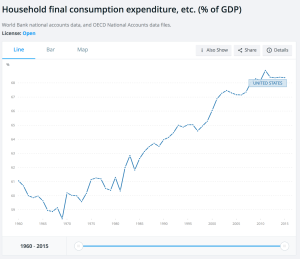

A recessive economy is no match against the steaming morning luxury that fuels the pulse of the city. Consumers pinch their pockets for the morning Cup O’ Joe, even during economic strife, but the foam-topped coffee can get expensive overtime.

Folks that are willing to spend as much as $6 a day on a morning beverage is a curious concept in a struggling economy. Spending habits on coffee are inextricably linked to an established morning routine. Coffee drinkers are creatures of habit. The coffee drinker views the cup as an inseparable part of the daily ebb and flow of life. Coffee sales outside of the home skyrocketed in 2004, likely due to the success and popularity of popular corporate coffee houses. Coffee transformed from an in-home treat to a fast food experience.

Over the past decade coffee consumption outside the home has shown some reaction the the nation’s economy. In 2001, coffee consumption outside the home was in the low 30% range as the nation entered the economic recession. Ryan Sweet, a U.S. economist for Moody’s Analytics alludes that a low coffee consumption percent is directly correlated to a high unemployment rate. In 2004, when the U.S. unemployment picture turned around for the better, outside home coffee sales soared from 29% to 40%.

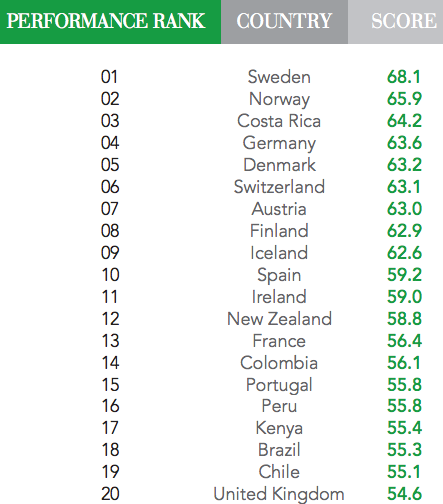

Coffee Consumption Outside of the Home

| YEAR | 2001 | 2002 | 2003 | 2004 | 2005 |

| Outside Home | 32% | 34% | 29% | 40% | 39% |

| Unemployment | 4.7% | 5.8% | 6.0% | 5.5% | 5.1% |

| Economic Climate Backdrop | Recession | “Jobless Recovery” | ” “ | “Unemployment Improves” | ” “ |

| YEAR | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Outside Home | 40% | 33% | 36% | 35% | 30% | 27% |

| Unemployment | 4.6% | 4.6% | 5.8% | 9.3% | 9.6% | *9.1% |

| Economic Climate Backdrop | ” “ | Recession | ” “ | ” “ | “Jobless Recovery” | ” “ |

*Seasonally adjusted unemployment rate for month of July from Bureau of Labor Statistics

Source: National Coffee Association of USA for coffee consumption in the home and outside of the home; Bureau of Labor Statistics for annual average unemployment rate figures; Economic climate backdrop Moody’s Analytics.

Via aol.news

According to one economist, however, coffee will only suffer in the most serious times, and is considered as necessary as the utility bills and automobile gas. Most coffee houses are doing as well as they ever have, and according to Verner Earls of Chauvin Coffee Company, some coffee houses have reported record sales. “People aren’t going to give up the latte,” claims Verner. “Bigger expenses will go first.” The mindset behind the consumption of coffee allows coffee houses to weather recessions well.

This general trend for coffee consumption does not leave all coffee houses safe. Many local shops struggle with a crunched economy, as well as corporate coffee chains being forced to close down stores. In 2008, during the heat of the recession, Starbucks Coffee announced it will close 600 stores across the United States, according to the New York Times. This move by Starbucks cost over 12,000 employees their jobs, the most in its history (via the New York Times).

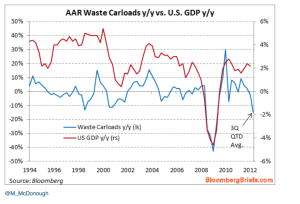

The fall of Starbucks in 2008 reveals that java sales are a hot economic indicator of the state of the economy. As the dollar collapses, so does the average American’s spending power.

Coffee has become a fast food luxury treat, all of which its raw materials: sugar, coffee, milk, wheat, and chocolate are all skyrocketing in price due primarily to the fall of the dollar, according the the Huffington Post. This hike in prices causes the cup cost to steadily rise.

Coffee sales, specifically using the example of Starbucks Coffee establishments is a prime example of how a falling dollar will make something like coffee, an item that Americans gorge on, daily for that matter, too expensive to include in the morning ritual.

Speaking from experience, a trip to a coffee shop is an absolute treat that I enjoy frequently with my mom. So much so, that we budget our social coffee hour into our weekly expenses tough economy or not.

Sources:

http://www.riverfronttimes.com/foodblog/2009/04/01/java-enabled-is-coffee-recession-proof

http://www.aol.com/article/2011/08/11/is-coffee-the-new-leading-economic-indicator/20015519/

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.

games distracts investors from problematic economic data and headlines. Bespoke confirmed this notion by tracking the Dow Jones performance during the Summer Olympics between the opening and closing ceremonies since 1900. Their results; positive returns in 18 of the last 26 games.