Suddenly, music is everywhere. We hear in while on our daily commutes, in stores and restaurants, and all throughout our everyday lives. In today’s climate, music is very easy to access and to consume. We are able to access any type of music through the phones and are able to pick and choose each song we want to listen to. In the past few years, companies like Pandora and Spotify have made it so easy for us to access music on-demand from the devices we hold in our hands. These firms have disrupted the previous revenue models of selling individual tracks for both the traditional music industry and the artists themselves, all while simplifying the user listening experience for consumers.

Many music industry experts believe that this will be the year that the market will correct and stabilize and will determine which firms will be able to survive the consolidation of the music consumption streaming market.

With the introduction of all of these new companies like Spotify and Pandora, iTunes no longer has a monopoly in the music consumption market. Streaming services now offer more music at a lower price, essentially making it impossible to justify purchasing one song for a dollar.

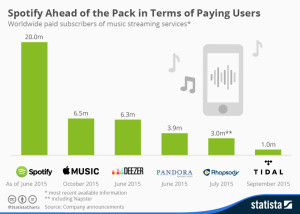

There are currently many streaming services in the market, all hoping to win the majority stake in the industry. Currently, Spotify is the largest in the United States, followed closely by Pandora and Apple Music.

Although there are many various streaming companies currently in the market, they all offer slightly different benefits for the consumer and attract different sectors of the population.

Although there are many various streaming companies currently in the market, they all offer slightly different benefits for the consumer and attract different sectors of the population.

One of the obvious current leaders is Spotify. Founded in 2006, Spotify is the largest streaming service in the United States today, with over 40 million paid subscribers. Competitor, Apple Music, which has only been released for about a year, has 17 million paid subscribers for comparison.

Over the past few years, the consumption of music has changed dramatically, from physical record sales to individual song purchases made on iTunes to now the unlimited consumption on streaming services.

According to recent numbers published by Billboard, the industry is looking to have the highest numbers of growth and sales since 2009. Currently, over 411 million units, measured in “total album consumption units,” have been sold in the first three quarters of 2016. These numbers are set surpass the 2009 sales number set at over 489.8 million albums.

The Recording Industry Association of America (RIAA) midyear report found that the overall industry, not just record sales, was up over 8.15% since 2015 as well.

Many attribute this growth and success to streaming services, as they have created alternative revenue sources for the artists and music industry. A few years ago, many downloaded their music illegally. Today, streaming services pay out the artists who have songs on their platforms.

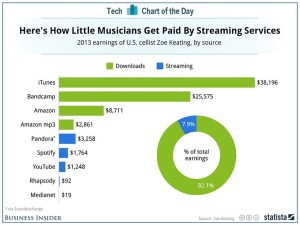

However, one of the biggest criticisms of the music industry today is that the revenue from streaming is nowhere near the physical streaming sales numbers. Although neither Spotify nor Apple Music releases the actual payout numbers to artists, leaked reports reveal payments of $0.006 per stream by Apple Music. Additionally, according to Spotify, instead of a per stream payout, they pay out 70% of revenue to rights holders. This typically averages out to $0.006 and $0.0084 per stream.

These numbers per stream are tiny; it is estimated that the payout for each stream is between $0.004 and $0.008 depending on each service. For the larger artists who receive radio play and are on major labels, this can be a h uge revenue stream, with annual payouts ranging from $100,000 to $500,000 per year. However, for the small artists who might only have a few thousand fans on Spotify or Apple Music, this can threaten their survival in the business.

uge revenue stream, with annual payouts ranging from $100,000 to $500,000 per year. However, for the small artists who might only have a few thousand fans on Spotify or Apple Music, this can threaten their survival in the business.

Many smaller artists and industry experts have criticized streaming services for their lack of payout, and believe that the streaming services should change their compensation models. However, it is not just small, indie artists who believe this should change.

In June 2015, Taylor Swift posted a Tweet criticizing the Apple Music launch. She believed that the service should pay out artists during the three-month trial period, which at the time, they were not planning to do. In a letter entitled, “To Apple, Love Taylor,” she wrote, “I’m sure you are aware that Apple Music will be offering a free 3-month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing, and completely unlike this historically progressive and generous company.”

