Could it be true that the taller the skyscraper the harder the fall? The correlation between completions of tall skyscraper buildings and economic is a fairly familiar concept. The Skyscraper Index was created by Andrew Lawrence in 1999 and explained that constructions of tall skyscrapers were representative of beginning of economic downturns. This trend of correlation between the construction of tall skyscrapers and economic business cycles that ended in recession was first studied in the 1930s, which was around the time of the Great Depression in the United States.

Historical examples of this phenomenon from the past century include the completion of the Empire State Building in the 1931 when the Great Depression had just started, the completion of the Petronas Twin Towers in Malaysia in 1996, which was when the Asian financial crisis began, and of course, the completion of the Burj Khalifa in Dubai in 2010 which was right after the 2008 worldwide financial crisis. Another key example would be the construction of the Sears Towers and the World Trade Center Towers that were built in 1973, during both the 1973 stock market crash and the 1973 oil crisis. Andrew Lawrence hence argued that almost all major skyscraper construction initiatives were pre-cursors to financial busts. The theory suggested that the building of skyscrapers generally started during the later phase or the peak of the economic boom when employment is usually high and the economy is growing, which is followed by economic downturns and low unemployment rates. So even though all economies go through business cycles, skyscrapers especially tend to be constructed in the last or peak phase of an economic boom and finish in a recession.

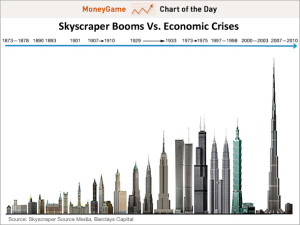

The skyscraper index might not seem legitimate and it could be possible that the aforementioned examples could be coincidences, because correlation does not always mean causation: and one may think why would impactful structures like skyscrapers that could be highly profitable be destructive to the economy? However, the Barclays Skyscraper Index Report shows that not only is there correlation between the construction of tall buildings and recession, the report also proposes that the rate of increase in the height of the skyscraper could indicate the extent of the financial crisis. The report tracks the building of new skyscrapers and their increase in height in comparison to the following recession that occurred from 1873-1878 until 2007-2010. There seems to be a trend in the study that the rate of increase in record-breaking skyscrapers is directly related to the magnitude of the economic downturn that occurred after.

Nevertheless, there have been some recessions that occurred in the past century that were not preceded by the construction of a tall skyscraper. For example the skyscraper index failed to predict economic downturn in Japan, which had a recession in 1990, and it also did not provide any indication of the economic recessions of 1920-1921, 1937-1938, and 1980-1981. An economist Mark Thorton commented, “both the causes of skyscrapers reaching new heights and severe business cycles are related to instability in debt financing”. Of course, economic indicator can predict perfectly, but the skyscraper index could be a basis to predicting some form of crisis rather than specifically speculating the severity of economic business cycles. It would be interesting to see what this could mean for the world’s fastest growing economies, India and China, which have multiple large scale skyscraper projects lined up for construction within the next few years.