The Great Sendai Earthquake happened on March 11, 2011. It was an earthquake of a 9.0 magnitude that caused large tsunami waves as well. The damage from this natural disaster was severe. There were nuclear accidents, thousands of buildings destroyed and damaged, ports were shut down, there were power outages and damaged infrastructure. The estimated cost of rebuilding was $200 billion.

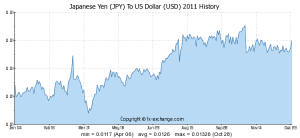

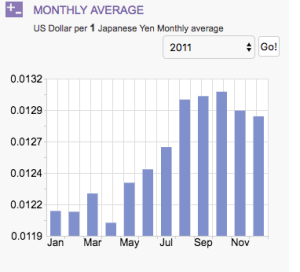

The value of the yen was greatly affected following the disaster. The yen hit a high at 76.25 against the U.S. dollar after the earthquake. The yen was previously at 83.8 on February 15, 2011 before the disaster. This happened because of repatriation of capital- Japanese corporations were exchanging their money they have in other countries for yen to pay for handling the aftermath. The large demand for yen was created so its value went up. What Japan did in an effort to lower the yen was had their central bank was sell yen to weaken its value, but it wasn’t enough to bring it down.

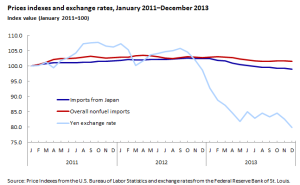

When the value of the yen is higher than foreign currencies, it makes it too expensive for the rest of the world to be able to buy Japan’s exports and makes it less desirable. So, if the yen is high this is very bad for Japan because 14% of their economy is based on exports. For example, every one yen move versus the U.S. dollar will cost Toyota $380 million a year. Also, the natural disaster’s immediate damage hurt their trade because it caused supply chain disruption. This is because Japan plays a large role in the global supply chains because they not only export parts of products but finished products as well. Japan’s large companies that have exports such as Toyota, Nissan, Sony and other tech and auto industry companies had to halt production because of damages.

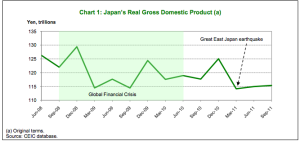

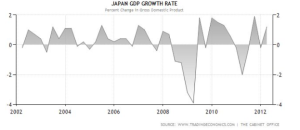

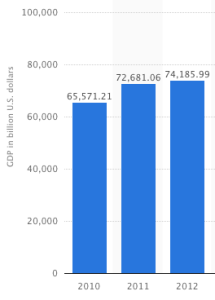

Because Japan’s production and trade was halted following the earthquake because of damages and increase of the yen, Japan’s GDP growth halted as well. Their national savings went down because they were spending it on repairs and their debt increased as well. At the time, Japan’s economy was the third largest in the world that accounted for 8.7% of the world’s GDP. But, this natural disaster moved Japan from this spot. Here is a brief look at how their GDP staggered from the disaster: in 2010 it was 42935.3, in 2011 it was 42824.7 and in 2012 it was 43658.2. The fall from 2010 to 2011 is bad because usually just a small amount of growth is bad; no growth to where it is negative is very bad (and this is what happened). But, Japan’s economy was able to get back in the steady direction it was going by 2012. Since the disaster, Japan’s growth has fell behind other large economies so it has not contributed to the growth of the global GDP.

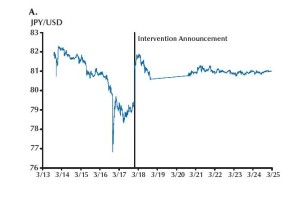

Japan was able to recover and able to maintain its economy because of the G7 Intervention that took place following the disaster and the sharp increase in the value of the yen. The G7 is made up of some the nation’s wealthiest countries, this includes the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. This group meets annually to discuss global economics, international security, and energy policies. They met on March 18, 2011 in regards to Japan’s economy after the earthquake and agreed to start selling the yen to makes the value of the yen go back down. The group wanted to decrease value of the yen so Japan could recover and they could continue trading with them. If Japan’s yen stayed at that very high level it would have affected the world’s trade in horrible way. Following the G7, the yen weakened and went back to 80.94 against the US dollar. Because of this, Japan’s economy was able to start recovering because they could resume exporting their goods (a large driving factor of their economy). Other countries were able to buy

Japan was able to recover and able to maintain its economy because of the G7 Intervention that took place following the disaster and the sharp increase in the value of the yen. The G7 is made up of some the nation’s wealthiest countries, this includes the United States, Canada, France, Germany, Italy, Japan, and the United Kingdom. This group meets annually to discuss global economics, international security, and energy policies. They met on March 18, 2011 in regards to Japan’s economy after the earthquake and agreed to start selling the yen to makes the value of the yen go back down. The group wanted to decrease value of the yen so Japan could recover and they could continue trading with them. If Japan’s yen stayed at that very high level it would have affected the world’s trade in horrible way. Following the G7, the yen weakened and went back to 80.94 against the US dollar. Because of this, Japan’s economy was able to start recovering because they could resume exporting their goods (a large driving factor of their economy). Other countries were able to buy

their exports because the value of the yen leveled-out to where the exports were affordable to other countries again. Without this intervention we most likely would have seen a rippling effect from Japan to the rest of the world causing other economies to weaken because of the disruption of trade. The global GDP was still able to grow in the year of 2011 following the earthquake, but it did not continue to grow at the same rate as it was from 2010 to 2011; this could be partly due to the disruption of trade in 2011 because of the halt of Japan’s production and exports that impacts the rest of the world.

their exports because the value of the yen leveled-out to where the exports were affordable to other countries again. Without this intervention we most likely would have seen a rippling effect from Japan to the rest of the world causing other economies to weaken because of the disruption of trade. The global GDP was still able to grow in the year of 2011 following the earthquake, but it did not continue to grow at the same rate as it was from 2010 to 2011; this could be partly due to the disruption of trade in 2011 because of the halt of Japan’s production and exports that impacts the rest of the world.

Leave a Reply

You must be logged in to post a comment.