Apple VP Eddy Cue responded, on Father’s Day, that Apple would be compensating the artists during the trial period, reversing his initial decision to withhold compensation during the trial period without revenue for the firm. With this single tweet, Swift was able to alter the business model of a huge media and tech conglomerate like Apple and was able to stand up for all of the smaller artists who do not have a voice as powerful and as large as Swift, creating a larger change in the streaming industry.

Swift’s label head and president of Big Machine Records, Scott Borchetta, has been very outspoken regarding his views on streaming and has called out Spotify by name. “Ninety percent of those outlets that we visited in that first year are out of business, so 10 years from now, I guarantee you at least half of those streaming services that exist today will not exist, at least not freestanding.”

While there are many like Borchetta and Swift who are outspoken against streaming, for many artists, platforms like Spotify have helped to launch their careers and gain exposure that they could only previously dream of.

For example, Hozier was an unknown artist until 2013, when he was introduced into a Spotify artist discovery program and added to a playlist, and eventually was added to more, increasing his daily streams from an initial 15,000 streams worldwide per day to over 2 million a day (Billboard). With the support and push of Spotify, Hozier was introduced to over 11 million new fans over the course of two years.

Streaming services can provide success to the lesser-known artists, but many people are weary of the services, as there is an influx of firms in the market that has is constantly changing and evolving.

At today’s point, the streaming services in the market are still in the development stage. Many, including Spotify, are not yet profitable. Even companies like Pandora, which has been in business since 2000, has reported losses of millions in the past few quarters.

So, if the companies aren’t making money but have millions and millions of customers, how will they ever be profitable?

The solution, many industry executives and trend predictors believe, is to move away from a “freemium model” and transition to one that is only paid. In the current economic climate, “freemium” means that companies like Spotify and Pandora offer a free, ad-supported version as well as a paid version for their customers. Many believe this will begin to vanish, as Apple Music only offers a paid version and revenue would increase if everyone were forced to pay.

With these changes, some services like Pandora and Spotify will pivot, encouraging consumers to pay for access to a streaming service. However, will new players in the market choose to create a free model to play with these tech giants?

According to the Financial Times, SoundCloud, a popular site for

remixes and unofficial music, is the next purchase for Spotify. This could be beneficial, as SoundCloud needs help financially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

remixes and unofficial music, is the next purchase for Spotify. This could be beneficial, as SoundCloud needs help financially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

The Spotify/SoundCloud acquisition could be one of many that will occur in the next few years, as the industry condenses and corrects from the current oversaturation. There are so many players in the market currently and it will be important for the consumers to express their wants and needs in the streaming market so that the companies best suited for the consumer and industry survive. In a few years,

Three years ago, Spotify and streaming were words that were uncommon in our everyday vernacular.

Sources

http://www.billboard.com/articles/business/6656722/spotify-spotlight-support-major-lazer-hozier

http://fortune.com/2016/09/29/spotify-soundcloud-acquisition/

http://www.digitaltrends.com/music/apple-music-vs-spotify/

http://www.digitalmusicnews.com/2016/05/24/apple-music-pays-every-country-worldwide/

http://time.com/3940500/apple-music-taylor-swift-release/

Former nomads settle in their gers near mines to find work.

Former nomads settle in their gers near mines to find work.

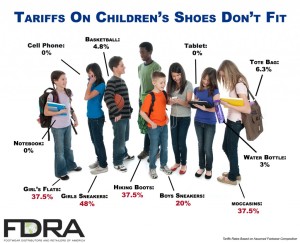

(BallotPedia, 2016). Hillary, on the other hand, was suspected of being in support of the TPP agreement when working under the Obama Administration. However, in May of 2016, she said, “I oppose the TPP agreement – and that means before and after the election.” She made another comment about the issue in March, when she claimed that one of the reasons she opposed the TPP is because the final proposal has too many loopholes, which will allow countries and citizens to be taken advantage of (BallotPedia, 2016).

(BallotPedia, 2016). Hillary, on the other hand, was suspected of being in support of the TPP agreement when working under the Obama Administration. However, in May of 2016, she said, “I oppose the TPP agreement – and that means before and after the election.” She made another comment about the issue in March, when she claimed that one of the reasons she opposed the TPP is because the final proposal has too many loopholes, which will allow countries and citizens to be taken advantage of (BallotPedia, 2016).