Last week the world saw yet another one of Tesla’s creations, the Cybertruck. This electric pickup truck that looks like a prop from a futuristic science-fiction film can accelerate from 0 to 60 mph in 2.9 seconds and boasts a driving range of up to 500 miles. The Cybertruck can easily rival a conventional internal combustion engine (ICE) automobile in performance, however, with a price tag of $69,900 for such performance, it is far from being affordable to most people. Although the industry is putting out cheaper models every year, generally electric vehicles cost more than gasoline-powered cars. The long-standing issue of a limited driving range poses a significant barrier for potential consumers. Additionally, the current infrastructure is insufficient to provide for comfortable use of electric vehicles and to dispel consumer doubts. On the supply side of the market, manufacturers often face production issues when demand suddenly spikes and there is a shortage of materials. Given that the electric car manufacturers operate on thin profit margins these challenges, or rather the ability of the industry to overcome them, will shape the market over the next two decades.

What is going on in the market today?

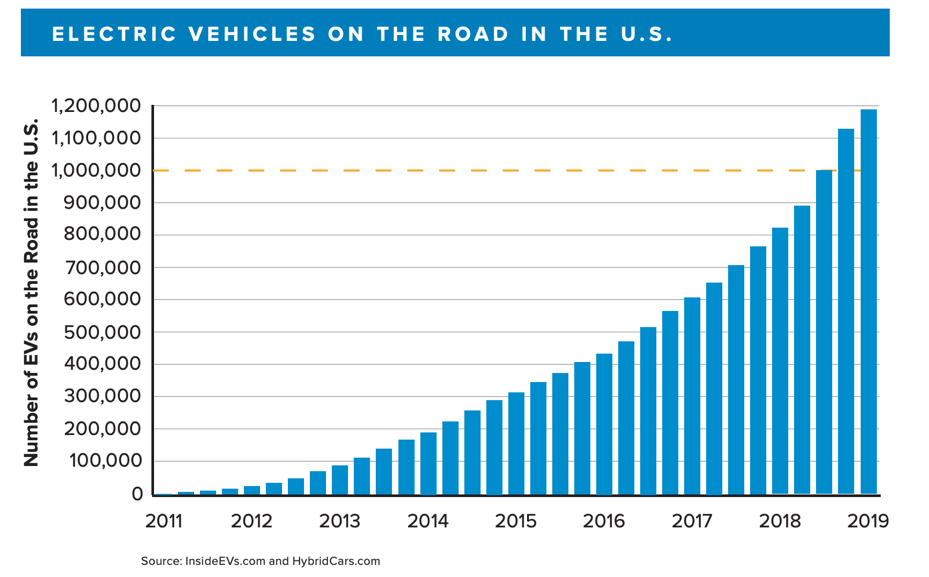

The electric vehicle industry is growing at an unprecedented rate. Last year, global EV sales were over 2 million units, a 63% jump from 2017. Out of 2 million units sold worldwide, China accounted for a lion’s share of sales. In the United States alone, the number of electric cars on roads has grown from barely a dozen thousand in 2011 to over 1.1 million cars in 2019 (reference figure 1 below). No doubt, electric cars are gaining increased popularity among drivers. Tesla Model 3 best showcases this trend as it became the best-selling electric car in the world in 2018 with 138,000 units sold, outselling its Chinese rivals BYD and BAIC as well as Nissan Leaf.

Tesla is still in the lead in terms of sales even surpassing the sales of luxury gasoline-powered car brands such as BMW in the United States. However, since Tesla unveiled its first electric car in 2008, other players have joined the race for EV dominance. Well-established automakers such as Volkswagen, BMW, GM, and Toyota are investing heavily in transitioning to electric vehicle production. Volkswagen is spending billions of dollars to reshape its factories for electric car production. The company has already revealed its first electric car model, ID. 3 1ST, which will start deliveries in 2020. It will offer free battery charging for a year and the vehicle will cost less than $45,000. Additionally, according to CNN Business, Volkswagen Group, which owns luxury car brands such as Porsche and Lamborghini, will spend $34 billion over the next half-decade to develop an electric or hybrid model of every car currently in production. Toyota claims 50% of its automobile sales will be electric in 2025 and plans to electrify all models by the same year. This year, BYD, a Chinese EV car brand that is barely mentioned in the west, began sales of its cheapest model, e1, starting at $8,950. Although the driving range is significantly lower than that of Tesla, the price provides an exceptional opportunity for the company to capture a sizable market share in China. According to Bloomberg, BYD Co. is now the largest producer of plug-in electric vehicles with monthly sales of 30,000 units in China. Favorable market conditions in China prompted the entry of startups as well. Premium EV startup, NIO, went public in the U.S. in 2018 and is already ramping up its production and deliveries in China. Multiple reports including Bloomberg predict Chinese EV makers will account for at least a third of the world’s production in a decade.

