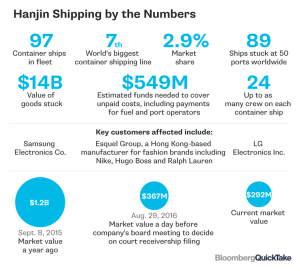

When Hanjin Shipping, the world’s seventh-largest container shipping line, filed for bankruptcy on August 31st, it put ports and retailers around the world into panic mode. By filing for bankruptcy, this meant that all Hanjin ships were either banned from docking in ports or were to seized by creditors.

The crisis caused major disruption to the global supply chain, as 89 ships carrying $14 billion in goods were left out at sea with no plans of being offloaded because to the company’s inability to pay docking fees. The effects of Hanjin’s bankruptcy on global trade were seen immediately, as the World Container Index reported that in the week following the ruling, rates on routes like Shanghai to Rotterdam were up by 39%. Furthermore, Hanjin accounts for 2.9% of the global market share and 10% on the Asia-to-Europe route.

For retailers and customers around the world, the question then became… how long will this last?

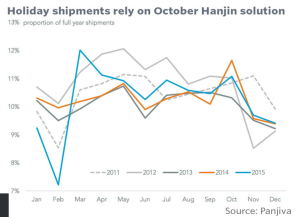

Hanjin’s collapse came at a pivotal time of the year, as retailers had already begun preparing for the holiday shopping season. Traditionally, goods begin shipping from Asia at this time in order to be on shelves for Thanksgiving, and with 89 ships stuck at sea this could cause major disruptions to the global supply chain.

So who’s stocking will be empty on December 25th?

According to analysts at CitiGroup, of the $14 billion worth of goods trapped on the ships, toys were expected to be the most affected good for retailers, along with apparel, handbags, washing machines and televisions. Additionally, Samsung claimed that it had $38 million of good stuck on two Hanjin ships in the U.S and would have to charter 16 planes to move the goods if the ships were unable to dock.

James Van Horn, a restructuring specialist at McGuireWoods LLP, estimated that, “the cost of shipping goods from Asia to the U.S. has almost doubled as a result of Hanjin’s bankrupcy.” This is because the inability of retailers to receive their products could drive up prices, as customers needing to shop for the holidays would now see them as “scarce” products. Furthermore, Van Horn predicts that the higher cost of stocking shelves could mean that stores across the US would hire fewer temporary workers and have a shortened Christmas shopping season.

The economic implications of Hanjin’s bankruptcy pose serious threats to retailers across the world, as they have already invested capital to produce the merchandise. Therefore, having goods sit on container ships can offset inventory planning and force retailers to suffer major losses due to their inability to sell their products. These effects can carry over onto the next season, as brands try to recuperate their sales.

In a statement about the bankruptcy, Jonathan Gold, VP of Supply Chain and Customs Policy for the National Retail Federation, said that “retailers’ main concern is that there is millions of dollars worth of merchandise that needs to be on store shelves that could be impacted by this.”

Only time will tell what happens for retailers this holiday season, but retailers and customers alike can only hope that whatever is on Santa’s list this year wasn’t stuck on a Hanjin ship.

http://www.bloomberg.com/news/articles/2016-09-09/quicktake-q-a-the-shipping-line-that-could-spoil-christmas

http://www.businessinsider.com/hanjin-bankruptcy-could-cause-christmas-disaster

http://www.usnews.com/news/business/articles/2016-09-01/hanjin-bankruptcy-causes-global-shipping-chaos-retail-fears

http://www.wsj.com/articles/hanjins-demise-why-global-shipping-glut-isnt-going-away-1472811129

http://www.marketwatch.com/story/hanjin-shippings-bankruptcy-filing-could-ruin-the-holiday-season-for-retailers-2016-09-02

http://www.reuters.com/article/us-hanjin-shipping-debt-usa-ports-idUSKCN11I03B

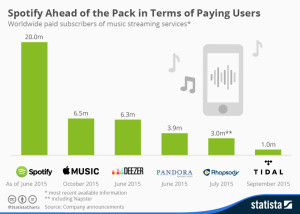

Although there are many various streaming companies currently in the market, they all offer slightly different benefits for the consumer and attract different sectors of the population.

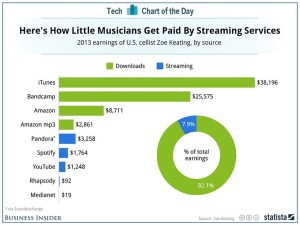

Although there are many various streaming companies currently in the market, they all offer slightly different benefits for the consumer and attract different sectors of the population. uge revenue stream, with annual payouts ranging from $100,000 to $500,000 per year. However, for the small artists who might only have a few thousand fans on Spotify or Apple Music, this can threaten their survival in the business

uge revenue stream, with annual payouts ranging from $100,000 to $500,000 per year. However, for the small artists who might only have a few thousand fans on Spotify or Apple Music, this can threaten their survival in the business

remixes and unofficial music, is the next purchase for Spotify. This could be beneficial, as SoundCloud needs help financially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.

remixes and unofficial music, is the next purchase for Spotify. This could be beneficial, as SoundCloud needs help financially and the purchase would diversify Spotify’s catalogue, as it would include more original content and more indie label releases.