economic turbulence that would be felt worldwide.

Sources:

https://www.donaldjtrump.com/positions/economic-vision

http://money.cnn.com/2016/09/14/news/economy/donald-trump-economic-plan-1-trillion/

http://www.cnbc.com/2016/09/14/us-economy-could-lose-up-to-5-pct-if-donald-trump-beats-hillary-clinton-in-presidential-election.html

https://www.washingtonpost.com/news/wonk/wp/2016/09/16/what-a-donald-trump-presidency-would-do-to-the-global-economy/