The main driver of growth: incentives

Aware of the current state of climate issues, governments worldwide are implementing strict CO2 emission policies and subsidizing buyers to expedite the transition from ICE cars to electric. Multiple countries have announced various bans on new gasoline vehicles. Norway, for example, stated there will be no sales of gasoline cars by 2025. The Netherlands said all vehicles will be emission-free by 2030 while the United States plans to reduce car emissions to zero by 2050. In order to achieve these ambitious goals countries are heavily subsidizing consumers. The Chinese government has been especially active in encouraging development in the market, hence the visible progress. It has implemented license-plate restriction on gasoline cars in Beijing and, until recently, China incentivized consumers to purchase electric cars by providing credits of up to $7,400. This year China raised its 2025 sales target for EVs from 20% to 25% to spur progress. England is pushing regulation to discourage fossil-fuel car use as well. According to a McKinsey report, local authorities in London are placing $16 daily fees on overly polluting vehicles in “ultra-low-emission zones”. In the U.S., buyers of electric vehicles can get a tax credit from $2,500 to $7,500 when purchasing a new electric car. Buyers in California are eligible for even higher tax credits. Some cities such as San Jose provide extra purchasing subsidies of $2,500 in addition to IRS incentives. Even Ukraine, Europe’s poorest country, offers subsidies by waiving a 20% VAT on all imported electric cars.

Current challenges: cost, range, infrastructure

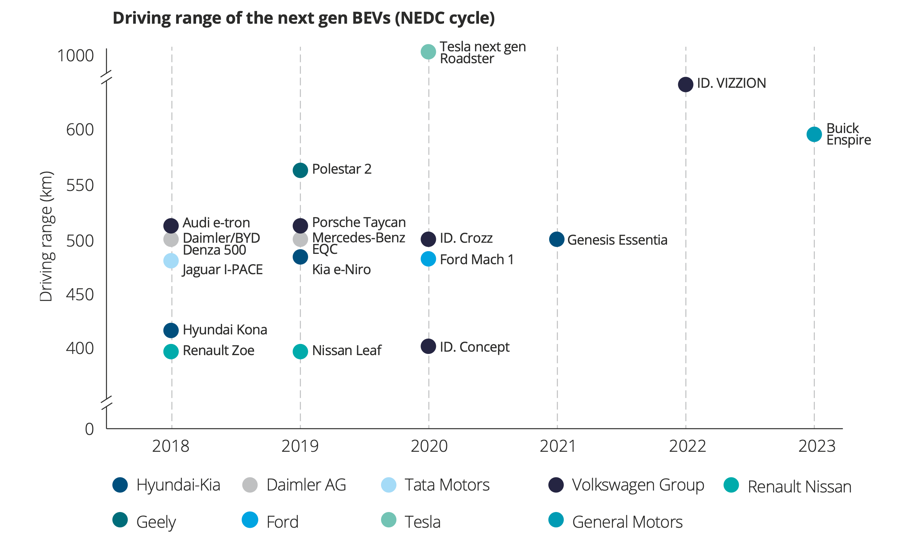

As impressive as the progress looks, the global EV market is facing numerous challenges that currently limit the growth of the industry as a whole. The most noticeable issue is the high price of electric vehicles. This year, the average price of an electric car in the U.S. was $55,600, while the average price for a full-size gasoline car in 2018 was $34,925. Hybrid cars were even cheaper with the price hovering around $27,600. There are several reasons why EVs cost more than conventional vehicles. EV producers focus on building luxury models thus driving up the average price. BMW’s cheapest EV model starts at $44,500 while Audi’s SUV starting price is $74,800. In terms of economics, a major price driver is a high vehicle production cost. The battery pack is one of the main contributors to an overall high price. Batteries are expensive to make and the process behind manufacturing cells is incredibly complex. Today, manufacturers use lithium ion batteries in production. According to an Accenture report on the industry, because lithium is a rare metal sensitive to shortages and price shocks it creates certain risks and can cause production issues or delays. Ultimately, the main factor contributing to the high costs of producing batteries and assembling cars is the scale of production. Currently, the industry does not have the demand nor the funds to scale its production. Therefore, consumers assume the burden of cost. In addition to high upfront costs, two other major public concerns slowing down the growth of the industry are the range and availability of infrastructure. The first concern is tied directly into battery production. However, a Deloitte report analyzing the EV industry states that as next-generation electric vehicles are introduced, and the battery technology improves, the “range anxiety” will become obsolete (refer to figure 2 below). According to the U.S. Department of Energy, the median drive range has already increased from 73 miles in 2011 to 125 miles last year.

