It is no surprise that retail is taking a heavy hit in 2017 with some of the most well-known and largest retail companies closing their doors to the public, or worse, filing for bankruptcy. With the up-roar of e-commerce, consumers choose to shop online for the quick satisfaction of the click of a button instead of making their way through traffic, parking, and rushing through people in an over-sized mall.

The CEO of Urban Outfitters, Richard Hayne described this issue in accordance with the housing market when he said, “Retail square feet per capita in the United States is more than six times that of Europe or Japan. And this doesn’t count digital commerce. Our industry, not unlike the housing industry, saw too much square footage capacity added in the 1990s and early 2000s. Thousands of new doors opened and rents soared. This created a bubble, and, like housing, that bubble has now burst. We are seeing the results: doors shuttering and rents retreating.”

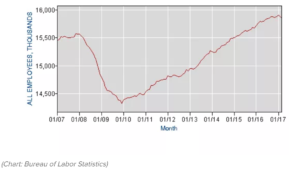

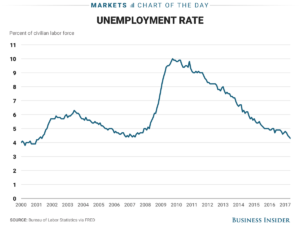

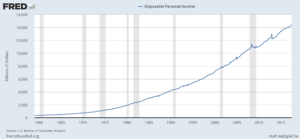

So, what does a massive hit in retail mean for jobs? Unsurprisingly, retailers have publicly announced over 200,000 lay-offs in the last four years and a growing 89,000 in 2017 alone. According to Business Insider, stores are closing at a rate not seen since the recession. When looking at the data, there is an interesting story being told. This chart shows that both traditional and online retail are soaring since the Recession. However, when diving deeper into particular industries is when we see a hit in job loss.

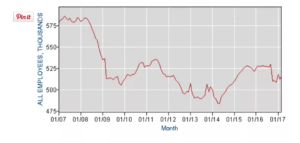

This chart shows the decline of employment from appliance and electronic stores which were a huge industry to shut their doors to the public.

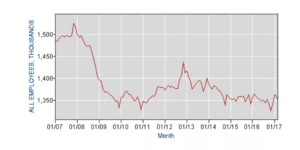

And then we have, of course, the struggling clothing and retail market chart that shows the loss of employment in the last few years.

With no surprise, e-commerce has soared in the last couple of years, but are they hiring those transitioning out of traditional retail positions? Probably not. While the retail industry is known for high turnover rates it is also known for hiring 1 out of 10 American workers within a large age range. That said, most of these workers being laid off do not hold the set of skills that an e-commerce job would entail.

So, is this weird retail hit of 2017 an economic indicator of what the future of the economy holds? Well, according to Mark Cohen, the Director of Retail Studies at Columbia University, the huge hit that retail continues to take is creating a “slow-rolling crisis.” The large amount of people that have lost their retail position and will continue to lose it (considering the way retail is going) are now going to spend less money since they are going through a period of unemployment which will create a “cascade of economic challenges,” says Cohen.

It will be interesting to continue to see the trajectory of retail, but right now it is looking like the start of a very interesting and slow rolling economic indicator. Would it be too big to say that we could be on the path towards another economic recession?

Sources:

http://www.businessinsider.com/retail-job-losses-are-hurting-the-economy-2017-4

https://psmag.com/news/the-long-and-painful-decline-of-the-retail-store

https://www.theatlantic.com/business/archive/2017/04/retail-meltdown-of-2017/522384/

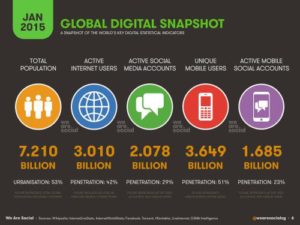

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.

Businesses are able to use social media to learn more about themselves. Reviews, feedback, and consumer research has never been easier, allowing businesses to spend less money on what is not working and pump more money into what is. This is so important for businesses to pay attention to and utilize, because it is something that can potentially take your company to the next level.

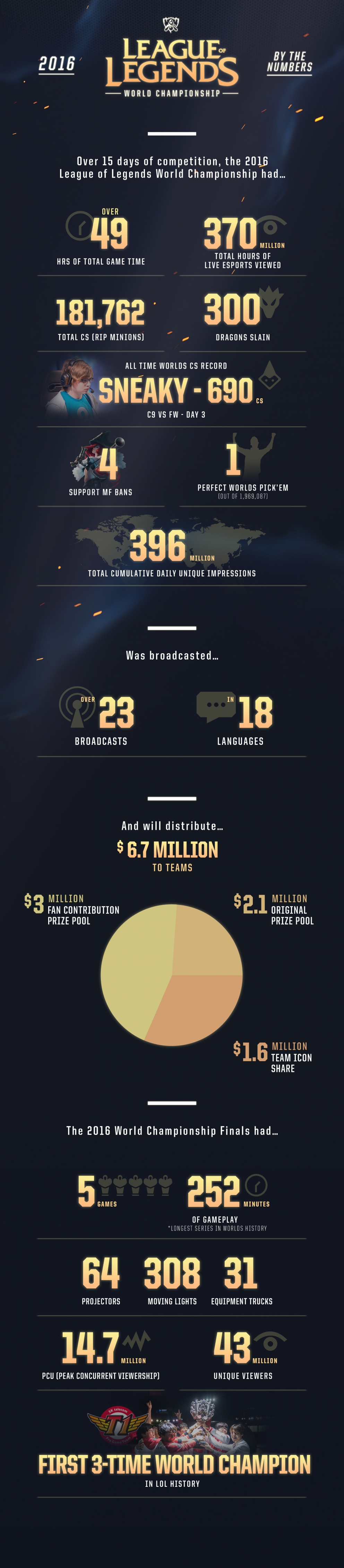

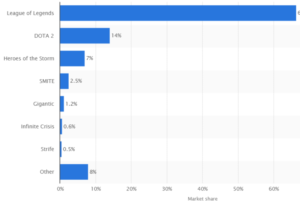

League of Legends is vital to E-Sports because it showcased how serious the professional gaming can be through the outstanding number of viewers over the world. League of Legends is a free-to-play online competitive multiplayer game developed by Riot Games in 2009. Two teams of five players are required to play the game and one match lasts about 35-45 minuets. Since its release, League of Legends has been gathering monthly active users in a very fast pace. The monthly active users have

League of Legends is vital to E-Sports because it showcased how serious the professional gaming can be through the outstanding number of viewers over the world. League of Legends is a free-to-play online competitive multiplayer game developed by Riot Games in 2009. Two teams of five players are required to play the game and one match lasts about 35-45 minuets. Since its release, League of Legends has been gathering monthly active users in a very fast pace. The monthly active users have

emergence of Overwatch mean the downfall of League of Legends? According to major video game news outlet

emergence of Overwatch mean the downfall of League of Legends? According to major video game news outlet