A far more pressing issue is the charging infrastructure. As of 2019, there were only around 10,000 public charging stations in the United States. Center for American Progress, a public policy research organization dealing with economic and social issues, stated that in order to support an increasing number of EVs in the U.S. the country must dramatically improve its charging infrastructure. It cannot accommodate the increasing demand for electric cars. It is estimated that the U.S. will need to invest around $4.7 billion by 2025 to install 330,000 public charging stations throughout the country.

How to address the concerns and challenges?

These challenges create substantial barriers for growth, however, there are several developments in the industry that will likely resolve issues with production, infrastructure, and consumer demand. Ultimately, it comes down to reducing costs for manufacturers without sacrificing the quality of production. The key factors are scale, location, and strategic partnerships. EV companies are already scaling up production. For example, Tesla’s Gigafactory is an expansive facility that produces batteries, car components, and solar panels and will eventually begin assembling cars. Furthermore, the company wants the factory to operate entirely on solar energy by installing solar panels on the factory’s roof. Since Tesla started building its first Gigafactory in Nevada, it has already built a second factory in the U.S. and a third in China. Moreover, recent plans were announced to build a Gigafactory in Germany. This will allow the company to minimize car manufacturing and shipping costs while expanding production on three continents.

Partnering with other EV manufacturers and placing key production in advantageous locations will allow EV companies to reduce risks of battery shortage and decrease cost. NIO outsources its manufacturing and, according to The Verge, was able to start production quicker while its Californian competitors, Faraday Future and Lucid Motors, struggled to build their own factories. General Motors and LG are investing $2.3 billion into a battery plant in Ohio to jointly make batteries for electric cars. Toyota is investing $2 billion in Indonesia to manufacture electric cars. This strategy will place Toyota EV production in a country that is rich in key resources that make up batteries. Since other companies are investing in Indonesia as well, according to Businessinsider, establishing production in Indonesia will allow Toyota to work close to other EV manufacturers and: “lead to supply chain and infrastructure efficiencies that can drive down costs for components, such as batteries.”

Government incentives will play a big role in helping the EV industry to grow. According to McKinsey, government subsidies and regulations decrease the gap between high costs and consumers’ ability to pay and directly stimulate investments in EV technology. Since 2016 the U.S. Congress has allocated roughly $8.9 billion to EV technologies R&D that includes battery and vehicle tech as well as sustainable transportation development. The funds that the U.S. Department of Energy (DOE) has been receiving from Congress has aided the development of EV technology. By 2014, DOE has helped cut battery costs by 50% which ultimately cut costs for manufacturers. In California, EV companies get a special incentive. The California Air Resources Board (CARB) enforces a cap-and-trade program to lower emissions in the state. Part of this program requires the automakers in the state to make a certain number of zero-emission vehicles a year. When companies produce more than required, they receive “allowances” which they can sell to automakers that did not meet the requirement. Such a program does two things: it encourages automakers to produce more EVs and generously rewards the EV manufacturers. By 2018, Tesla has sold $1.2 billion worth of “allowances”. Furthermore, the U.S. government aims to subsidize the costs of installing charging infrastructure. According to the Center for American Progress, 17 states have already implemented incentives to develop the infrastructure. These include tax exemptions and direct investments. The industry will, no doubt, require more robust investments and incentives on behalf of governments to develop the infrastructure to an appropriate level. To keep the industry growing it is vital for the world’s governments to directly subsidize costs for both the consumers and companies.

The future is near

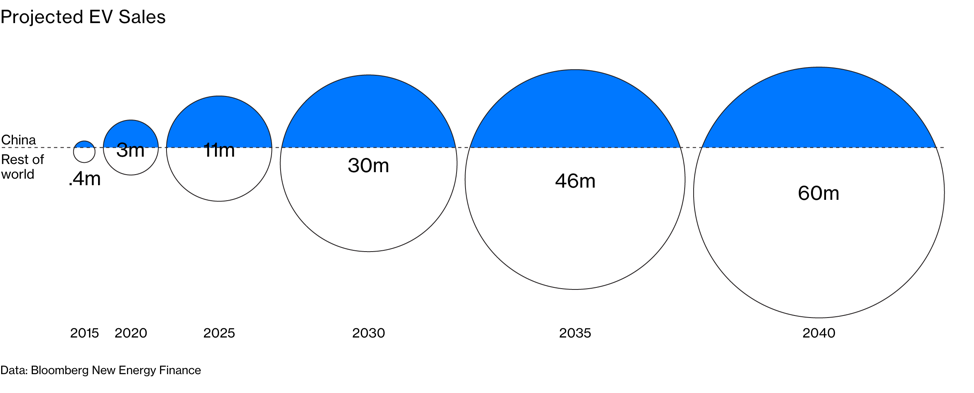

Just like many other exciting developments in the modern world, the electric vehicle industry is widely discussed, especially given the climate circumstances all over the world. However, it is important to keep in mind that gasoline cars are still far more prevalent. It is estimated that non-electric passenger vehicles sales in 2018 exceeded 85 million units worldwide while electric vehicles only accounted for 2 million units. This will change, however, within two decades. The sales of EVs are expected to surpass ICEs in 2038. Already ICE auto sales are contracting in China while EV sales are growing and account for half of worldwide sales. China will, in fact, remain the largest market for the EV industry, although its market share will start declining in about 5 years (see figure 3 below).

Every year the costs are subsiding, the range is increasing, the infrastructure is getting more widespread, therefore drivers are more willing to purchase an electric vehicle. An Accenture global study done in 12 countries involving thousands of people showed that 60% of those who wanted to purchase a car within 10 years will probably consider an electric vehicle. This indicates a shifting mentality among the population and will drive the demand for the EVs. Cost won’t be a major issue within a couple of years. Deloitte estimates that the costs of owning EVs will reach an equilibrium point with the costs of owning ICE cars as early as 2022. McKinsey stated that as battery efficiency and economies of scale improve, we can expect a cost reduction of at least $5,100 per vehicle. As these trends emerge, the EV brands will evolve and compete for supremacy; their ability to overcome previously mentioned challenges by taking advantage of location, partnerships, and scale will determine their fate in the market. The future is not as far as it seems but is much further than we would like it to be.

Sources:

https://www.bbc.com/news/uk-49578790

https://fas.org/sgp/crs/misc/R45747.pdf

https://www.cbinsights.com/research/report/electric-car-race/

https://cars.usnews.com/cars-trucks/cheapest-electric-cars

https://finance.yahoo.com/news/average-car-prices-more-1-110000010.html

https://www.audiusa.com/models/audi-e-tron

https://www.bmwusa.com/vehicles/bmwi/i3/sedan/all-electric.html

https://qz.com/1695602/the-average-electric-vehicle-is-getting-cheaper-in-the-us/

http://www.orocobre.com/news/china-raises-2025-ev-target/

https://www.energy.gov/eere/electricvehicles/electric-vehicles-tax-credits-and-other-incentives

https://www.industryweek.com/energy/how-california-taught-china-sell-electric-cars

http://knowledge.wharton.upenn.edu/article/chinas-ev-market/

https://www.businessinsider.com/toyota-investing-in-electric-vehicles-indonesia-2019-7

https://www.theverge.com/2018/8/19/17692560/nio-ipo-tesla-china-electric-cars-public

http://www.nytimes.com/2019/12/05/business/gm-lg-battery.html

http://www.orocobre.com/news/global-ev-sales-jump-63-percent-in-2018/

https://qz.com/1618775/by-2038-sales-of-electric-cars-to-overtake-fossil-fuel-ones/

http://semiengineering.com/electric-cars-gain-traction-but-challenges-remain/

https://www.cnn.com/interactive/2019/08/business/electric-cars-audi-volkswagen-tesla/

https://edition.cnn.com/2019/05/09/business/volkswagen-id-electric-car-reservation/index.html

https://www.britannica.com/topic/Tesla-Motors

https://www.tesla.com/cybertruck

https://www.theverge.com/2019/2/22/18236707/tesla-model-3-2018-best-selling-ev-global

https://fortune.com/longform/electric-car-auto-industry-china/

https://www.autonews.com/sales/toyota-amps-us-ev-plans-join-new-surge